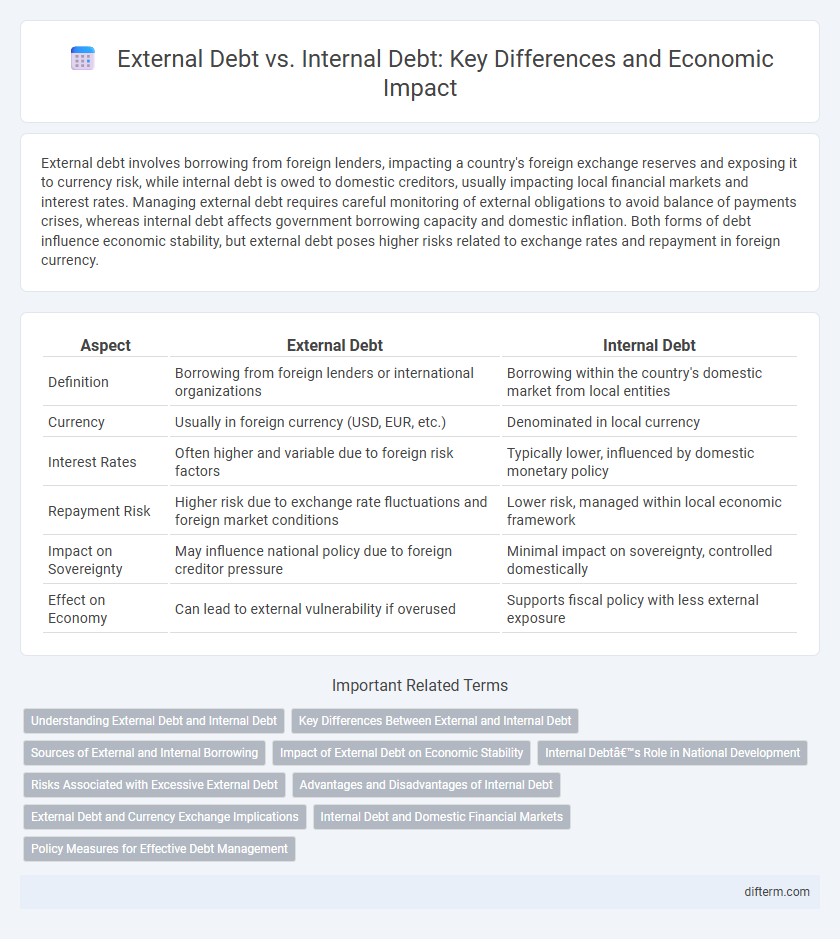

External debt involves borrowing from foreign lenders, impacting a country's foreign exchange reserves and exposing it to currency risk, while internal debt is owed to domestic creditors, usually impacting local financial markets and interest rates. Managing external debt requires careful monitoring of external obligations to avoid balance of payments crises, whereas internal debt affects government borrowing capacity and domestic inflation. Both forms of debt influence economic stability, but external debt poses higher risks related to exchange rates and repayment in foreign currency.

Table of Comparison

| Aspect | External Debt | Internal Debt |

|---|---|---|

| Definition | Borrowing from foreign lenders or international organizations | Borrowing within the country's domestic market from local entities |

| Currency | Usually in foreign currency (USD, EUR, etc.) | Denominated in local currency |

| Interest Rates | Often higher and variable due to foreign risk factors | Typically lower, influenced by domestic monetary policy |

| Repayment Risk | Higher risk due to exchange rate fluctuations and foreign market conditions | Lower risk, managed within local economic framework |

| Impact on Sovereignty | May influence national policy due to foreign creditor pressure | Minimal impact on sovereignty, controlled domestically |

| Effect on Economy | Can lead to external vulnerability if overused | Supports fiscal policy with less external exposure |

Understanding External Debt and Internal Debt

External debt refers to the total public and private debt owed to foreign creditors, denominated in foreign currency and impacting a country's exchange rates and foreign reserves. Internal debt consists of government borrowings within the country, typically issued in local currency to domestic investors, influencing national monetary policy and inflation dynamics. Recognizing the distinctions helps policymakers balance fiscal risks, optimize debt management, and ensure sustainable economic growth.

Key Differences Between External and Internal Debt

External debt is borrowed from foreign lenders, often denominated in foreign currencies, exposing countries to exchange rate risks and repayment challenges tied to international market conditions. Internal debt, on the other hand, is raised within a country's domestic financial system, typically in local currency, making it less vulnerable to currency fluctuations but potentially crowding out private investment. Key differences include creditor origin, currency denomination, risk exposure, and impact on national financial sovereignty.

Sources of External and Internal Borrowing

External debt primarily originates from foreign governments, international financial institutions like the IMF and World Bank, and global capital markets through sovereign bonds and syndicated loans. Internal debt is sourced mainly from domestic banks, non-bank financial institutions, and government securities marketed to local investors including pension funds and insurance companies. The cost and currency risk differ significantly between external and internal borrowing, influencing fiscal policy and debt sustainability strategies.

Impact of External Debt on Economic Stability

External debt significantly affects economic stability by increasing vulnerability to currency fluctuations and foreign interest rate changes, which can lead to higher repayment costs and reduced fiscal space. Heavy reliance on external borrowing often results in balance of payments deficits, currency depreciation, and inflationary pressures. Countries with substantial external debt are more susceptible to financial crises, undermining investor confidence and stalling economic growth.

Internal Debt’s Role in National Development

Internal debt plays a crucial role in national development by financing infrastructure projects, social programs, and public services without depleting foreign exchange reserves. It helps governments manage economic stability by providing a stable source of funds through domestic bond markets and encouraging local investment. Reliance on internal debt also reduces vulnerability to external shocks and exchange rate fluctuations compared to external debt.

Risks Associated with Excessive External Debt

Excessive external debt exposes a country to currency depreciation risks and sudden capital flight, leading to balance of payments crises and increased vulnerability to global financial shocks. Reliance on foreign lenders can escalate debt servicing costs due to exchange rate fluctuations and rising interest rates, potentially triggering sovereign default. Moreover, high external debt limits fiscal policy flexibility, constraining governments' ability to invest in development and social programs.

Advantages and Disadvantages of Internal Debt

Internal debt allows governments to finance budget deficits without affecting foreign exchange reserves, reducing vulnerability to external shocks. However, high levels of internal debt can crowd out private investment by increasing interest rates and potentially lead to inflationary pressures if monetized. Although easier to manage domestically, internal debt repayment depends heavily on the availability of sufficient domestic revenue.

External Debt and Currency Exchange Implications

External debt refers to the money a country owes to foreign creditors, denominated in foreign currencies, which exposes the borrower to exchange rate fluctuations and potential repayment difficulties. When a local currency depreciates against the debt currency, the real cost of servicing external debt increases, straining national budgets and affecting economic stability. Managing exchange rate risks is critical for countries with high external debt to avoid balance of payments crises and maintain investor confidence.

Internal Debt and Domestic Financial Markets

Internal debt plays a crucial role in financing government expenditures through domestic financial markets, often sourced from banks, financial institutions, and individual investors. This form of debt influences interest rates and liquidity in the domestic economy, affecting the cost of borrowing for both the public and private sectors. Efficient management of internal debt supports financial stability and sustainable economic growth by mobilizing savings within the country.

Policy Measures for Effective Debt Management

Effective debt management policies prioritize balancing external debt with internal debt to minimize exchange rate risks and inflationary pressures. Governments implement stringent borrowing limits, enhance transparency through fiscal reporting, and diversify funding sources to stabilize debt servicing costs. Strengthening institutional frameworks and adopting risk assessment tools enable proactive monitoring and timely adjustments in debt strategy.

External Debt vs Internal Debt Infographic

difterm.com

difterm.com