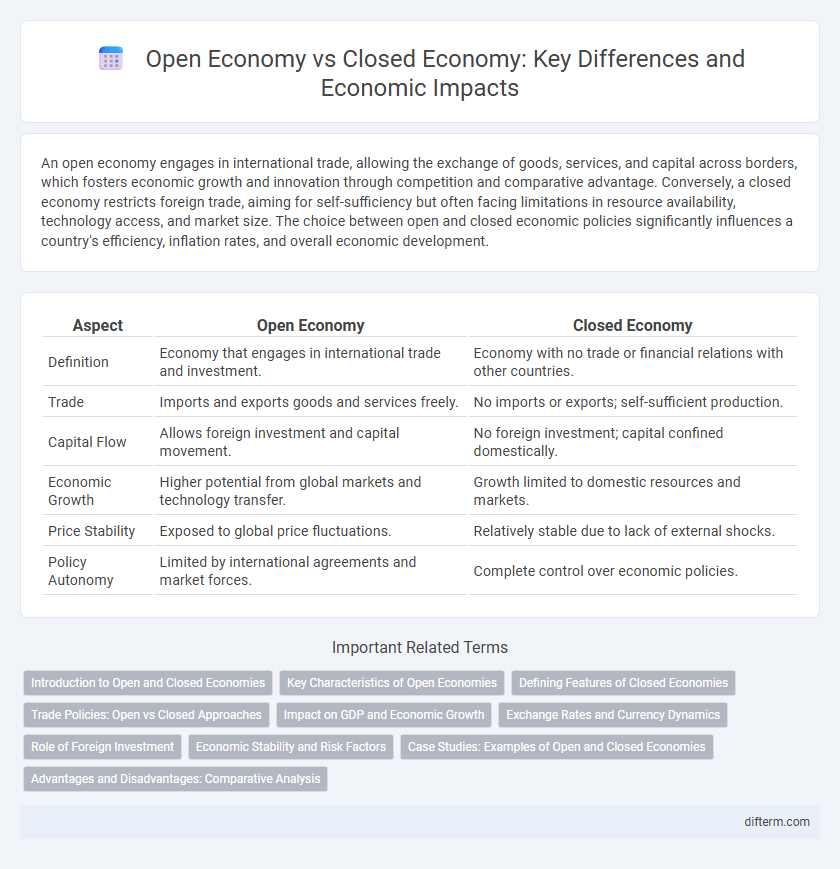

An open economy engages in international trade, allowing the exchange of goods, services, and capital across borders, which fosters economic growth and innovation through competition and comparative advantage. Conversely, a closed economy restricts foreign trade, aiming for self-sufficiency but often facing limitations in resource availability, technology access, and market size. The choice between open and closed economic policies significantly influences a country's efficiency, inflation rates, and overall economic development.

Table of Comparison

| Aspect | Open Economy | Closed Economy |

|---|---|---|

| Definition | Economy that engages in international trade and investment. | Economy with no trade or financial relations with other countries. |

| Trade | Imports and exports goods and services freely. | No imports or exports; self-sufficient production. |

| Capital Flow | Allows foreign investment and capital movement. | No foreign investment; capital confined domestically. |

| Economic Growth | Higher potential from global markets and technology transfer. | Growth limited to domestic resources and markets. |

| Price Stability | Exposed to global price fluctuations. | Relatively stable due to lack of external shocks. |

| Policy Autonomy | Limited by international agreements and market forces. | Complete control over economic policies. |

Introduction to Open and Closed Economies

An open economy engages in international trade, allowing the exchange of goods, services, and capital across borders, which enhances economic efficiency and growth potential through access to larger markets and foreign investments. In contrast, a closed economy restricts external trade and capital flows, relying primarily on domestic resources and markets to sustain economic activity. Understanding the distinctions between open and closed economies is crucial for analyzing trade policies, economic resilience, and the impacts of globalization.

Key Characteristics of Open Economies

Open economies engage in international trade, allowing the free flow of goods, services, capital, and labor across borders, which promotes economic growth and diversification. They typically have flexible exchange rates, tariffs, and trade policies that facilitate foreign investment and competitive markets. Key characteristics include higher integration into the global market, exposure to external economic shocks, and increased access to technology and innovation compared to closed economies.

Defining Features of Closed Economies

Closed economies operate without engaging in international trade, relying exclusively on domestic production and consumption to meet their economic needs. Key features include the absence of imports and exports, limited foreign investment, and self-sufficiency in goods and services. This isolation often results in restricted market competition and slower technological advancement compared to open economies.

Trade Policies: Open vs Closed Approaches

Open economies implement trade policies that encourage free trade through reduced tariffs, quotas, and trade barriers, fostering international market access and economic growth. Closed economies adopt protectionist trade policies, imposing high tariffs and import restrictions to shield domestic industries from foreign competition. These contrasting approaches significantly influence a country's trade volume, foreign investment inflows, and overall economic development.

Impact on GDP and Economic Growth

An open economy typically experiences higher GDP growth due to increased trade, foreign investment, and technology transfer, which stimulate productivity and innovation. In contrast, a closed economy limits these external interactions, often resulting in slower economic growth and reduced efficiency gains from specialization. Empirical data shows that countries engaging in international trade generally achieve higher long-term GDP growth rates compared to those with protectionist policies.

Exchange Rates and Currency Dynamics

Exchange rates in an open economy fluctuate based on foreign exchange markets, influenced by trade balances, capital flows, and monetary policies, enabling currency values to adjust dynamically. In contrast, a closed economy limits foreign trade and capital movement, resulting in fixed or artificially controlled exchange rates that restrict currency flexibility and responsiveness to global economic shifts. Currency dynamics in open economies reflect real-time economic interactions and investor sentiment, while closed economies often experience currency stability at the cost of market distortions and limited growth opportunities.

Role of Foreign Investment

Foreign investment plays a crucial role in an open economy by facilitating capital inflows, boosting economic growth, and enhancing technological advancement. In contrast, a closed economy limits foreign investment, which can restrict access to international capital markets and hinder innovation and competitiveness. The integration of foreign capital in an open economy often leads to increased productivity, job creation, and improved infrastructure development.

Economic Stability and Risk Factors

An open economy promotes economic stability through diversified trade and investment flows, reducing dependency on domestic markets and spreading risk across global partners. In contrast, a closed economy faces higher risk of economic shocks due to limited external engagement and reliance on internal resources, making it vulnerable to domestic supply and demand fluctuations. However, the openness to global markets also exposes an economy to international financial crises and trade disruptions, requiring strong regulatory frameworks to mitigate associated risks.

Case Studies: Examples of Open and Closed Economies

China exemplifies a shifting open economy with extensive international trade and foreign investment driving rapid growth, while North Korea represents a closed economy characterized by strict trade restrictions and minimal economic interaction with global markets. Singapore's open economy harnesses free trade policies and advanced infrastructure to become a global financial hub, contrasting with Cuba's closed economy approach, limiting foreign exchange and relying heavily on domestic resources. These case studies illustrate the impact of openness on economic development and international competitiveness.

Advantages and Disadvantages: Comparative Analysis

An open economy enhances resource allocation efficiency through international trade, promotes innovation via foreign direct investment, and provides consumers with a greater variety of goods. However, it faces vulnerabilities such as exposure to global economic shocks, exchange rate volatility, and potential loss of domestic industries due to foreign competition. In contrast, a closed economy ensures greater economic self-sufficiency and protects local jobs but often suffers from inefficiencies, limited market size, reduced competitiveness, and slower technological advancement.

open economy vs closed economy Infographic

difterm.com

difterm.com