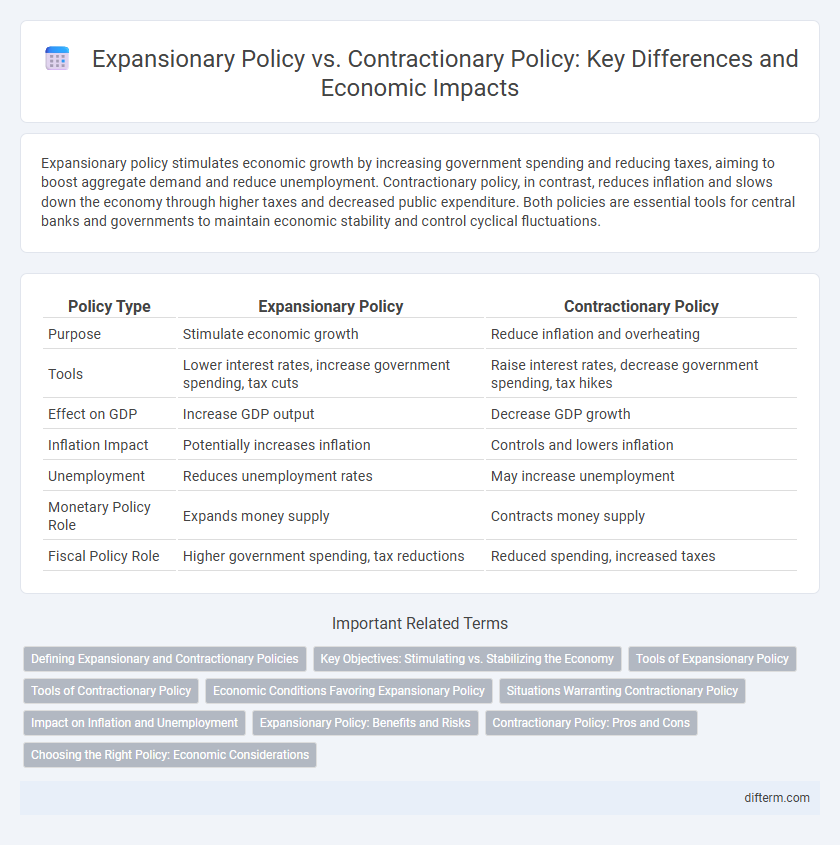

Expansionary policy stimulates economic growth by increasing government spending and reducing taxes, aiming to boost aggregate demand and reduce unemployment. Contractionary policy, in contrast, reduces inflation and slows down the economy through higher taxes and decreased public expenditure. Both policies are essential tools for central banks and governments to maintain economic stability and control cyclical fluctuations.

Table of Comparison

| Policy Type | Expansionary Policy | Contractionary Policy |

|---|---|---|

| Purpose | Stimulate economic growth | Reduce inflation and overheating |

| Tools | Lower interest rates, increase government spending, tax cuts | Raise interest rates, decrease government spending, tax hikes |

| Effect on GDP | Increase GDP output | Decrease GDP growth |

| Inflation Impact | Potentially increases inflation | Controls and lowers inflation |

| Unemployment | Reduces unemployment rates | May increase unemployment |

| Monetary Policy Role | Expands money supply | Contracts money supply |

| Fiscal Policy Role | Higher government spending, tax reductions | Reduced spending, increased taxes |

Defining Expansionary and Contractionary Policies

Expansionary policy involves increasing government spending and decreasing taxes to stimulate economic growth and reduce unemployment, often implemented during recessions. Contractionary policy aims to decrease inflation by reducing government spending or increasing taxes, slowing economic activity when the economy overheats. Both policies are tools of fiscal management used to stabilize economic fluctuations and maintain sustainable growth.

Key Objectives: Stimulating vs. Stabilizing the Economy

Expansionary policy aims to stimulate economic growth by increasing aggregate demand through lower interest rates and higher government spending, targeting reduced unemployment and boosted output. In contrast, contractionary policy seeks to stabilize the economy by curbing inflation and overheating, typically employing higher interest rates and decreased public expenditure to slow down excessive demand. Both policies are essential tools used by central banks and governments to balance economic growth and price stability.

Tools of Expansionary Policy

Expansionary policy primarily uses tools such as lowering interest rates, increasing government spending, and reducing taxes to stimulate economic growth. These measures enhance consumer and business spending by increasing disposable income and lowering the cost of borrowing. Quantitative easing and open market operations are also key components that inject liquidity into the financial system to boost demand and promote employment.

Tools of Contractionary Policy

Contractionary policy primarily uses tools such as increasing interest rates, selling government bonds, and raising reserve requirements to reduce money supply and control inflation. The central bank's open market operations involve selling securities to withdraw liquidity from the banking system, which suppresses spending and investment. Higher reserve requirements force banks to hold a larger portion of deposits, limiting their ability to create loans and further tightening credit conditions.

Economic Conditions Favoring Expansionary Policy

Economic conditions favoring expansionary policy include periods of high unemployment, low inflation, and sluggish economic growth. Governments implement increased public spending and tax cuts to stimulate demand, boost employment, and accelerate GDP growth. Expansionary monetary policy also lowers interest rates to encourage borrowing and investment, helping to revive underperforming economies.

Situations Warranting Contractionary Policy

Contractionary policy is warranted during periods of high inflation where demand outpaces supply, threatening economic stability. Central banks implement higher interest rates to reduce money supply, curbing consumer spending and investment. This approach helps prevent overheating in the economy and controls price increases.

Impact on Inflation and Unemployment

Expansionary policy stimulates economic growth by increasing government spending or cutting taxes, which reduces unemployment but often raises inflation due to higher demand. Contractionary policy involves reducing spending or increasing taxes to slow down the economy, effectively lowering inflation but potentially increasing unemployment. Balancing these policies is crucial for maintaining stable inflation rates while minimizing joblessness in the economy.

Expansionary Policy: Benefits and Risks

Expansionary policy stimulates economic growth by increasing government spending and lowering interest rates, which boosts consumer demand and reduces unemployment. Benefits include higher GDP, improved business investment, and enhanced wage growth, while risks involve rising inflation and potential fiscal deficits. Careful calibration ensures sustainable growth without overheating the economy or triggering asset bubbles.

Contractionary Policy: Pros and Cons

Contractionary policy reduces inflation and curbs excessive economic growth by increasing interest rates and decreasing government spending, stabilizing prices and maintaining currency value. However, these measures can slow economic growth, increase unemployment, and reduce consumer spending, potentially leading to a recession. Policymakers must balance controlling inflation with maintaining employment levels to ensure sustainable economic stability.

Choosing the Right Policy: Economic Considerations

Expansionary policy stimulates economic growth by increasing government spending and lowering taxes to boost aggregate demand, making it ideal during recessionary periods with high unemployment. Contractionary policy reduces inflationary pressures by decreasing spending and raising taxes, effectively cooling an overheated economy experiencing rapid price increases. Policymakers must assess factors like current inflation rates, unemployment levels, and GDP growth to select the optimal approach for maintaining economic stability.

Expansionary Policy vs Contractionary Policy Infographic

difterm.com

difterm.com