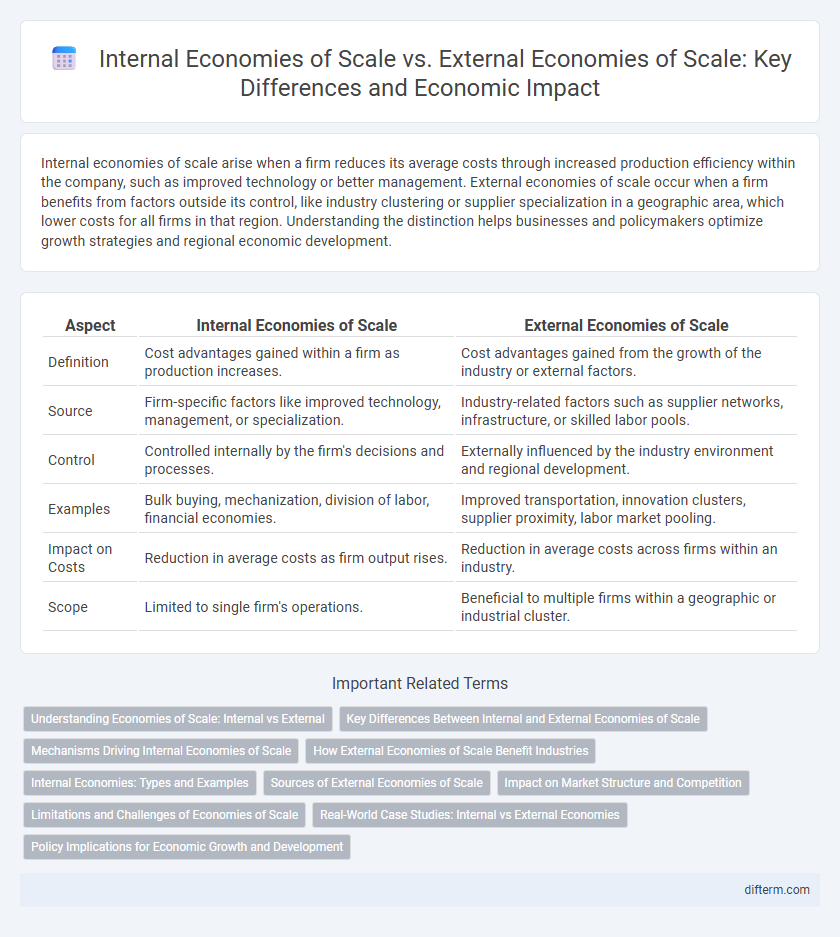

Internal economies of scale arise when a firm reduces its average costs through increased production efficiency within the company, such as improved technology or better management. External economies of scale occur when a firm benefits from factors outside its control, like industry clustering or supplier specialization in a geographic area, which lower costs for all firms in that region. Understanding the distinction helps businesses and policymakers optimize growth strategies and regional economic development.

Table of Comparison

| Aspect | Internal Economies of Scale | External Economies of Scale |

|---|---|---|

| Definition | Cost advantages gained within a firm as production increases. | Cost advantages gained from the growth of the industry or external factors. |

| Source | Firm-specific factors like improved technology, management, or specialization. | Industry-related factors such as supplier networks, infrastructure, or skilled labor pools. |

| Control | Controlled internally by the firm's decisions and processes. | Externally influenced by the industry environment and regional development. |

| Examples | Bulk buying, mechanization, division of labor, financial economies. | Improved transportation, innovation clusters, supplier proximity, labor market pooling. |

| Impact on Costs | Reduction in average costs as firm output rises. | Reduction in average costs across firms within an industry. |

| Scope | Limited to single firm's operations. | Beneficial to multiple firms within a geographic or industrial cluster. |

Understanding Economies of Scale: Internal vs External

Internal economies of scale arise from factors within a company, such as improved production techniques, skilled labor, and efficient management, leading to reduced average costs as output increases. External economies of scale occur outside the firm, benefiting all firms in an industry through infrastructure improvements, supplier specialization, or technological advancements. Distinguishing between these two types is crucial for strategic planning and understanding cost advantages in competitive markets.

Key Differences Between Internal and External Economies of Scale

Internal economies of scale arise from factors within a company, such as improved production techniques, bulk purchasing, or enhanced managerial efficiency, leading to reduced average costs as the firm expands. External economies of scale occur due to industry-wide growth and external factors like infrastructure development, supplier specialization, or skilled labor availability, benefiting all firms in the market. The key difference lies in the source of cost advantages: internal economies are firm-specific and controllable, whereas external economies depend on broader market or industry conditions.

Mechanisms Driving Internal Economies of Scale

Internal economies of scale primarily arise from operational efficiencies within a firm, such as technological advancements, specialization of labor, and improved managerial expertise. These mechanisms reduce average costs as production expands by optimizing resource allocation and streamlining processes. Investment in innovation and employee training further enhances productivity, solidifying cost advantages exclusive to the firm's internal growth.

How External Economies of Scale Benefit Industries

External economies of scale benefit industries by reducing costs through factors outside individual firms, such as improved infrastructure, supplier specialization, and a skilled labor pool developed within a geographic region. Clusters of firms in industries like technology or manufacturing experience increased productivity and innovation as shared resources and knowledge spillovers lower average production costs. Government investment in transport networks and research institutions further amplifies these cost advantages, attracting more businesses and enhancing overall industry competitiveness.

Internal Economies: Types and Examples

Internal economies of scale refer to cost advantages that a firm gains as it increases production within its own operations, such as technical economies from investing in advanced machinery, managerial economies through specialized management, and financial economies by accessing cheaper capital. Examples include a large manufacturing company reducing per-unit costs by using automated production lines or a retail chain lowering procurement expenses due to bulk buying. These internal efficiencies result in lower average costs and enhance competitive advantage as the firm's scale expands.

Sources of External Economies of Scale

External economies of scale arise from factors outside a firm but within an industry, such as improved infrastructure, enhanced supplier networks, and a skilled labor pool that benefits all companies in the sector. Clustering of businesses in industrial hubs leads to shared knowledge spillovers and reduced input costs, driving efficiency and innovation across the industry. Government policies supporting education, transportation, and technology development also contribute significantly to external economies of scale by enhancing the collective productivity of firms.

Impact on Market Structure and Competition

Internal economies of scale arise from within a firm, such as improved production techniques or bulk purchasing, which reduce average costs and enable firms to expand output efficiently, leading to market concentration as larger firms dominate. External economies of scale occur outside a single firm, often through industry clustering or shared infrastructure, lowering costs for all firms and fostering competitive markets with numerous players benefiting collectively. The contrast impacts market structure by favoring oligopolies or monopolies in internal economies, while external economies promote more competitive, fragmented industries with dynamic innovation and entry.

Limitations and Challenges of Economies of Scale

Internal economies of scale face limitations such as increasing complexity in management, diminishing returns from over-expansion, and rising coordination costs that can reduce efficiency gains. External economies of scale are challenged by dependency on industry-wide factors, vulnerability to market fluctuations, and potential congestion effects in local infrastructure. Both types encounter scalability barriers when initial benefits plateau, requiring firms to innovate or diversify to sustain growth.

Real-World Case Studies: Internal vs External Economies

Internal economies of scale occur within a firm, such as Toyota's production efficiency gains through advanced robotics reducing per-unit costs, while external economies of scale arise from industry-wide benefits like Silicon Valley's tech cluster fostering innovation and shared resources among firms. Real-world case studies highlight how internal economies enable companies like Amazon to leverage automation for cost advantages, whereas external economies in industries like aerospace in Seattle emerge from supplier networks and skilled labor pools. These examples demonstrate the distinct impacts of internal improvements versus external industry conditions on firm competitiveness and economic growth.

Policy Implications for Economic Growth and Development

Internal economies of scale arise from cost advantages within a firm, while external economies of scale occur from industry-level growth, shaping different policy interventions for economic development. Policies promoting technology adoption and skill enhancement foster internal economies, whereas infrastructure investments and cluster development support external economies. Targeted strategies that balance firm-level efficiencies with industry-wide synergies accelerate sustainable economic growth and competitive advantage.

Internal economies of scale vs External economies of scale Infographic

difterm.com

difterm.com