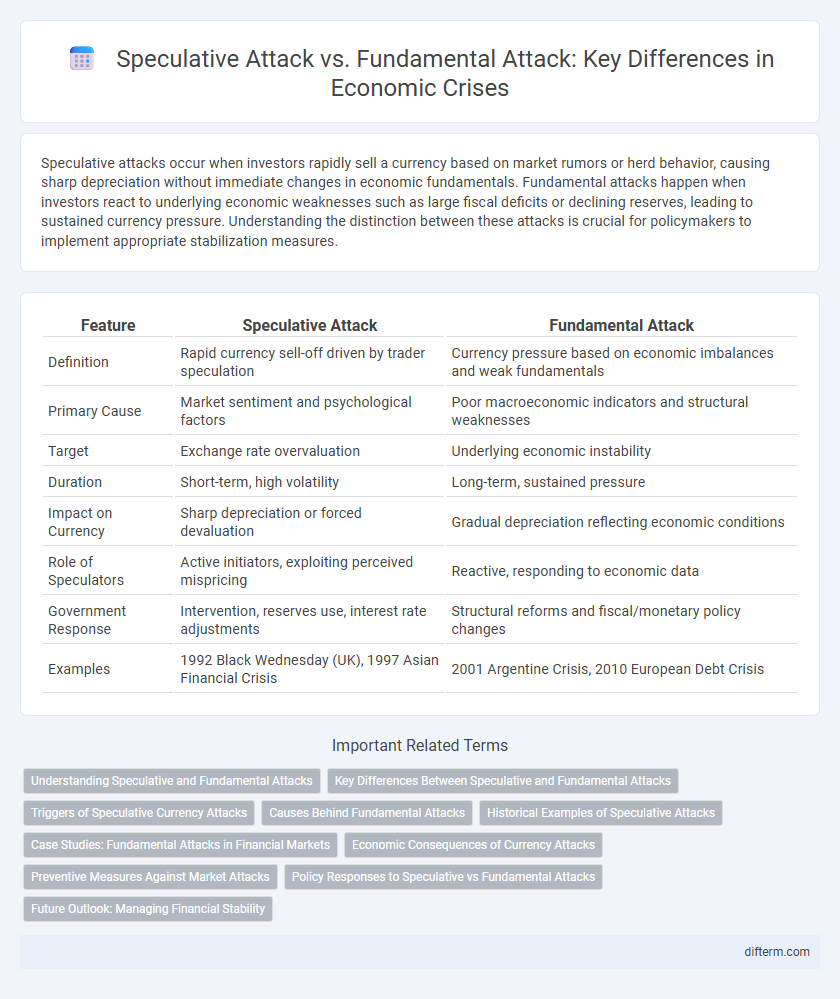

Speculative attacks occur when investors rapidly sell a currency based on market rumors or herd behavior, causing sharp depreciation without immediate changes in economic fundamentals. Fundamental attacks happen when investors react to underlying economic weaknesses such as large fiscal deficits or declining reserves, leading to sustained currency pressure. Understanding the distinction between these attacks is crucial for policymakers to implement appropriate stabilization measures.

Table of Comparison

| Feature | Speculative Attack | Fundamental Attack |

|---|---|---|

| Definition | Rapid currency sell-off driven by trader speculation | Currency pressure based on economic imbalances and weak fundamentals |

| Primary Cause | Market sentiment and psychological factors | Poor macroeconomic indicators and structural weaknesses |

| Target | Exchange rate overvaluation | Underlying economic instability |

| Duration | Short-term, high volatility | Long-term, sustained pressure |

| Impact on Currency | Sharp depreciation or forced devaluation | Gradual depreciation reflecting economic conditions |

| Role of Speculators | Active initiators, exploiting perceived mispricing | Reactive, responding to economic data |

| Government Response | Intervention, reserves use, interest rate adjustments | Structural reforms and fiscal/monetary policy changes |

| Examples | 1992 Black Wednesday (UK), 1997 Asian Financial Crisis | 2001 Argentine Crisis, 2010 European Debt Crisis |

Understanding Speculative and Fundamental Attacks

Speculative attacks occur when investors rapidly sell a currency or asset due to anticipated devaluation, often triggered by market sentiments or rumors, leading to sharp declines in value. Fundamental attacks, in contrast, are driven by underlying economic weaknesses such as unsustainable fiscal deficits, poor balance of payments, or weak monetary policy that justify a currency's vulnerability. Understanding these attacks enables policymakers to identify whether market movements are driven by transient speculation or structural economic problems, guiding appropriate intervention strategies.

Key Differences Between Speculative and Fundamental Attacks

Speculative attacks exploit short-term market vulnerabilities by targeting currency weaknesses through massive capital outflows, often driven by investor sentiment and expectations rather than economic fundamentals. Fundamental attacks arise when underlying economic imbalances, such as persistent trade deficits or fiscal mismanagement, create sustained pressure on a currency's value, reflecting deeper structural weaknesses. The key difference lies in speculative attacks being rapid, investor-driven maneuvers on perceived vulnerabilities, whereas fundamental attacks are rooted in actual economic conditions that undermine currency stability over time.

Triggers of Speculative Currency Attacks

Speculative currency attacks are primarily triggered by macroeconomic imbalances such as large current account deficits, excessive short-term foreign debt, and dwindling foreign exchange reserves, signaling vulnerability in a country's currency. Market perceptions of weak fiscal policies, political instability, and anticipated policy shifts exacerbate investor concerns, leading to rapid capital outflows. The combination of these factors creates a self-fulfilling prophecy where speculation accelerates currency depreciation beyond fundamental levels.

Causes Behind Fundamental Attacks

Fundamental attacks on a currency arise from underlying economic weaknesses such as large fiscal deficits, declining foreign reserves, persistent trade imbalances, and deteriorating economic indicators like GDP contraction or rising inflation. Investors identify these structural vulnerabilities, leading to loss of confidence and triggering capital outflows. Unlike speculative attacks based solely on market sentiment, fundamental attacks reflect measurable economic deterioration that undermines currency stability.

Historical Examples of Speculative Attacks

Historical examples of speculative attacks include the 1992 Black Wednesday crisis when George Soros famously shorted the British pound, forcing the UK to withdraw from the ERM. Another significant event occurred during the 1997 Asian Financial Crisis, where speculative pressure on currencies like the Thai baht led to sharp devaluations and financial turmoil. These attacks exploit market perceptions and vulnerabilities rather than underlying economic fundamentals, differentiating them from fundamental attacks driven by weak economic indicators.

Case Studies: Fundamental Attacks in Financial Markets

Fundamental attacks in financial markets occur when investors exploit underlying economic weaknesses such as unsustainable fiscal deficits, deteriorating trade balances, or declining foreign reserves, triggering currency devaluations or sovereign debt crises. Notable case studies include the 1997 Asian Financial Crisis, where weak banking sectors and large current account deficits in Thailand and Indonesia prompted massive capital flight and speculative pressure. Another example is the 1992 European Exchange Rate Mechanism (ERM) crisis, where persistent inflation differentials and lack of fiscal discipline in the UK led to the forced exit of the pound from the ERM.

Economic Consequences of Currency Attacks

Speculative attacks often lead to rapid currency devaluation, triggering inflation, capital flight, and loss of investor confidence. Fundamental attacks exploit underlying economic weaknesses, resulting in prolonged currency instability and erosion of fiscal reserves. Both types of attacks can cause severe disruptions in trade balances, increase borrowing costs, and necessitate costly interventions by central banks.

Preventive Measures Against Market Attacks

Preventive measures against speculative attacks and fundamental attacks include strengthening foreign exchange reserves and implementing flexible exchange rate policies to absorb shock. Central banks often use interest rate adjustments and capital controls to deter rapid capital flight and stabilize currency value. Enhancing transparency in monetary policy and maintaining robust economic fundamentals reduce vulnerability to market attacks by reinforcing investor confidence.

Policy Responses to Speculative vs Fundamental Attacks

Policy responses to speculative attacks often involve short-term interventions such as raising interest rates and implementing capital controls to stabilize currency markets and deter rapid capital outflows. In contrast, responses to fundamental attacks require structural reforms targeting underlying economic weaknesses, including fiscal consolidation, improving governance, and reducing external imbalances to restore investor confidence. Effective crisis management necessitates distinguishing between attacks driven by market sentiment and those grounded in economic fundamentals, guiding policymakers to tailor interventions accordingly.

Future Outlook: Managing Financial Stability

Speculative attacks involve rapid capital outflows triggered by market sentiment, posing immediate threats to currency stability, whereas fundamental attacks stem from underlying economic weaknesses such as fiscal deficits or inflation. Managing financial stability requires enhanced surveillance of macroeconomic indicators and the implementation of robust monetary policies to deter speculative pressures. Future outlook emphasizes strengthening international cooperation and deploying targeted capital controls to mitigate vulnerabilities and preserve market confidence.

Speculative Attack vs Fundamental Attack Infographic

difterm.com

difterm.com