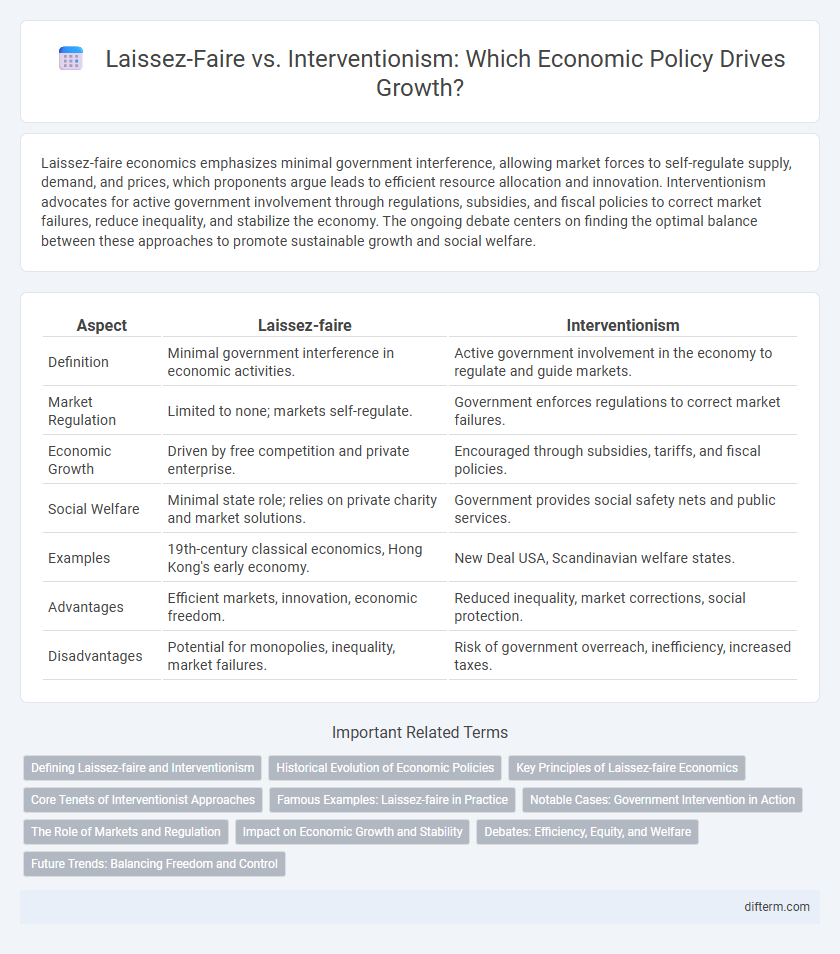

Laissez-faire economics emphasizes minimal government interference, allowing market forces to self-regulate supply, demand, and prices, which proponents argue leads to efficient resource allocation and innovation. Interventionism advocates for active government involvement through regulations, subsidies, and fiscal policies to correct market failures, reduce inequality, and stabilize the economy. The ongoing debate centers on finding the optimal balance between these approaches to promote sustainable growth and social welfare.

Table of Comparison

| Aspect | Laissez-faire | Interventionism |

|---|---|---|

| Definition | Minimal government interference in economic activities. | Active government involvement in the economy to regulate and guide markets. |

| Market Regulation | Limited to none; markets self-regulate. | Government enforces regulations to correct market failures. |

| Economic Growth | Driven by free competition and private enterprise. | Encouraged through subsidies, tariffs, and fiscal policies. |

| Social Welfare | Minimal state role; relies on private charity and market solutions. | Government provides social safety nets and public services. |

| Examples | 19th-century classical economics, Hong Kong's early economy. | New Deal USA, Scandinavian welfare states. |

| Advantages | Efficient markets, innovation, economic freedom. | Reduced inequality, market corrections, social protection. |

| Disadvantages | Potential for monopolies, inequality, market failures. | Risk of government overreach, inefficiency, increased taxes. |

Defining Laissez-faire and Interventionism

Laissez-faire is an economic principle advocating minimal government interference in market activities, emphasizing free-market competition and individual entrepreneurship as key drivers of economic growth. Interventionism involves proactive government policies and regulations aimed at correcting market failures, promoting social welfare, and stabilizing the economy through tools such as fiscal stimulus and regulatory oversight. These contrasting approaches shape diverse economic systems by balancing autonomy and control to optimize resource allocation and economic resilience.

Historical Evolution of Economic Policies

Laissez-faire economics emerged prominently during the 18th century, advocating minimal government interference to allow free markets to self-regulate, as exemplified by Adam Smith's principles in "The Wealth of Nations." The 20th century witnessed a shift toward interventionism, particularly during the Great Depression when governments adopted Keynesian policies to stabilize economies through fiscal stimulus and regulation. Post-World War II, mixed economies became prevalent, blending laissez-faire ideals with strategic intervention to foster growth and social welfare.

Key Principles of Laissez-faire Economics

Laissez-faire economics centers on minimal government interference in markets, emphasizing the role of free markets in allocating resources efficiently. Key principles include individual economic freedom, private property rights, and voluntary exchange, which collectively promote competition and innovation. This approach argues that market forces naturally regulate supply and demand, leading to optimal outcomes without state intervention.

Core Tenets of Interventionist Approaches

Interventionist economic approaches emphasize government involvement to correct market failures and ensure equitable resource distribution. Key tenets include regulatory oversight, fiscal policies aimed at stabilizing the economy, and social safety nets to protect vulnerable populations. These strategies contrast with laissez-faire principles by prioritizing state action to mitigate economic inequalities and promote sustainable growth.

Famous Examples: Laissez-faire in Practice

Laissez-faire economics is exemplified by the United States during the Gilded Age, where minimal government interference allowed rapid industrial growth and market expansion. The British Empire's market policies in the 19th century further illustrate laissez-faire principles, fostering global trade through limited regulation. These examples highlight how unrestricted markets can drive economic innovation and wealth creation, despite potential inequalities.

Notable Cases: Government Intervention in Action

The 2008 financial crisis exemplifies government intervention in action, where central banks and governments worldwide injected trillions of dollars to stabilize financial markets and prevent economic collapse. In contrast, laissez-faire policies during the Great Depression initially delayed recovery due to limited government involvement, highlighting the risks of minimal intervention. Notable cases such as the post-World War II Marshall Plan demonstrate strategic government intervention fostering rapid economic growth and reconstruction.

The Role of Markets and Regulation

Markets operate most efficiently under laissez-faire principles, where minimal government interference allows supply and demand to determine prices and resource allocation. Interventionism argues that regulation is essential to correct market failures, protect consumers, and ensure equitable distribution of wealth. Effective economic policy often involves balancing free-market mechanisms with strategic regulatory frameworks to foster sustainable growth and stability.

Impact on Economic Growth and Stability

Laissez-faire policies promote economic growth by allowing market forces to operate with minimal government interference, fostering innovation and entrepreneurship. Interventionism aims to enhance economic stability through regulatory measures, fiscal policies, and social safety nets that mitigate market volatility and prevent crises. Empirical studies indicate that balanced intervention can prevent economic downturns without significantly stifling growth, while excessive intervention may lead to inefficiencies and slower expansion.

Debates: Efficiency, Equity, and Welfare

Laissez-faire economics emphasizes minimal government intervention, arguing that free markets maximize efficiency through supply and demand mechanisms, which typically lead to optimal allocation of resources. Interventionism advocates for government involvement to correct market failures, enhance equity, and provide social welfare, addressing issues like income inequality and public goods underprovision. The debate centers on balancing economic efficiency with social equity, as unregulated markets may generate disparities that interventionist policies aim to mitigate without significantly hampering growth.

Future Trends: Balancing Freedom and Control

Future economic trends indicate a nuanced balance between laissez-faire policies and interventionism, with data showing increasing state involvement in strategic sectors alongside market-driven innovation. Advanced technologies and global challenges, such as climate change and digital regulation, are driving governments to rethink traditional free-market approaches to ensure sustainable growth. Economists predict hybrid models combining regulatory frameworks with entrepreneurial freedom will shape the next decade's economic landscape.

Laissez-faire vs Interventionism Infographic

difterm.com

difterm.com