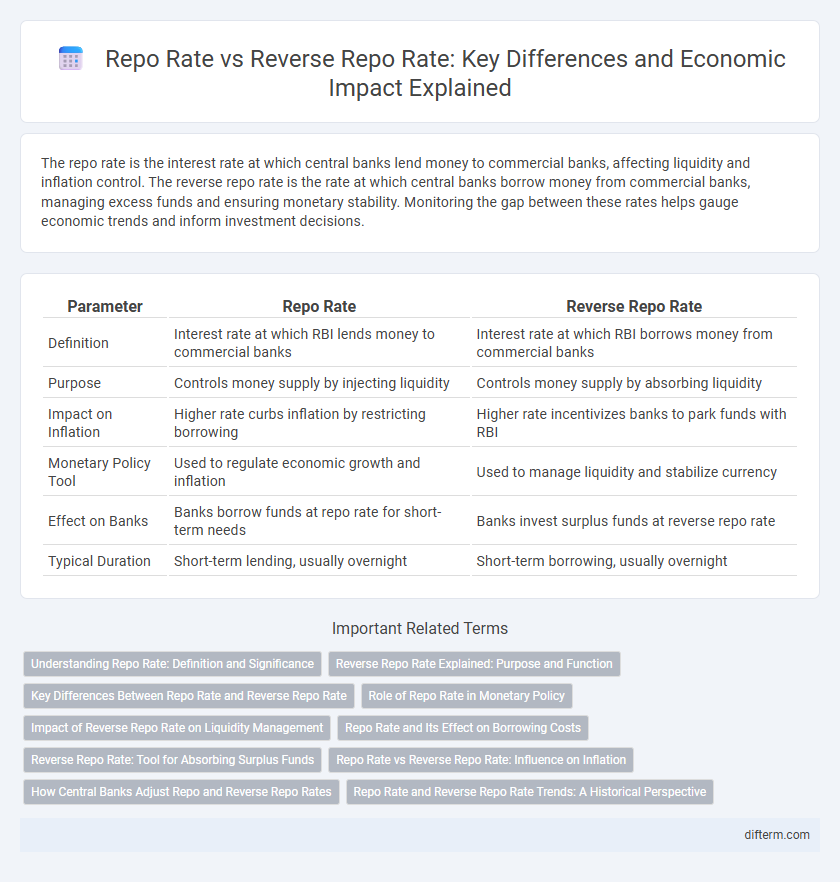

The repo rate is the interest rate at which central banks lend money to commercial banks, affecting liquidity and inflation control. The reverse repo rate is the rate at which central banks borrow money from commercial banks, managing excess funds and ensuring monetary stability. Monitoring the gap between these rates helps gauge economic trends and inform investment decisions.

Table of Comparison

| Parameter | Repo Rate | Reverse Repo Rate |

|---|---|---|

| Definition | Interest rate at which RBI lends money to commercial banks | Interest rate at which RBI borrows money from commercial banks |

| Purpose | Controls money supply by injecting liquidity | Controls money supply by absorbing liquidity |

| Impact on Inflation | Higher rate curbs inflation by restricting borrowing | Higher rate incentivizes banks to park funds with RBI |

| Monetary Policy Tool | Used to regulate economic growth and inflation | Used to manage liquidity and stabilize currency |

| Effect on Banks | Banks borrow funds at repo rate for short-term needs | Banks invest surplus funds at reverse repo rate |

| Typical Duration | Short-term lending, usually overnight | Short-term borrowing, usually overnight |

Understanding Repo Rate: Definition and Significance

The repo rate is the interest rate at which central banks lend short-term funds to commercial banks, playing a pivotal role in controlling inflation and liquidity in the economy. By influencing borrowing costs, changes in the repo rate impact consumer spending, business investment, and overall economic growth. Understanding the repo rate helps gauge monetary policy trends and anticipate shifts in financial markets.

Reverse Repo Rate Explained: Purpose and Function

The reverse repo rate is the interest rate at which the central bank borrows money from commercial banks, serving as a tool to absorb excess liquidity from the banking system. By increasing the reverse repo rate, the central bank encourages banks to park more funds with it, thereby tightening money supply and controlling inflation. This mechanism helps maintain monetary stability and manages short-term interest rates in the economy.

Key Differences Between Repo Rate and Reverse Repo Rate

Repo rate is the interest rate at which the central bank lends money to commercial banks for short-term liquidity needs, while the reverse repo rate is the rate at which the central bank borrows money from commercial banks to control money supply. A higher repo rate signals tightening monetary policy to curb inflation, whereas an increased reverse repo rate encourages banks to park funds with the central bank, reducing liquidity in the economy. These rates directly influence borrowing costs, liquidity management, and overall economic growth.

Role of Repo Rate in Monetary Policy

The repo rate serves as a critical tool in monetary policy by influencing liquidity and controlling inflation through short-term borrowing costs for commercial banks. Adjusting the repo rate affects lending rates across the economy, thereby regulating consumer spending and investment. Central banks primarily use the repo rate to stabilize economic growth and maintain price stability.

Impact of Reverse Repo Rate on Liquidity Management

The reverse repo rate influences liquidity management by enabling the central bank to absorb excess funds from the banking system, thereby controlling inflation and stabilizing short-term interest rates. When the reverse repo rate is increased, banks are incentivized to park more funds with the central bank, resulting in reduced money supply and tightened liquidity. This mechanism helps maintain financial stability by preventing overheating of the economy and ensuring adequate control over inflationary pressures.

Repo Rate and Its Effect on Borrowing Costs

The repo rate is the interest rate at which central banks lend funds to commercial banks, directly influencing borrowing costs in the economy. A higher repo rate increases the cost of borrowing for banks, which in turn raises interest rates for businesses and consumers, leading to reduced spending and investment. Conversely, a lower repo rate decreases borrowing costs, stimulating economic activity by encouraging loans and credit expansion.

Reverse Repo Rate: Tool for Absorbing Surplus Funds

The reverse repo rate serves as a critical monetary policy tool allowing central banks to absorb excess liquidity from the banking system, stabilizing inflation and controlling money supply. By offering commercial banks an interest rate on their surplus funds parked with the central bank, it incentivizes short-term deposits, reducing the cash flow in the economy. This absorption mechanism helps maintain economic equilibrium, preventing overheating and fostering sustainable economic growth.

Repo Rate vs Reverse Repo Rate: Influence on Inflation

The repo rate directly influences inflation by affecting borrowing costs for banks, which in turn impacts credit availability and consumer spending. The reverse repo rate helps control liquidity in the banking system, reducing excess money supply and curbing inflationary pressures. Central banks adjust these rates strategically to balance inflation control and economic growth.

How Central Banks Adjust Repo and Reverse Repo Rates

Central banks adjust the repo rate to control liquidity by influencing borrowing costs for commercial banks, thereby managing inflation and economic growth. The reverse repo rate is modified to regulate money absorption from the banking system, stabilizing surplus funds and maintaining interest rate stability. These rate changes are critical tools in monetary policy to balance credit availability and control inflationary pressures within the economy.

Repo Rate and Reverse Repo Rate Trends: A Historical Perspective

The repo rate, which is the interest rate at which central banks lend money to commercial banks, has shown a fluctuating trend influenced by inflation control and economic growth targets over the decades. Conversely, the reverse repo rate, the rate at which central banks absorb excess liquidity from commercial banks, often moves in tandem with the repo rate but tends to stabilize during periods of monetary tightening to maintain liquidity balance. Historical data from major economies illustrate that shifts in the repo rate often signal monetary policy changes, while adjustments in the reverse repo rate reflect efforts to manage short-term liquidity and banking system stability.

Repo rate vs Reverse repo rate Infographic

difterm.com

difterm.com