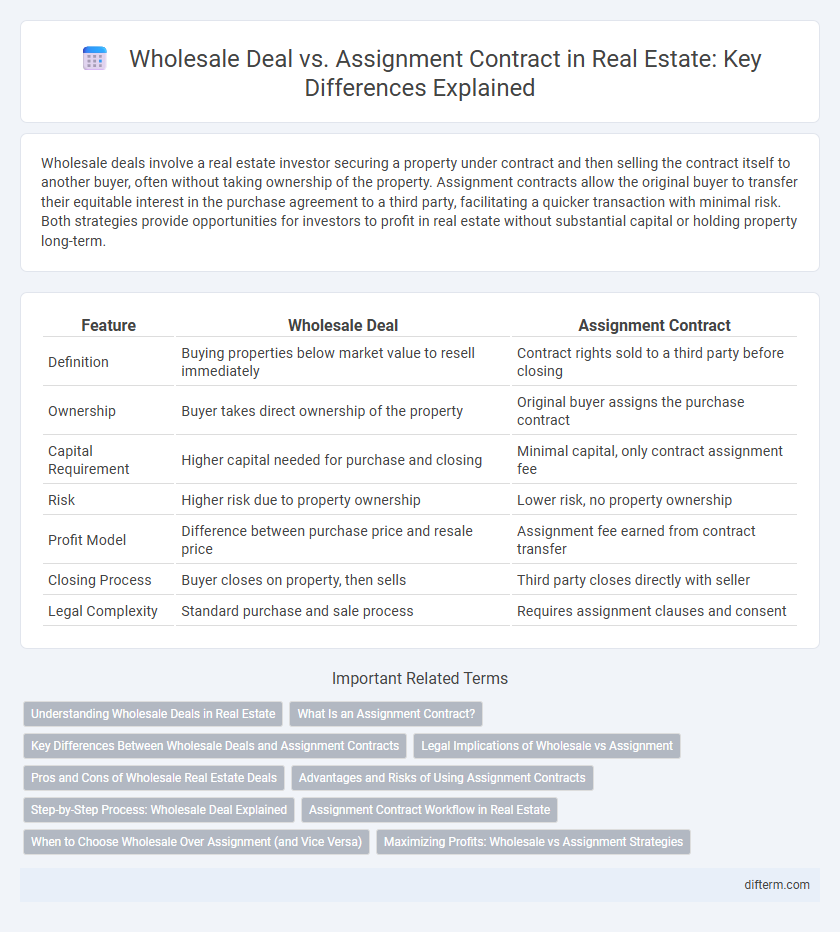

Wholesale deals involve a real estate investor securing a property under contract and then selling the contract itself to another buyer, often without taking ownership of the property. Assignment contracts allow the original buyer to transfer their equitable interest in the purchase agreement to a third party, facilitating a quicker transaction with minimal risk. Both strategies provide opportunities for investors to profit in real estate without substantial capital or holding property long-term.

Table of Comparison

| Feature | Wholesale Deal | Assignment Contract |

|---|---|---|

| Definition | Buying properties below market value to resell immediately | Contract rights sold to a third party before closing |

| Ownership | Buyer takes direct ownership of the property | Original buyer assigns the purchase contract |

| Capital Requirement | Higher capital needed for purchase and closing | Minimal capital, only contract assignment fee |

| Risk | Higher risk due to property ownership | Lower risk, no property ownership |

| Profit Model | Difference between purchase price and resale price | Assignment fee earned from contract transfer |

| Closing Process | Buyer closes on property, then sells | Third party closes directly with seller |

| Legal Complexity | Standard purchase and sale process | Requires assignment clauses and consent |

Understanding Wholesale Deals in Real Estate

Wholesale deals in real estate involve a wholesaler securing a property under contract at a discounted price, then selling the contract rights to an end buyer for a profit without ever taking ownership. This strategy relies heavily on strong negotiation skills and market knowledge to identify undervalued properties and motivated sellers. Understanding the legal frameworks governing assignment contracts is crucial to ensuring transparent and compliant transactions.

What Is an Assignment Contract?

An assignment contract in real estate enables a wholesaler to transfer their contractual rights to purchase a property to another buyer before closing. This legally binding agreement allows the assignee to step into the original buyer's position, often for a fee, without the need for finalizing the purchase themselves. Understanding the specifics of assignment contracts is crucial for investors seeking to optimize wholesale deals and minimize risks.

Key Differences Between Wholesale Deals and Assignment Contracts

Wholesale deals involve purchasing a property at a discounted price and reselling it quickly for profit, while assignment contracts allow the wholesaler to transfer their purchase rights to another buyer without closing on the property themselves. In wholesale deals, the investor takes ownership, whereas in assignment contracts, the investor assigns the contract rights to a third party before closing. Key differences include the level of risk, funding requirements, and the legal complexity associated with each method.

Legal Implications of Wholesale vs Assignment

Wholesale deals often involve the direct purchase and resale of property, creating a traditional sales contract with clear legal obligations and transfer of ownership at closing. Assignment contracts allow an investor to sell their interest in a purchase agreement before closing, which can introduce complexities around enforceability and buyer protections. Legal implications differ significantly, with assignment contracts requiring precise disclosure to avoid allegations of misrepresentation or unauthorized practice of real estate.

Pros and Cons of Wholesale Real Estate Deals

Wholesale real estate deals offer the advantage of requiring minimal upfront capital, allowing investors to quickly generate profits by assigning contracts to end buyers. However, these deals often involve limited control over the property and rely heavily on finding motivated sellers and reliable buyers, which can create challenges in closing transactions. While wholesale deals provide speed and flexibility, they may yield lower profit margins compared to traditional buy-and-hold investments or direct property purchases.

Advantages and Risks of Using Assignment Contracts

Assignment contracts in real estate allow investors to secure property deals without full purchase commitment, enabling quick profits by assigning contract rights to another buyer. Advantages include lower upfront capital requirements and reduced holding risks compared to traditional wholesale deals, as the original investor never takes title. Risks involve potential legal complexities, contract enforceability issues, and reliance on timely buyer assignment to avoid deal collapse or forfeited deposits.

Step-by-Step Process: Wholesale Deal Explained

A wholesale deal in real estate involves finding a property at a below-market price, securing the rights through a purchase contract, and then selling those rights to an end buyer for a profit. The step-by-step process includes locating motivated sellers, negotiating and signing a purchase agreement with an assignable clause, conducting due diligence to confirm property value, and marketing the contract to potential investors or buyers. Assigning the contract allows the wholesaler to transfer their purchase rights without taking ownership, streamlining transactions and minimizing financial risk.

Assignment Contract Workflow in Real Estate

The assignment contract workflow in real estate involves a wholesaler securing a property under contract and then assigning that contract to an end buyer for a fee, streamlining transaction speed and reducing risk. Key steps include identifying motivated sellers, executing the purchase agreement with an assignment clause, marketing the contract to potential buyers, and facilitating contract assignment while ensuring all parties fulfill their obligations. This process leverages legal documentation and timely communication to maximize profitability without requiring wholesalers to close on the property.

When to Choose Wholesale Over Assignment (and Vice Versa)

Wholesale deals suit investors seeking faster closings and control over property transactions without purchasing ownership, ideal for those confident in marketing to buyers quickly. Assignment contracts work better when the buyer wants to lock in a property under contract with minimal upfront risk and potentially higher profits from assigning the contract. Choosing wholesale or assignment depends on investment goals, cash flow availability, and risk tolerance in real estate asset acquisition strategies.

Maximizing Profits: Wholesale vs Assignment Strategies

Wholesale deals enable investors to secure properties below market value by contracting directly with motivated sellers, creating opportunities for significant profit margins through rapid reselling. Assignment contracts allow investors to lock in a purchase price and assign their equitable interest to another buyer for an assignment fee, reducing upfront capital requirements while maximizing returns. Comparing both strategies, wholesaling often demands stronger negotiation skills and seller relationships, whereas assignments focus on leveraging buyer networks to capitalize on quick transaction fees.

Wholesale Deal vs Assignment Contract Infographic

difterm.com

difterm.com