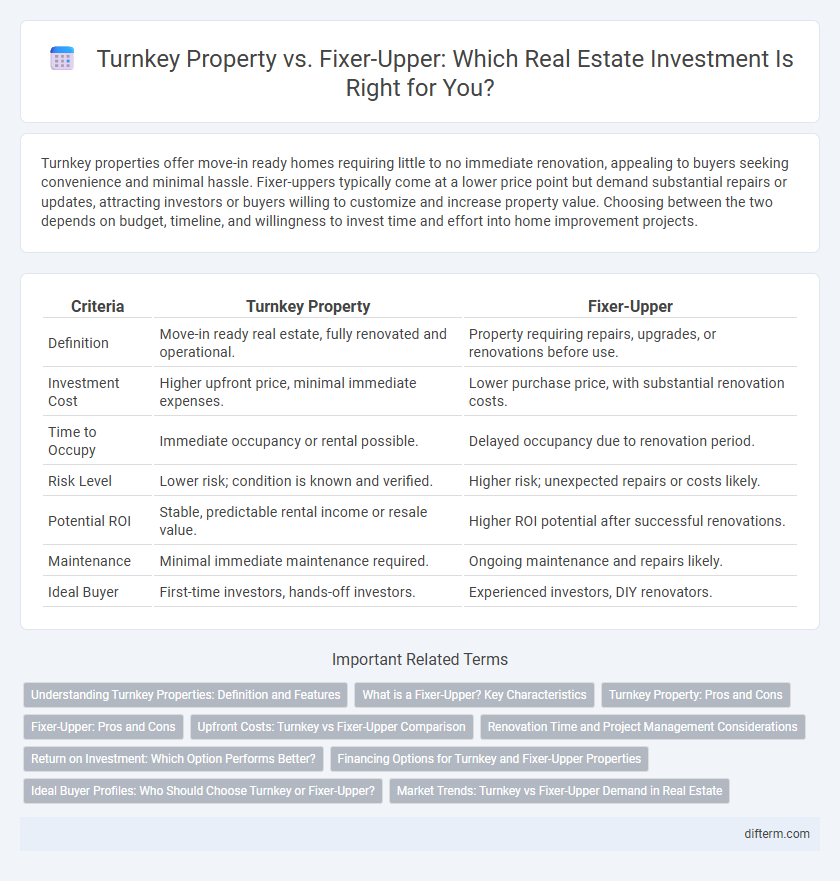

Turnkey properties offer move-in ready homes requiring little to no immediate renovation, appealing to buyers seeking convenience and minimal hassle. Fixer-uppers typically come at a lower price point but demand substantial repairs or updates, attracting investors or buyers willing to customize and increase property value. Choosing between the two depends on budget, timeline, and willingness to invest time and effort into home improvement projects.

Table of Comparison

| Criteria | Turnkey Property | Fixer-Upper |

|---|---|---|

| Definition | Move-in ready real estate, fully renovated and operational. | Property requiring repairs, upgrades, or renovations before use. |

| Investment Cost | Higher upfront price, minimal immediate expenses. | Lower purchase price, with substantial renovation costs. |

| Time to Occupy | Immediate occupancy or rental possible. | Delayed occupancy due to renovation period. |

| Risk Level | Lower risk; condition is known and verified. | Higher risk; unexpected repairs or costs likely. |

| Potential ROI | Stable, predictable rental income or resale value. | Higher ROI potential after successful renovations. |

| Maintenance | Minimal immediate maintenance required. | Ongoing maintenance and repairs likely. |

| Ideal Buyer | First-time investors, hands-off investors. | Experienced investors, DIY renovators. |

Understanding Turnkey Properties: Definition and Features

Turnkey properties are fully renovated homes that are move-in ready, requiring no immediate repairs or upgrades. These properties often come with modern amenities, updated systems, and contemporary finishes, appealing to buyers seeking convenience and minimal hassle. Investors favor turnkey rentals for their potential to generate immediate rental income without the need for extensive maintenance or renovation.

What is a Fixer-Upper? Key Characteristics

A fixer-upper is a property that requires significant repairs or renovations before it becomes livable or market-ready, often appealing to investors or homebuyers seeking lower purchase prices and customization opportunities. Key characteristics include structural issues, outdated systems, cosmetic wear, and potential for increased value through refurbishment. These properties typically demand time, budget for repairs, and expertise in construction or project management to maximize return on investment.

Turnkey Property: Pros and Cons

Turnkey properties offer immediate rental income and minimal renovation stress, making them ideal for investors seeking hassle-free real estate ventures. The primary advantages include move-in readiness, full compliance with local building codes, and often professional property management services, reducing operational burdens. However, turnkey homes typically carry higher upfront costs and limited customization options compared to fixer-uppers, potentially affecting long-term investment returns.

Fixer-Upper: Pros and Cons

Fixer-upper properties offer the potential for significant equity growth by allowing buyers to customize renovations and increase property value through strategic improvements. They often come at a lower purchase price compared to turnkey properties but require substantial time, effort, and additional investment in repairs and upgrades. Risks include unforeseen structural issues, fluctuating renovation costs, and extended timelines, which can impact overall profitability and market readiness.

Upfront Costs: Turnkey vs Fixer-Upper Comparison

Turnkey properties typically involve higher upfront costs due to their move-in ready condition, including completed renovations and modern amenities. In contrast, fixer-upper homes have lower initial purchase prices but require significant investment in repairs and upgrades, which can accumulate unexpected expenses. Assessing total upfront costs involves comparing immediate purchase price against potential renovation budgets and time commitments for each option.

Renovation Time and Project Management Considerations

Turnkey properties offer immediate occupancy with minimal renovation time, making them ideal for investors seeking quick returns without extensive project management. Fixer-upper homes require significant renovation efforts, extending the timeline and necessitating hands-on coordination of contractors, permits, and design choices. Evaluating renovation time and the ability to manage complex projects is crucial when deciding between turnkey properties and fixer-uppers for real estate investment.

Return on Investment: Which Option Performs Better?

Turnkey properties typically offer a faster return on investment due to immediate rental income and reduced renovation costs, making them ideal for investors prioritizing cash flow and low risk. Fixer-upper properties often require significant upfront capital and time but can yield higher returns through increased property value after renovation, appealing to investors with renovation expertise and long-term growth strategies. Market conditions and location play crucial roles in determining which option delivers better ROI, emphasizing the importance of thorough financial analysis before purchase.

Financing Options for Turnkey and Fixer-Upper Properties

Financing options for turnkey properties often include conventional loans and FHA loans, attracting investors due to the move-in ready condition and lower risk. Fixer-upper properties typically require specialized financing such as renovation loans like the FHA 203(k) or Fannie Mae HomeStyle Renovation loan to cover repair costs. Understanding these options helps buyers leverage the right loan products based on property condition and investment strategy.

Ideal Buyer Profiles: Who Should Choose Turnkey or Fixer-Upper?

Turnkey properties are ideal for investors or homebuyers seeking immediate rental income or move-in readiness without the hassle of repairs, often appealing to those with limited renovation experience or time. Fixer-upper homes attract buyers with construction skills, renovation budgets, and a willingness to invest time and effort to increase property value and customize features. First-time investors or busy professionals typically prefer turnkey homes, while DIY enthusiasts and value-driven buyers lean towards fixer-uppers.

Market Trends: Turnkey vs Fixer-Upper Demand in Real Estate

Turnkey properties have surged in demand due to buyers prioritizing convenience and immediate move-in readiness, reflecting a market trend toward hassle-free investments. In contrast, fixer-upper interest remains strong among investors seeking value-add opportunities and potential for higher returns through renovations. Market data shows a growing premium on turnkey homes in competitive urban areas, while fixer-uppers retain appeal in emerging neighborhoods with lower entry costs.

Turnkey Property vs Fixer-Upper Infographic

difterm.com

difterm.com