Broad money includes narrow money plus other liquid assets such as savings deposits and money market funds, offering a more comprehensive measure of the total money supply in an economy. Narrow money consists mainly of physical currency and demand deposits, representing the most liquid forms of money readily available for transactions. Understanding the distinction helps policymakers gauge liquidity levels and implement effective monetary policies to control inflation and support economic growth.

Table of Comparison

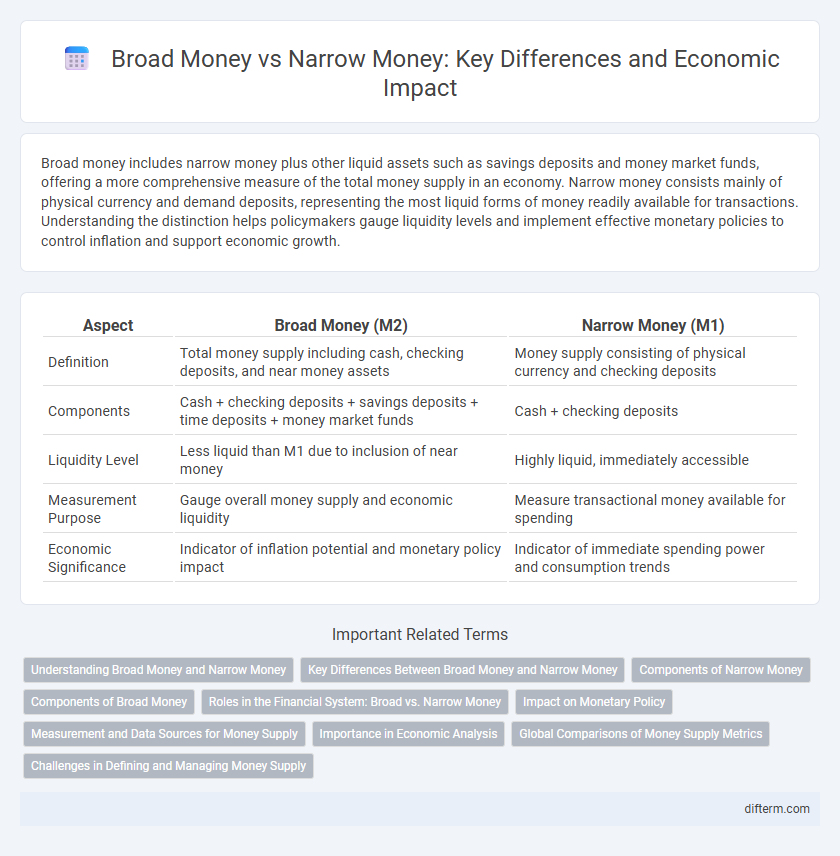

| Aspect | Broad Money (M2) | Narrow Money (M1) |

|---|---|---|

| Definition | Total money supply including cash, checking deposits, and near money assets | Money supply consisting of physical currency and checking deposits |

| Components | Cash + checking deposits + savings deposits + time deposits + money market funds | Cash + checking deposits |

| Liquidity Level | Less liquid than M1 due to inclusion of near money | Highly liquid, immediately accessible |

| Measurement Purpose | Gauge overall money supply and economic liquidity | Measure transactional money available for spending |

| Economic Significance | Indicator of inflation potential and monetary policy impact | Indicator of immediate spending power and consumption trends |

Understanding Broad Money and Narrow Money

Broad money encompasses all liquid assets within an economy, including cash, checking deposits, savings accounts, and other near-money assets, representing the total money supply available for spending and investment. Narrow money, often referred to as M1, includes the most liquid forms such as physical currency and demand deposits, reflecting immediate purchasing power. Understanding the distinctions between broad money (M3 or M2, depending on the country) and narrow money (M1) is crucial for analyzing monetary policy effects, inflation trends, and economic liquidity.

Key Differences Between Broad Money and Narrow Money

Broad money includes narrow money along with other liquid assets such as time deposits and money market funds, representing a wider measure of a country's money supply. Narrow money refers primarily to the most liquid forms of money including cash and demand deposits, used for immediate transactions. The key difference lies in liquidity and scope, with broad money providing a comprehensive view of available financial resources beyond mere currency and checking accounts.

Components of Narrow Money

Narrow money, also known as M1, primarily consists of the most liquid forms of money including currency in circulation and demand deposits held by the public at commercial banks. It excludes less liquid forms such as savings deposits and time deposits, which are included in broad money (M2 and beyond). Components of narrow money serve as the immediate medium of exchange within the economy, crucial for daily transactions and short-term liquidity.

Components of Broad Money

Broad money includes narrow money along with various other liquid financial assets such as savings deposits, time deposits, and money market mutual funds, reflecting a wider measure of the money supply within an economy. These components enhance liquidity beyond just cash and checking deposits, providing a more comprehensive understanding of money available for spending and investment. Monitoring broad money helps economists and policymakers gauge economic activity and inflationary pressures more accurately than narrow money alone.

Roles in the Financial System: Broad vs. Narrow Money

Broad money encompasses all liquid assets, including currency, checking deposits, savings accounts, and other near-money assets, playing a crucial role in assessing overall money supply and liquidity in the financial system. Narrow money, consisting primarily of physical currency and demand deposits, serves as the most immediate means of transaction and payment within the economy. The distinction between broad and narrow money helps policymakers gauge inflationary pressures and design effective monetary policies by understanding the different components' influences on economic activity.

Impact on Monetary Policy

Broad money, which includes narrow money plus savings deposits and time deposits, offers a more comprehensive measure of the money supply, enabling central banks to better gauge liquidity in the economy. Narrow money consists primarily of currency and demand deposits, directly influencing short-term consumer spending and transactional activities. Policymakers rely on broad money trends to design effective monetary policies that stabilize inflation and promote sustainable economic growth.

Measurement and Data Sources for Money Supply

Broad money measures the total money supply, including cash, checking deposits, and easily convertible near money like savings accounts, while narrow money focuses on the most liquid forms such as currency in circulation and demand deposits. Central banks and financial institutions primarily use monetary aggregates like M0, M1, and M2 to quantify these categories, drawing data from bank balance sheets, payment systems, and currency circulation records. Accurate measurement relies on standardized data collection and regular reporting by commercial banks, which enables policymakers to monitor liquidity conditions and implement effective monetary policies.

Importance in Economic Analysis

Broad money encompasses a wider range of liquid assets, including savings deposits and money market securities, offering a comprehensive measure of a country's total money supply. Narrow money, consisting primarily of physical currency and demand deposits, serves as an immediate medium of exchange reflecting short-term liquidity. Analyzing both measures helps economists assess monetary policy effectiveness, inflation trends, and overall economic stability.

Global Comparisons of Money Supply Metrics

Broad money, encompassing currencies, demand deposits, and easily liquidated assets, significantly exceeds narrow money, which includes only currency and checking accounts, across global economies. Countries like the United States and the Eurozone exhibit high ratios of broad to narrow money, reflecting extensive financial instruments and liquidity beyond cash holdings. These variations in money supply metrics influence monetary policy effectiveness, inflation rates, and economic stability worldwide.

Challenges in Defining and Managing Money Supply

Defining broad money and narrow money involves challenges due to varying components like currency, demand deposits, and near-money assets, which differ across countries and financial systems. Managing the money supply is complicated by the dynamic nature of these aggregates, influenced by factors such as financial innovation, changing reserve requirements, and shifts in economic behavior. Central banks face difficulties in accurately targeting monetary policy as the fluid definitions of money aggregates affect liquidity measurement and economic forecasting.

broad money vs narrow money Infographic

difterm.com

difterm.com