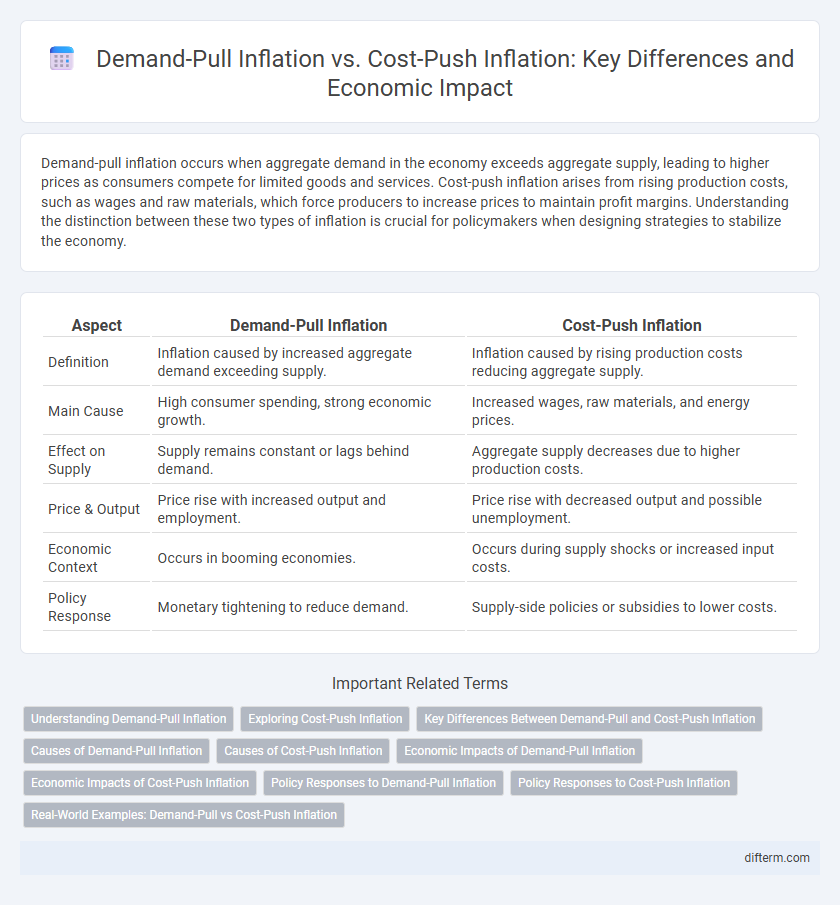

Demand-pull inflation occurs when aggregate demand in the economy exceeds aggregate supply, leading to higher prices as consumers compete for limited goods and services. Cost-push inflation arises from rising production costs, such as wages and raw materials, which force producers to increase prices to maintain profit margins. Understanding the distinction between these two types of inflation is crucial for policymakers when designing strategies to stabilize the economy.

Table of Comparison

| Aspect | Demand-Pull Inflation | Cost-Push Inflation |

|---|---|---|

| Definition | Inflation caused by increased aggregate demand exceeding supply. | Inflation caused by rising production costs reducing aggregate supply. |

| Main Cause | High consumer spending, strong economic growth. | Increased wages, raw materials, and energy prices. |

| Effect on Supply | Supply remains constant or lags behind demand. | Aggregate supply decreases due to higher production costs. |

| Price & Output | Price rise with increased output and employment. | Price rise with decreased output and possible unemployment. |

| Economic Context | Occurs in booming economies. | Occurs during supply shocks or increased input costs. |

| Policy Response | Monetary tightening to reduce demand. | Supply-side policies or subsidies to lower costs. |

Understanding Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand in an economy surpasses aggregate supply, leading to a general increase in prices. This type of inflation is often driven by factors such as increased consumer spending, government expenditure, or investment, which outpace the economy's productive capacity. Understanding demand-pull inflation is crucial for policymakers to implement measures like adjusting interest rates or fiscal policy to stabilize prices without hindering economic growth.

Exploring Cost-Push Inflation

Cost-push inflation occurs when rising production costs, such as increased wages or raw material prices, drive up overall price levels in the economy. This type of inflation reduces aggregate supply, leading to higher prices even when demand remains constant or falls. Key contributors include supply chain disruptions, higher energy costs, and increased labor expenses, which collectively strain business profitability and push consumer prices upward.

Key Differences Between Demand-Pull and Cost-Push Inflation

Demand-pull inflation occurs when aggregate demand in an economy exceeds aggregate supply, leading to rising prices, while cost-push inflation results from increased production costs such as higher wages or raw material prices driving prices upward. Demand-pull inflation is typically associated with economic growth and low unemployment, whereas cost-push inflation can occur even in stagnant or recessionary conditions. Key differences include their underlying causes--demand pressures versus supply constraints--and their effects on economic output, with demand-pull inflation often boosting growth and cost-push inflation potentially reducing it.

Causes of Demand-Pull Inflation

Demand-pull inflation is primarily caused by an increase in aggregate demand exceeding the economy's productive capacity, often driven by factors such as rising consumer spending, government expenditure, and investment. Expansionary fiscal policies, low interest rates, and increased money supply contribute significantly to higher demand, pushing prices upward. A booming economy with low unemployment also intensifies demand pressures, leading to demand-pull inflation.

Causes of Cost-Push Inflation

Cost-push inflation arises primarily from increased production costs, such as rising wages, higher raw material prices, and supply chain disruptions. These cost increases force producers to raise prices to maintain profit margins, reducing overall supply in the economy. Key factors include energy price shocks, higher taxes or regulations, and shortages in essential inputs like oil and commodities.

Economic Impacts of Demand-Pull Inflation

Demand-pull inflation occurs when aggregate demand in an economy outpaces aggregate supply, leading to upward pressure on prices. This inflationary pressure can stimulate short-term economic growth by encouraging production and investment but may also reduce purchasing power and increase income inequality over time. Persistent demand-pull inflation risks overheating the economy, causing central banks to implement tighter monetary policies that can slow down economic expansion.

Economic Impacts of Cost-Push Inflation

Cost-push inflation leads to decreased aggregate supply, resulting in higher production costs that reduce business profitability and output. This type of inflation often causes stagflation, where rising prices coincide with stagnant economic growth and elevated unemployment rates. Consumers face diminished purchasing power, while policymakers struggle to balance inflation control without stifling economic recovery.

Policy Responses to Demand-Pull Inflation

Policy responses to demand-pull inflation primarily involve tightening monetary policy by raising interest rates to reduce consumer spending and borrowing. Fiscal measures may include reducing government expenditures or increasing taxes to decrease overall demand. Central banks also monitor inflation expectations closely to ensure policies effectively stabilize aggregate demand without triggering recession.

Policy Responses to Cost-Push Inflation

Policy responses to cost-push inflation primarily involve supply-side measures such as improving productivity and reducing input costs through subsidies or tax incentives. Central banks may adopt tighter monetary policies cautiously to avoid stifling growth while governments focus on enhancing energy efficiency and diversifying supply chains. Targeted interventions like wage controls or price caps are sometimes implemented to mitigate inflationary pressures without triggering recession risks.

Real-World Examples: Demand-Pull vs Cost-Push Inflation

Demand-pull inflation occurs when aggregate demand in an economy exceeds supply, exemplified by the 2021 U.S. economic recovery, where consumer spending surged and supply chain constraints pushed prices up. Cost-push inflation is driven by rising production costs, such as the 1970s oil crisis when increased oil prices led to widespread price hikes across industries. Real-world data demonstrates how demand-pull inflation often follows rapid economic expansion, while cost-push inflation results from external shocks disrupting supply chains.

Demand-pull inflation vs Cost-push inflation Infographic

difterm.com

difterm.com