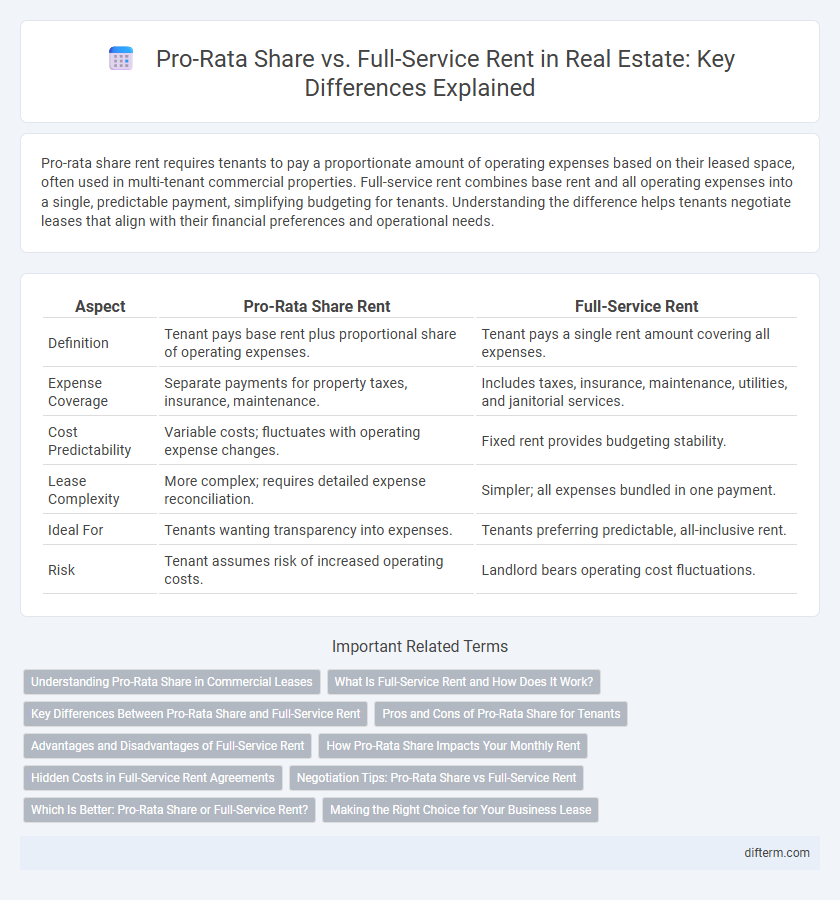

Pro-rata share rent requires tenants to pay a proportionate amount of operating expenses based on their leased space, often used in multi-tenant commercial properties. Full-service rent combines base rent and all operating expenses into a single, predictable payment, simplifying budgeting for tenants. Understanding the difference helps tenants negotiate leases that align with their financial preferences and operational needs.

Table of Comparison

| Aspect | Pro-Rata Share Rent | Full-Service Rent |

|---|---|---|

| Definition | Tenant pays base rent plus proportional share of operating expenses. | Tenant pays a single rent amount covering all expenses. |

| Expense Coverage | Separate payments for property taxes, insurance, maintenance. | Includes taxes, insurance, maintenance, utilities, and janitorial services. |

| Cost Predictability | Variable costs; fluctuates with operating expense changes. | Fixed rent provides budgeting stability. |

| Lease Complexity | More complex; requires detailed expense reconciliation. | Simpler; all expenses bundled in one payment. |

| Ideal For | Tenants wanting transparency into expenses. | Tenants preferring predictable, all-inclusive rent. |

| Risk | Tenant assumes risk of increased operating costs. | Landlord bears operating cost fluctuations. |

Understanding Pro-Rata Share in Commercial Leases

Pro-rata share in commercial leases refers to the tenant's portion of the total operating expenses for a building, calculated based on the rentable square footage they occupy relative to the entire property. This percentage determines how much the tenant pays for common area maintenance, property taxes, and insurance beyond the base rent. Understanding pro-rata share is crucial for tenants to accurately assess total occupancy costs compared to full-service rent, which bundles rent and expenses into a single payment.

What Is Full-Service Rent and How Does It Work?

Full-service rent is a leasing arrangement where tenants pay a single, comprehensive rent amount covering base rent and operating expenses such as property taxes, maintenance, insurance, and utilities. This type of rent simplifies budgeting for tenants by transferring variable costs to the landlord, who manages all building services and maintenance. Full-service rent is commonly used in office buildings and multi-tenant properties, providing predictable monthly expenses and streamlined property management.

Key Differences Between Pro-Rata Share and Full-Service Rent

Pro-rata share rent requires tenants to pay a portion of the building's operating expenses based on their leased space percentage, making costs variable and subject to changes in maintenance, taxes, and utilities. Full-service rent bundles base rent and operating expenses into one fixed payment, offering predictable monthly costs without separate expense bills. Understanding these distinctions helps tenants evaluate risk exposure and budgeting flexibility in commercial lease agreements.

Pros and Cons of Pro-Rata Share for Tenants

Pro-rata share rent requires tenants to pay a portion of operating expenses based on their leased space, offering transparency and potentially lower base rent compared to full-service agreements where all expenses are bundled. A key advantage for tenants is cost control through monitoring shared costs, but fluctuating operating expenses can lead to unpredictable monthly payments. Pro-rata arrangements may also demand greater administrative effort and financial diligence from tenants to verify and reconcile expenses accurately.

Advantages and Disadvantages of Full-Service Rent

Full-service rent includes all operating expenses such as maintenance, taxes, and insurance in one consistent monthly payment, providing tenants with predictable budgeting and reduced administrative burden. This leasing model simplifies cost management but often results in higher base rent compared to pro-rata share, where tenants separately pay their portion of expenses. Disadvantages of full-service rent include potential overpayment for unused services and less transparency in how operating costs are allocated.

How Pro-Rata Share Impacts Your Monthly Rent

Pro-rata share impacts your monthly rent by allocating costs based on the proportion of leased space within a multi-tenant property, resulting in tenants paying only for their fair share of common area expenses such as maintenance, utilities, and property taxes. Unlike full-service rent, where a single flat rate covers all expenses, the pro-rata method provides transparency and potential savings by adjusting costs according to actual usage and leased square footage. This approach can lead to fluctuating monthly rent payments depending on the changes in building operating costs and tenant space occupancy.

Hidden Costs in Full-Service Rent Agreements

Full-service rent agreements often include hidden costs such as management fees, maintenance charges, and utilities bundled into the rent, leading to higher overall expenses compared to pro-rata share leases. Tenants paying a pro-rata share are only responsible for their proportionate costs of shared expenses, providing clearer visibility and control over monthly outlays. Understanding these hidden fees is crucial for real estate tenants aiming to budget accurately and negotiate lease terms effectively.

Negotiation Tips: Pro-Rata Share vs Full-Service Rent

When negotiating lease terms, understanding the difference between pro-rata share and full-service rent is crucial for maximizing cost efficiency and transparency. Pro-rata share requires tenants to pay a proportionate part of operating expenses, offering potential negotiation leverage on controllable costs, while full-service rent bundles all expenses into a single rate, simplifying budgeting but reducing flexibility. Focus on negotiating caps on expense increases and sub-metering utilities under pro-rata arrangements to avoid unexpected charges, or seek clear definitions of included services in full-service leases to prevent overpaying for unused amenities.

Which Is Better: Pro-Rata Share or Full-Service Rent?

Pro-rata share rent allocates expenses based on the tenant's leased space, providing transparency and control over operational costs, while full-service rent bundles base rent with all expenses, simplifying budgeting with a fixed monthly payment. Tenants seeking predictability often prefer full-service rent to avoid fluctuations in variable costs, whereas those aiming for cost savings and control lean towards pro-rata share agreements. The better choice depends on the tenant's risk tolerance, budget preferences, and the nature of the commercial lease agreement.

Making the Right Choice for Your Business Lease

Understanding the difference between pro-rata share and full-service rent is crucial for optimizing your business lease expenses. Pro-rata share requires tenants to pay their portion of operating expenses in addition to base rent, while full-service rent bundles all costs into a single predictable payment. Choosing the right option depends on your business's cash flow stability and preference for financial transparency in property management.

Pro-rata share vs Full-service rent Infographic

difterm.com

difterm.com