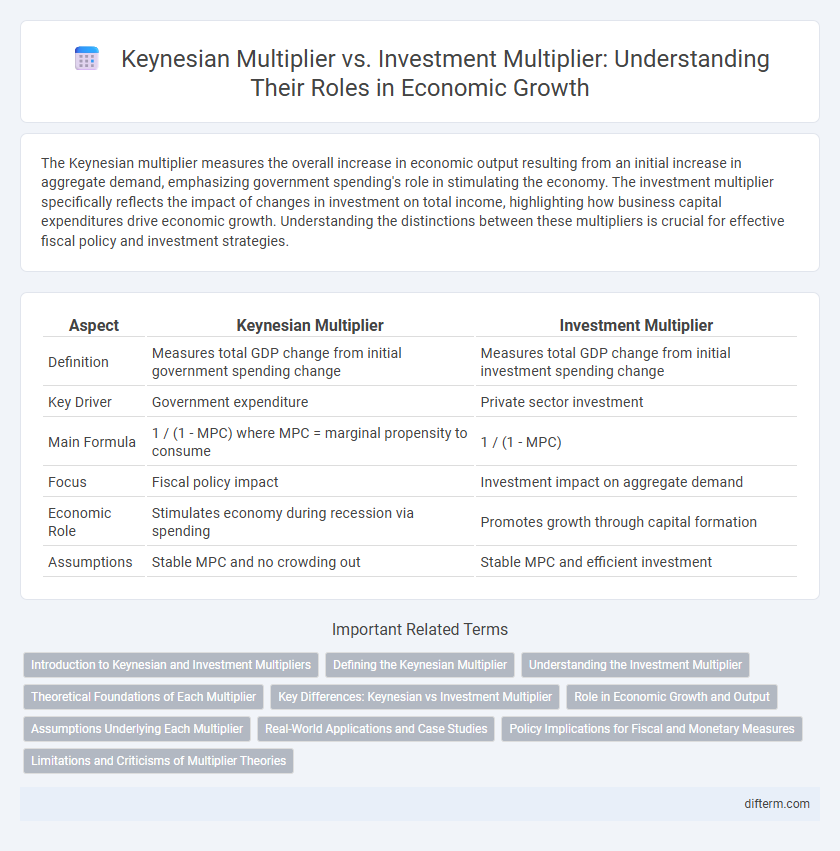

The Keynesian multiplier measures the overall increase in economic output resulting from an initial increase in aggregate demand, emphasizing government spending's role in stimulating the economy. The investment multiplier specifically reflects the impact of changes in investment on total income, highlighting how business capital expenditures drive economic growth. Understanding the distinctions between these multipliers is crucial for effective fiscal policy and investment strategies.

Table of Comparison

| Aspect | Keynesian Multiplier | Investment Multiplier |

|---|---|---|

| Definition | Measures total GDP change from initial government spending change | Measures total GDP change from initial investment spending change |

| Key Driver | Government expenditure | Private sector investment |

| Main Formula | 1 / (1 - MPC) where MPC = marginal propensity to consume | 1 / (1 - MPC) |

| Focus | Fiscal policy impact | Investment impact on aggregate demand |

| Economic Role | Stimulates economy during recession via spending | Promotes growth through capital formation |

| Assumptions | Stable MPC and no crowding out | Stable MPC and efficient investment |

Introduction to Keynesian and Investment Multipliers

The Keynesian multiplier measures the overall impact of a change in aggregate demand on national income, emphasizing consumption-induced variations within the economy. The investment multiplier specifically quantifies how initial investment expenditures lead to amplified increases in total output and income. Both concepts highlight the proportional relationship between spending injections and economic growth, central to Keynesian macroeconomic theory.

Defining the Keynesian Multiplier

The Keynesian multiplier measures the proportional increase in aggregate demand resulting from an initial increase in autonomous spending, emphasizing the role of marginal propensity to consume in amplifying economic output. Unlike the broader investment multiplier, which specifically isolates investment spending's effect, the Keynesian multiplier encompasses all forms of autonomous expenditures including government spending, consumption, and net exports. This concept highlights how initial injections into the economy lead to multiplied increases in overall income and employment through recursive rounds of spending.

Understanding the Investment Multiplier

The investment multiplier measures the ratio of change in national income to the initial change in investment spending, illustrating how increased investment leads to amplified economic growth. Unlike the broader Keynesian multiplier, which includes various types of spending, the investment multiplier isolates the impact of capital expenditures on aggregate demand. Understanding this concept is crucial for policymakers aiming to stimulate economic activity through targeted investment initiatives.

Theoretical Foundations of Each Multiplier

The Keynesian multiplier is grounded in the principle that an initial increase in autonomous spending leads to a larger overall increase in national income due to induced consumption, emphasizing marginal propensity to consume (MPC) as a key variable. The investment multiplier specifically highlights how changes in investment expenditures amplify aggregate demand, with its foundation rooted in the accelerator theory and the interaction between investment and output levels. Both multipliers rely on the concepts of aggregate demand stimulation but differ in the source of exogenous spending and the mechanisms driving subsequent economic expansion.

Key Differences: Keynesian vs Investment Multiplier

The Keynesian multiplier measures the overall impact of fiscal stimulus on aggregate demand, driven by government spending that triggers increased consumption, while the Investment multiplier specifically quantifies the effect of private investment on national income and output. Keynesian multiplier emphasizes the role of marginal propensity to consume, reflecting how initial government expenditure circulates through the economy, whereas the Investment multiplier focuses on capital formation and productivity growth as key drivers of economic expansion. Key distinction lies in the source of spending: government fiscal intervention for the Keynesian multiplier versus private sector investment in the Investment multiplier.

Role in Economic Growth and Output

The Keynesian multiplier quantifies how initial government spending boosts total economic output by increasing aggregate demand, crucial for countering recessions and stimulating growth. The investment multiplier specifically measures the amplified effect of private capital investments on GDP, driving long-term productive capacity and enhancing potential output. Both multipliers highlight the importance of fiscal and investment spending in accelerating economic growth and elevating overall output levels.

Assumptions Underlying Each Multiplier

The Keynesian multiplier assumes a fixed price level, constant marginal propensity to consume (MPC), and idle resources in the economy, which amplifies initial government spending through increased aggregate demand. The investment multiplier operates under the assumption that investment injections trigger higher income levels, with a stable interest rate and marginal propensity to save (MPS), promoting business cycles and long-run economic growth. Both multipliers rely on closed economy conditions, no government intervention beyond initial spending, and the absence of supply-side constraints for their calculated effects to hold true.

Real-World Applications and Case Studies

The Keynesian multiplier demonstrates how initial government spending increases aggregate demand and boosts GDP, evidenced by fiscal stimulus programs during the 2008 financial crisis that helped stabilize economies. The Investment multiplier highlights the amplified impact of private investments on economic growth, seen in infrastructure projects where each dollar invested generates multiple dollars in output, as in China's rapid urban development. Real-world case studies reveal that while both multipliers drive economic expansion, their effectiveness depends on factors like marginal propensity to consume and the economy's capacity to utilize increased demand.

Policy Implications for Fiscal and Monetary Measures

Keynesian multiplier emphasizes the amplified effect of government spending on aggregate demand, guiding fiscal policies to stimulate economic growth through direct expenditures and transfer payments. Investment multiplier focuses on how initial investments lead to increased income and consumption, encouraging monetary policies that lower interest rates to boost private investment. Policymakers leverage Keynesian strategies for immediate demand stabilization, while investment multiplier insights support sustained growth via incentivizing capital formation.

Limitations and Criticisms of Multiplier Theories

Keynesian multiplier and investment multiplier theories face limitations such as overestimating the impact of government spending due to assumptions of constant marginal propensity to consume and neglect of supply-side constraints. Both multipliers often fail to account for crowding-out effects, where increased public investment can raise interest rates and reduce private investment. Critics also highlight the difficulty in isolating multiplier effects in real economies because of factors like inflation, tax structures, and external trade balances.

Keynesian multiplier vs Investment multiplier Infographic

difterm.com

difterm.com