PPP measures the relative value of currencies by comparing the cost of a standard set of goods in different countries, providing a more accurate reflection of living standards and economic productivity. MER, based on current exchange rates determined by foreign exchange markets, often fluctuates due to speculation, trade flows, and government interventions, which can misrepresent the true economic capacity of a country. For economic analysis and cross-country comparisons, PPP offers a more stable and realistic gauge of economic well-being than MER.

Table of Comparison

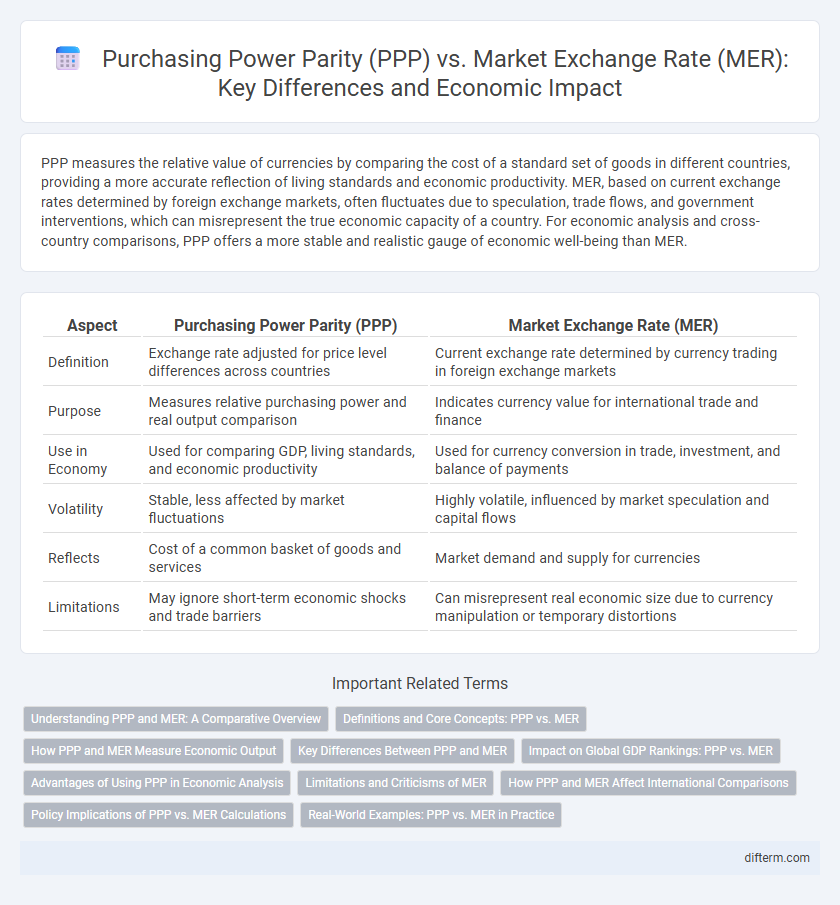

| Aspect | Purchasing Power Parity (PPP) | Market Exchange Rate (MER) |

|---|---|---|

| Definition | Exchange rate adjusted for price level differences across countries | Current exchange rate determined by currency trading in foreign exchange markets |

| Purpose | Measures relative purchasing power and real output comparison | Indicates currency value for international trade and finance |

| Use in Economy | Used for comparing GDP, living standards, and economic productivity | Used for currency conversion in trade, investment, and balance of payments |

| Volatility | Stable, less affected by market fluctuations | Highly volatile, influenced by market speculation and capital flows |

| Reflects | Cost of a common basket of goods and services | Market demand and supply for currencies |

| Limitations | May ignore short-term economic shocks and trade barriers | Can misrepresent real economic size due to currency manipulation or temporary distortions |

Understanding PPP and MER: A Comparative Overview

Purchasing Power Parity (PPP) measures the relative value of currencies based on the cost of a standardized basket of goods, providing a more accurate comparison of living standards across countries than Market Exchange Rate (MER), which reflects currency values driven by trade, capital flows, and speculation. PPP is essential for international economic analysis, as it adjusts for price level differences and mitigates distortions caused by volatile exchange rates that MER often exhibits. Understanding the distinction between PPP and MER enables economists to better assess real income levels, economic productivity, and global poverty rates.

Definitions and Core Concepts: PPP vs. MER

Purchasing Power Parity (PPP) measures the relative value of currencies by comparing the cost of a standardized basket of goods and services across countries, reflecting true consumer purchasing power. In contrast, Market Exchange Rate (MER) represents the current price at which one currency can be exchanged for another in the global currency markets, influenced by supply and demand factors. PPP provides a more stable comparison of economic productivity and living standards by neutralizing short-term market fluctuations inherent in MER.

How PPP and MER Measure Economic Output

Purchasing Power Parity (PPP) measures economic output by comparing the relative cost of a fixed basket of goods and services across countries, reflecting the actual living standards and domestic purchasing power. Market Exchange Rate (MER) assesses economic output by converting national GDP values using current currency exchange rates, emphasizing international trade and financial market valuations. PPP offers a more accurate comparison of real income and productivity, while MER captures cross-border economic activity and currency fluctuations.

Key Differences Between PPP and MER

Purchasing Power Parity (PPP) measures the relative value of currencies based on the cost of a standard basket of goods, reflecting the true living cost and economic productivity, while Market Exchange Rate (MER) is determined by supply and demand in foreign exchange markets, influenced by capital flows and speculative activities. PPP provides a more stable comparison for GDP and economic well-being across countries, whereas MER is volatile and suited for short-term financial and trade transactions analysis. Understanding these distinctions is essential for accurate cross-country economic comparisons and policy decisions.

Impact on Global GDP Rankings: PPP vs. MER

Purchasing Power Parity (PPP) adjusts GDP by accounting for cost of living and inflation differences, offering a more accurate comparison of economic productivity and living standards across countries. Market Exchange Rate (MER) reflects current currency trading values, influencing GDP rankings by emphasizing short-term economic fluctuations and international capital flows. Countries with lower price levels often rank higher in global GDP standings under PPP, while MER-based rankings may favor economies with stronger currencies despite lower domestic purchasing power.

Advantages of Using PPP in Economic Analysis

Purchasing Power Parity (PPP) provides a more accurate comparison of living standards and economic productivity between countries by accounting for differences in price levels, unlike Market Exchange Rates (MER) which are influenced by short-term market fluctuations. PPP reduces distortions caused by currency volatility and speculative movements, enabling a more stable and consistent measure of real purchasing power. This method better reflects the true cost of goods and services, enhancing the reliability of international economic analysis and policy formulation.

Limitations and Criticisms of MER

Market Exchange Rates (MER) often fail to reflect the true comparative economic strength between countries due to short-term volatility and market speculation, distorting international price comparisons and economic analysis. MER ignores differences in price levels and living costs, leading to misleading conclusions about real income and economic well-being across nations. The reliance on MER can undervalue or overvalue economies, particularly in developing countries where currency markets are less liquid or manipulated, emphasizing the necessity for alternative measures like Purchasing Power Parity (PPP) to provide more accurate cross-country economic comparisons.

How PPP and MER Affect International Comparisons

Purchasing Power Parity (PPP) provides a more accurate reflection of living standards by adjusting for price level differences across countries, allowing economists to compare economic productivity and consumption more effectively. Market Exchange Rates (MER) are influenced by currency fluctuations and speculative activities, which can distort the real economic value when comparing GDP or income levels internationally. Using PPP-based comparisons helps to eliminate distortions caused by volatile exchange rates, offering a clearer view of relative economic sizes and citizens' purchasing capacities.

Policy Implications of PPP vs. MER Calculations

Policy implications of using PPP versus MER calculations significantly influence economic decision-making and international comparisons. PPP provides a more accurate reflection of domestic purchasing power and living standards, guiding policymakers in setting realistic poverty thresholds and designing social welfare programs. MER-based assessments often misrepresent economic size and competitiveness, potentially leading to misaligned trade policies and investment strategies.

Real-World Examples: PPP vs. MER in Practice

China's GDP evaluated using Purchasing Power Parity (PPP) surpasses the United States, reflecting a more accurate measure of domestic purchasing power by accounting for local price levels. In contrast, Market Exchange Rate (MER) valuations may underestimate China's economic size due to currency fluctuations and international trade dynamics. India also illustrates significant discrepancies between PPP and MER rankings, highlighting the importance of PPP for comparing living standards and economic output in emerging markets.

PPP (Purchasing Power Parity) vs MER (Market Exchange Rate) Infographic

difterm.com

difterm.com