Build-to-rent developments prioritize long-term rental income through residential properties designed for tenants, offering consistent cash flow and reduced vacancy rates. In contrast, build-to-sell projects focus on constructing homes for immediate sale, maximizing upfront profits but exposing developers to market fluctuations. Understanding the financial goals and market demand helps investors decide between sustained rental revenue and quick capital gains.

Table of Comparison

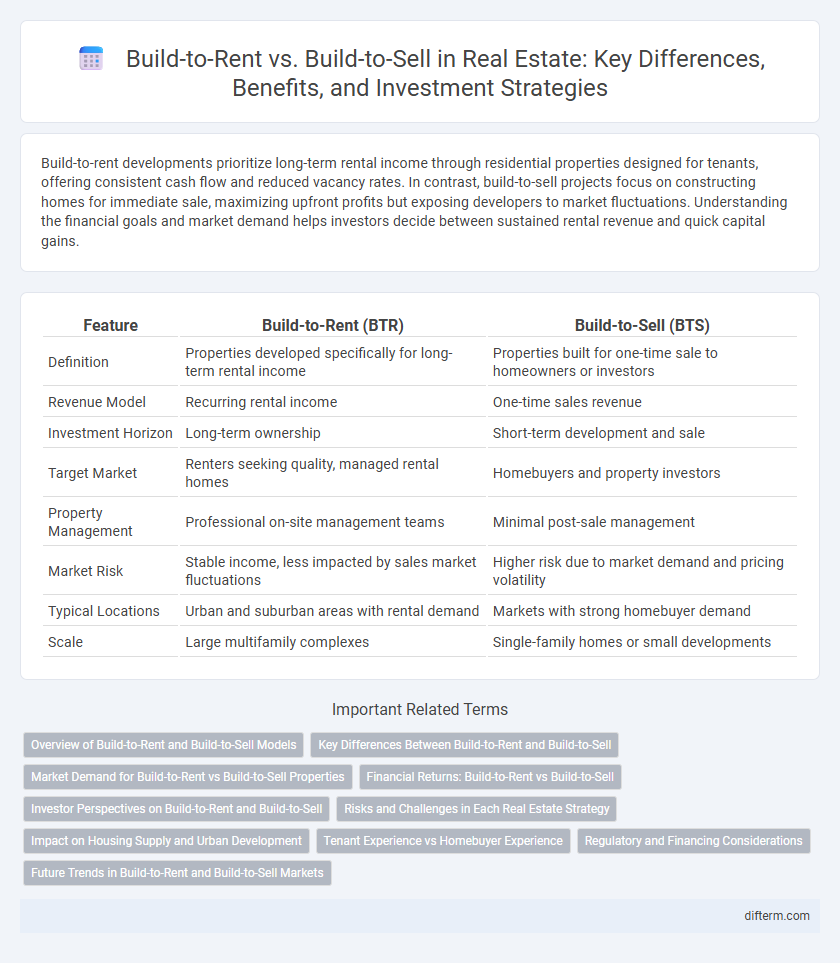

| Feature | Build-to-Rent (BTR) | Build-to-Sell (BTS) |

|---|---|---|

| Definition | Properties developed specifically for long-term rental income | Properties built for one-time sale to homeowners or investors |

| Revenue Model | Recurring rental income | One-time sales revenue |

| Investment Horizon | Long-term ownership | Short-term development and sale |

| Target Market | Renters seeking quality, managed rental homes | Homebuyers and property investors |

| Property Management | Professional on-site management teams | Minimal post-sale management |

| Market Risk | Stable income, less impacted by sales market fluctuations | Higher risk due to market demand and pricing volatility |

| Typical Locations | Urban and suburban areas with rental demand | Markets with strong homebuyer demand |

| Scale | Large multifamily complexes | Single-family homes or small developments |

Overview of Build-to-Rent and Build-to-Sell Models

Build-to-rent (BTR) focuses on developing residential properties specifically for long-term leasing, targeting tenants seeking quality rental homes with professional management and amenities. Build-to-sell (BTS) involves constructing homes intended for immediate sale, appealing to buyers looking for ownership and investment opportunities in the real estate market. Investors and developers choose BTR for steady rental income streams and BTS for quicker capital returns through property sales.

Key Differences Between Build-to-Rent and Build-to-Sell

Build-to-rent properties are designed and constructed specifically for long-term rental income, featuring amenities and layouts that cater to tenants' needs, whereas build-to-sell developments focus on quick sales with diverse unit types to attract buyers. Build-to-rent emphasizes steady cash flow and property management, while build-to-sell prioritizes rapid capital return and inventory turnover. Investors in build-to-rent benefit from recurring revenue and tenant retention, contrasting with build-to-sell's dependence on market conditions and sales velocity.

Market Demand for Build-to-Rent vs Build-to-Sell Properties

Market demand for build-to-rent properties continues to rise, driven by growing urbanization, changing lifestyle preferences, and affordability challenges for homebuyers. Build-to-rent developments attract long-term tenants seeking quality rental options with amenities, creating stable cash flow for investors. In contrast, build-to-sell markets fluctuate with buyer confidence and interest rate changes, often experiencing seasonal variability and higher transaction costs.

Financial Returns: Build-to-Rent vs Build-to-Sell

Build-to-rent developments generate steady, long-term cash flow through consistent rental income, offering investors higher capitalization rates compared to build-to-sell projects. Build-to-sell delivers immediate financial returns by capitalizing on property appreciation and market demand but carries higher risk due to market volatility. The choice between build-to-rent and build-to-sell hinges on investment goals, with build-to-rent favoring stable, recurring revenue streams and build-to-sell aiming for quicker capital gains.

Investor Perspectives on Build-to-Rent and Build-to-Sell

Investor perspectives on build-to-rent emphasize steady, long-term cash flow and portfolio diversification through rental income, appealing to those seeking predictable returns and reduced market volatility. In contrast, build-to-sell attracts investors aiming for quicker capital gains, driven by strong property demand and market appreciation potential. Risk tolerance and investment horizon significantly influence preference, with build-to-rent favored for stability and build-to-sell favored for higher, short-term profit opportunities.

Risks and Challenges in Each Real Estate Strategy

Build-to-rent developments face risks such as prolonged vacancy periods and higher maintenance costs due to ongoing property management responsibilities, impacting cash flow stability. Build-to-sell projects encounter challenges like market price fluctuations and construction delays, which can erode profit margins and extend timelines. Both strategies require careful assessment of local market demand, regulatory compliance, and financing risks to ensure successful project execution.

Impact on Housing Supply and Urban Development

Build-to-rent developments increase long-term rental housing supply, addressing demand in urban areas with growing populations and reducing homeownership pressure. Build-to-sell projects boost immediate housing stock by delivering new homes for purchase, which can accelerate neighborhood revitalization and diversify urban development. Both models influence urban density and land use patterns, with build-to-rent promoting stable rental communities and build-to-sell encouraging homeownership and individual property investment.

Tenant Experience vs Homebuyer Experience

Build-to-rent properties prioritize tenant experience by offering flexible lease terms, community amenities, and professional management to enhance convenience and lifestyle. In contrast, build-to-sell developments focus on homebuyer experience through customization options, property ownership benefits, and long-term investment potential. Tenant satisfaction in build-to-rent models drives retention and stable income, whereas build-to-sell caters to buyers seeking equity and personalization in their homes.

Regulatory and Financing Considerations

Build-to-rent developments often face distinct regulatory challenges compared to build-to-sell projects, including zoning laws that favor multi-family rentals and stricter landlord-tenant regulations. Financing for build-to-rent typically involves longer-term loans with stable return expectations, while build-to-sell projects rely on short-term construction financing and faster capital turnover. Lenders assess build-to-rent projects based on steady income streams and market rental demand, whereas build-to-sell financing depends heavily on sales velocity and property appreciation forecasts.

Future Trends in Build-to-Rent and Build-to-Sell Markets

Future trends in build-to-rent markets reveal a surge in demand driven by urbanization, affordability challenges, and a growing preference for flexible living arrangements among millennials and Gen Z. Build-to-sell markets will continue emphasizing sustainable and smart home features to attract eco-conscious buyers while navigating fluctuating interest rates and supply chain constraints. Both sectors are increasingly adopting digital platforms for customer engagement, streamlining transactions, and leveraging data analytics to predict market shifts and optimize investment returns.

build-to-rent vs build-to-sell Infographic

difterm.com

difterm.com