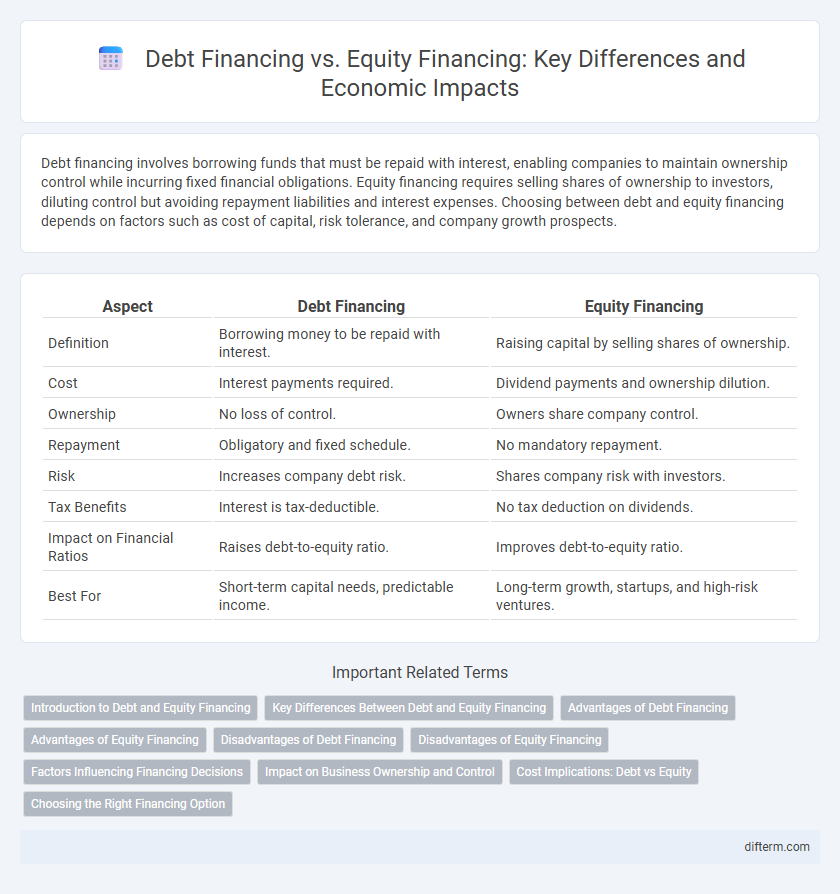

Debt financing involves borrowing funds that must be repaid with interest, enabling companies to maintain ownership control while incurring fixed financial obligations. Equity financing requires selling shares of ownership to investors, diluting control but avoiding repayment liabilities and interest expenses. Choosing between debt and equity financing depends on factors such as cost of capital, risk tolerance, and company growth prospects.

Table of Comparison

| Aspect | Debt Financing | Equity Financing |

|---|---|---|

| Definition | Borrowing money to be repaid with interest. | Raising capital by selling shares of ownership. |

| Cost | Interest payments required. | Dividend payments and ownership dilution. |

| Ownership | No loss of control. | Owners share company control. |

| Repayment | Obligatory and fixed schedule. | No mandatory repayment. |

| Risk | Increases company debt risk. | Shares company risk with investors. |

| Tax Benefits | Interest is tax-deductible. | No tax deduction on dividends. |

| Impact on Financial Ratios | Raises debt-to-equity ratio. | Improves debt-to-equity ratio. |

| Best For | Short-term capital needs, predictable income. | Long-term growth, startups, and high-risk ventures. |

Introduction to Debt and Equity Financing

Debt financing involves borrowing funds from external sources with a legal obligation to repay principal and interest, typically through loans or bonds, enabling businesses to leverage capital without diluting ownership. Equity financing entails raising capital by selling shares of the company to investors, which provides funds without immediate repayment but shares ownership and future profits. Both financing methods carry distinct implications for cash flow, control, and risk management in corporate finance strategies.

Key Differences Between Debt and Equity Financing

Debt financing involves borrowing funds that must be repaid with interest, creating a fixed financial obligation for the business, while equity financing entails raising capital by selling shares, resulting in ownership dilution but no repayment requirement. Debt financing offers tax advantages due to interest deductibility and maintains ownership control, contrasting with equity financing where investors gain voting rights and influence over business decisions. The choice between debt and equity financing impacts cash flow, risk exposure, financial leverage, and long-term profitability of a company.

Advantages of Debt Financing

Debt financing offers significant tax advantages as interest payments are usually tax-deductible, reducing the overall cost of capital. It enables business owners to retain full ownership and control without diluting equity or granting voting rights to external investors. Furthermore, debt financing provides predictable repayment schedules, improving financial planning and cash flow management for companies.

Advantages of Equity Financing

Equity financing provides businesses with capital without incurring debt or interest obligations, reducing financial risk and improving cash flow. It allows access to investors' expertise and networks, which can accelerate growth and enhance strategic decision-making. Since equity does not require repayment, companies can invest more confidently in long-term projects and innovation.

Disadvantages of Debt Financing

Debt financing increases financial risk due to mandatory interest payments and principal repayment schedules, which can strain cash flow and reduce operational flexibility. High leverage may also lead to credit rating downgrades, making future borrowing more expensive or inaccessible. Furthermore, excessive debt raises the likelihood of insolvency during economic downturns, potentially resulting in bankruptcy or loss of assets.

Disadvantages of Equity Financing

Equity financing dilutes ownership and control, potentially leading to conflicts among shareholders and management. It often involves giving up a significant portion of future profits to investors, reducing overall returns for founders. Furthermore, raising equity can be time-consuming and expensive due to regulatory compliance and underwriting fees.

Factors Influencing Financing Decisions

Debt financing decisions are influenced by interest rates, company credit ratings, and tax implications, favoring situations where predictable cash flows support regular repayments. Equity financing depends on market conditions, investor confidence, and dilution concerns, often preferred when companies seek growth capital without increasing leverage. Firm-specific factors, including cash flow stability, profitability, and growth prospects, critically determine the balance between debt and equity financing strategies.

Impact on Business Ownership and Control

Debt financing involves borrowing funds that must be repaid with interest, allowing business owners to retain full ownership and control but increasing financial risk and obligations. Equity financing requires selling shares of the company, which dilutes ownership and control but does not create debt or mandatory repayments. Choosing between debt and equity financing depends on a company's priorities regarding ownership retention, control, and financial flexibility.

Cost Implications: Debt vs Equity

Debt financing often incurs lower initial costs due to tax-deductible interest payments, reducing the overall cost of capital for businesses compared to equity financing. Equity financing requires sharing ownership and profits with investors, potentially diluting control and leading to higher long-term costs despite no mandatory repayment. Companies must evaluate the cost implications, balancing interest expenses and possible dilution to optimize their capital structure effectively.

Choosing the Right Financing Option

Evaluating debt financing versus equity financing requires analyzing cost of capital, control dilution, and risk tolerance to determine the optimal funding strategy. Debt financing offers tax advantages through interest deductibility and maintains ownership but increases leverage and repayment obligations. Equity financing avoids repayment pressure and strengthens balance sheets but dilutes ownership and may increase the cost of capital.

Debt financing vs Equity financing Infographic

difterm.com

difterm.com