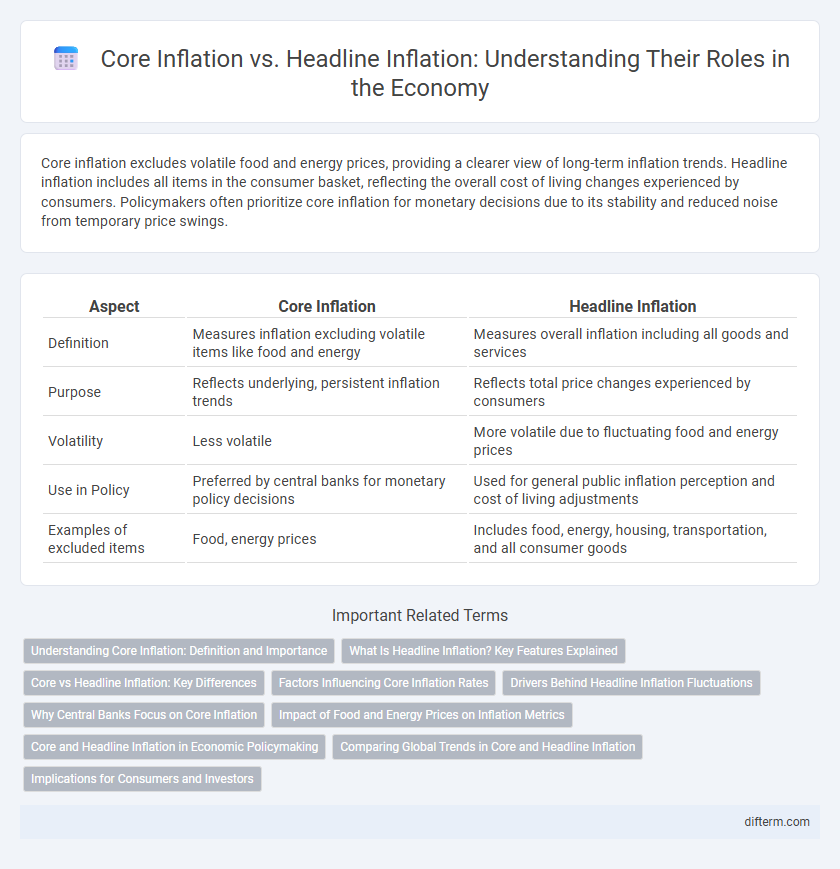

Core inflation excludes volatile food and energy prices, providing a clearer view of long-term inflation trends. Headline inflation includes all items in the consumer basket, reflecting the overall cost of living changes experienced by consumers. Policymakers often prioritize core inflation for monetary decisions due to its stability and reduced noise from temporary price swings.

Table of Comparison

| Aspect | Core Inflation | Headline Inflation |

|---|---|---|

| Definition | Measures inflation excluding volatile items like food and energy | Measures overall inflation including all goods and services |

| Purpose | Reflects underlying, persistent inflation trends | Reflects total price changes experienced by consumers |

| Volatility | Less volatile | More volatile due to fluctuating food and energy prices |

| Use in Policy | Preferred by central banks for monetary policy decisions | Used for general public inflation perception and cost of living adjustments |

| Examples of excluded items | Food, energy prices | Includes food, energy, housing, transportation, and all consumer goods |

Understanding Core Inflation: Definition and Importance

Core inflation measures the long-term trend in price changes by excluding volatile items such as food and energy prices, providing a clearer view of underlying inflation pressures. It is crucial for policymakers and economists because it helps in making informed decisions about monetary policy and assessing the true inflationary environment. Understanding core inflation allows for better predictions of future inflation and economic stability.

What Is Headline Inflation? Key Features Explained

Headline inflation measures the total change in consumer prices, including volatile food and energy costs, reflecting the overall cost of living. It is a critical indicator used by policymakers and economists to gauge inflation's impact on households and the economy. Unlike core inflation, headline inflation captures short-term price fluctuations that can significantly influence consumer purchasing power.

Core vs Headline Inflation: Key Differences

Core inflation excludes volatile food and energy prices to provide a clearer picture of long-term inflation trends, while headline inflation includes all items, capturing the total inflation experienced by consumers. Core inflation is often preferred by policymakers for setting monetary policy because it reflects underlying inflationary pressures more accurately. Headline inflation, meanwhile, is useful for understanding the immediate impact of price changes on household budgets and cost of living.

Factors Influencing Core Inflation Rates

Core inflation rates exclude volatile food and energy prices, providing a clearer view of underlying inflation trends influenced primarily by factors such as wage growth, supply chain disruptions, and changes in consumer demand. Persistent increases in core inflation often stem from sustained labor market tightness and rising production costs, which gradually feed into prices across various sectors. Monetary policy decisions and global commodity price stability also play crucial roles in shaping core inflation dynamics over time.

Drivers Behind Headline Inflation Fluctuations

Headline inflation fluctuates mainly due to volatile components such as food and energy prices, which are sensitive to supply shocks, weather conditions, and geopolitical events. Core inflation, excluding these volatile sectors, reflects underlying long-term price trends driven by labor market dynamics, wage growth, and monetary policy. Understanding the divergence between headline and core inflation helps policymakers distinguish between temporary price spikes and persistent inflationary pressures.

Why Central Banks Focus on Core Inflation

Central banks prioritize core inflation because it excludes volatile food and energy prices, providing a clearer picture of long-term inflation trends. Core inflation helps policymakers assess underlying demand pressures and make more stable monetary policy decisions. By targeting core inflation, central banks aim to maintain economic stability and control inflation expectations effectively.

Impact of Food and Energy Prices on Inflation Metrics

Core inflation excludes volatile food and energy prices, providing a clearer measure of underlying inflation trends by filtering out short-term price shocks. Headline inflation includes all items, reflecting the direct impact of fluctuating food and energy costs, which can cause significant short-term inflation volatility. The disparity between core and headline inflation metrics highlights the critical role that food and energy prices play in shaping overall inflation readings and influencing policy decisions.

Core and Headline Inflation in Economic Policymaking

Core inflation excludes volatile food and energy prices, providing policymakers with a clearer measure of underlying, persistent inflation trends essential for setting interest rates and monetary policy. Headline inflation reflects the total price changes in the economy, including food and energy, which can be affected by temporary shocks and may distort short-term policy decisions. Accurate interpretation of both core and headline inflation enables central banks to balance inflation control with economic growth.

Comparing Global Trends in Core and Headline Inflation

Core inflation, which excludes volatile food and energy prices, offers a clearer measure of underlying inflation trends, while headline inflation reflects the total inflation rate including these volatile components. Global trends indicate that core inflation tends to be more stable and less susceptible to short-term shocks compared to headline inflation, which can show sharp fluctuations due to commodity price volatility. Policymakers often emphasize core inflation to set monetary policy because it provides a more consistent gauge of long-term inflationary pressures worldwide.

Implications for Consumers and Investors

Core inflation excludes volatile food and energy prices, providing a clearer measure of long-term inflation trends that helps consumers anticipate stable purchasing power and investors gauge real returns more accurately. Headline inflation reflects the overall change in prices, directly impacting everyday expenses and influencing short-term consumer behavior and investment decisions. Understanding the distinction aids in strategic financial planning, risk assessment, and policy formulation for both consumers and market participants.

Core inflation vs Headline inflation Infographic

difterm.com

difterm.com