The capital adequacy ratio (CAR) measures a bank's available capital expressed as a percentage of its risk-weighted assets, ensuring the institution can absorb potential losses and protect depositors. The reserve requirement ratio mandates banks to hold a specific fraction of their deposit liabilities as reserves, maintaining liquidity and controlling money supply. While CAR focuses on long-term financial stability, the reserve requirement ratio primarily addresses short-term liquidity and monetary policy objectives.

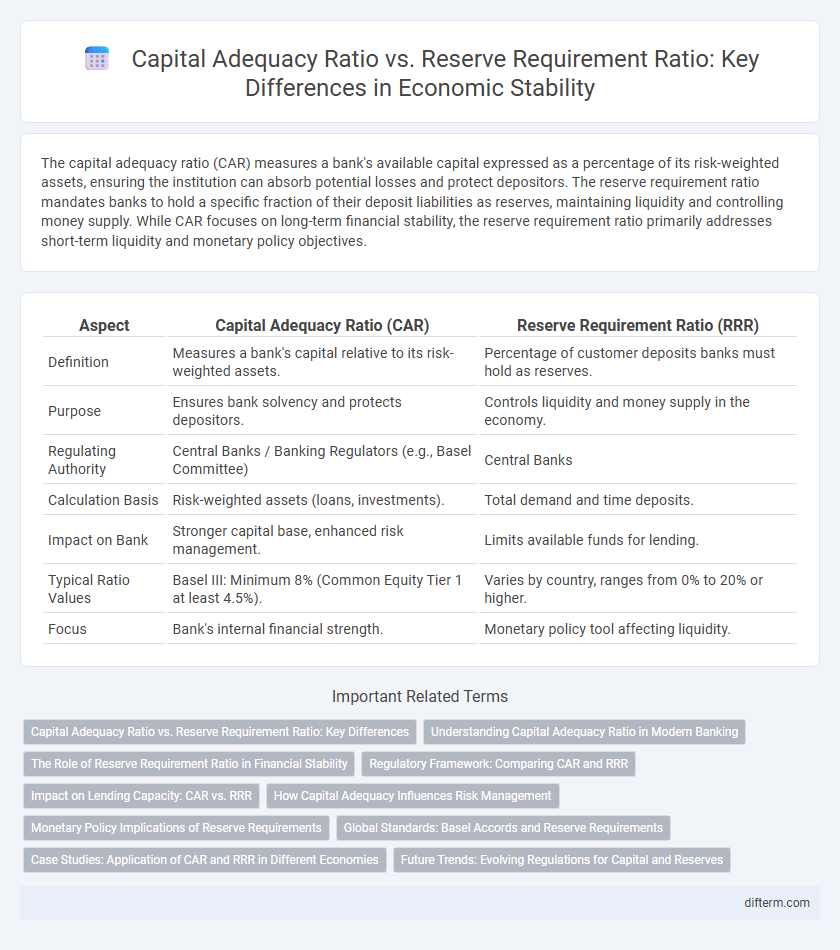

Table of Comparison

| Aspect | Capital Adequacy Ratio (CAR) | Reserve Requirement Ratio (RRR) |

|---|---|---|

| Definition | Measures a bank's capital relative to its risk-weighted assets. | Percentage of customer deposits banks must hold as reserves. |

| Purpose | Ensures bank solvency and protects depositors. | Controls liquidity and money supply in the economy. |

| Regulating Authority | Central Banks / Banking Regulators (e.g., Basel Committee) | Central Banks |

| Calculation Basis | Risk-weighted assets (loans, investments). | Total demand and time deposits. |

| Impact on Bank | Stronger capital base, enhanced risk management. | Limits available funds for lending. |

| Typical Ratio Values | Basel III: Minimum 8% (Common Equity Tier 1 at least 4.5%). | Varies by country, ranges from 0% to 20% or higher. |

| Focus | Bank's internal financial strength. | Monetary policy tool affecting liquidity. |

Capital Adequacy Ratio vs. Reserve Requirement Ratio: Key Differences

The Capital Adequacy Ratio (CAR) measures a bank's available capital relative to its risk-weighted assets, ensuring financial stability by absorbing potential losses, while the Reserve Requirement Ratio (RRR) mandates the minimum reserves a bank must hold against deposits to maintain liquidity. CAR primarily focuses on solvency and long-term risk management, reflecting a bank's ability to withstand financial distress, whereas RRR targets short-term liquidity control and monetary policy implementation by central banks. Banks use CAR to gauge risk exposure and regulatory compliance under Basel III, while RRR directly influences money supply and credit availability in the economy.

Understanding Capital Adequacy Ratio in Modern Banking

The Capital Adequacy Ratio (CAR) measures a bank's capital in relation to its risk-weighted assets, ensuring financial stability and protecting depositors. Unlike the Reserve Requirement Ratio (RRR), which mandates a fixed percentage of deposits to be held as reserves, CAR focuses on risk management by maintaining sufficient capital buffers to absorb potential losses. Regulators use CAR to assess a bank's ability to withstand financial stress and promote a resilient banking sector.

The Role of Reserve Requirement Ratio in Financial Stability

The Reserve Requirement Ratio (RRR) plays a critical role in maintaining financial stability by mandating banks to hold a specific fraction of their deposits as reserves, thus ensuring liquidity and reducing the risk of bank runs. Unlike the Capital Adequacy Ratio, which focuses on the bank's capital relative to its risk-weighted assets, the RRR directly controls the money supply and credit availability in the economy. Central banks use RRR adjustments as a strategic tool to stabilize the banking system, influence inflation rates, and mitigate systemic risks during economic fluctuations.

Regulatory Framework: Comparing CAR and RRR

The Capital Adequacy Ratio (CAR) measures a bank's available capital relative to its risk-weighted assets, ensuring financial stability and absorption of potential losses within the regulatory framework. The Reserve Requirement Ratio (RRR) mandates banks to hold a specific fraction of customer deposits as reserves, controlling liquidity and influencing money supply. Regulatory authorities use CAR to assess solvency and RRR to manage liquidity risk, each playing a distinct role in maintaining the resilience of the banking system.

Impact on Lending Capacity: CAR vs. RRR

Capital adequacy ratio (CAR) directly influences a bank's lending capacity by determining the minimum capital a bank must hold relative to its risk-weighted assets, thereby ensuring financial stability and absorbing potential losses. Reserve requirement ratio (RRR) impacts lending by mandating a portion of deposits to be held as reserves, limiting the funds available for loans but affecting liquidity more immediately than risk exposure. While CAR enforces long-term capital strength, RRR primarily controls short-term money supply and influences the velocity of credit creation in the economy.

How Capital Adequacy Influences Risk Management

Capital adequacy ratio (CAR) measures a bank's available capital relative to its risk-weighted assets, directly influencing its ability to absorb potential losses and maintain financial stability. By ensuring banks hold sufficient capital buffers, CAR enhances risk management practices, reducing the likelihood of insolvency during economic downturns. Unlike the reserve requirement ratio, which mandates liquidity for daily operations, CAR provides a strategic safeguard against credit, market, and operational risks.

Monetary Policy Implications of Reserve Requirements

The Capital Adequacy Ratio (CAR) measures a bank's capital relative to its risk-weighted assets, ensuring financial stability and solvency, while the Reserve Requirement Ratio mandates the minimum reserves banks must hold against deposits, directly influencing liquidity and credit supply in the economy. Monetary authorities use reserve requirements as a key tool to control money supply and inflation by adjusting banks' lending capacity. Changes in reserve requirements impact short-term interest rates and monetary policy effectiveness, shaping overall economic growth and financial market conditions.

Global Standards: Basel Accords and Reserve Requirements

The Capital Adequacy Ratio (CAR) under the Basel Accords sets global regulatory standards to ensure banks maintain sufficient capital against their risk-weighted assets, promoting financial stability and reducing the likelihood of insolvency. Reserve Requirement Ratios, often mandated by national central banks, dictate the minimum reserves banks must hold against deposit liabilities to control liquidity and influence monetary policy. While Basel Accords focus on the quality and quantity of capital to absorb losses, reserve requirements primarily serve as a tool for managing money supply and banking system liquidity on a macroeconomic scale.

Case Studies: Application of CAR and RRR in Different Economies

Case studies reveal that the Capital Adequacy Ratio (CAR) in economies like Singapore emphasizes bank solvency by maintaining a minimum CAR of 8%, promoting financial stability during economic stress. In contrast, the Reserve Requirement Ratio (RRR) in China acts as a liquidity control tool, with variations between 8% to 15% depending on the bank size, influencing credit expansion and monetary policy effectiveness. Comparative analysis shows that while CAR ensures capital buffer for loss absorption, RRR directly regulates money supply, with their combined application tailoring unique responses to banking sector risks across different economic environments.

Future Trends: Evolving Regulations for Capital and Reserves

Future trends in capital adequacy ratio (CAR) and reserve requirement ratio (RRR) regulations emphasize increased flexibility and risk sensitivity to better align with dynamic financial environments. Regulatory bodies are moving towards integrating advanced risk-based models and incorporating macroprudential elements to enhance systemic stability. Innovations in digital finance and global coordination among regulators are driving the evolution of capital and reserve frameworks to support resilient banking sectors worldwide.

Capital adequacy ratio vs Reserve requirement ratio Infographic

difterm.com

difterm.com