Single net leases require tenants to pay property taxes in addition to rent, while landlords cover insurance and maintenance costs. Triple net leases shift all three expenses -- property taxes, insurance, and maintenance -- to the tenant, resulting in lower landlord risk and more predictable income. Investors often prefer triple net leases for long-term stability, whereas single net leases may offer a balanced approach with moderate tenant responsibilities.

Table of Comparison

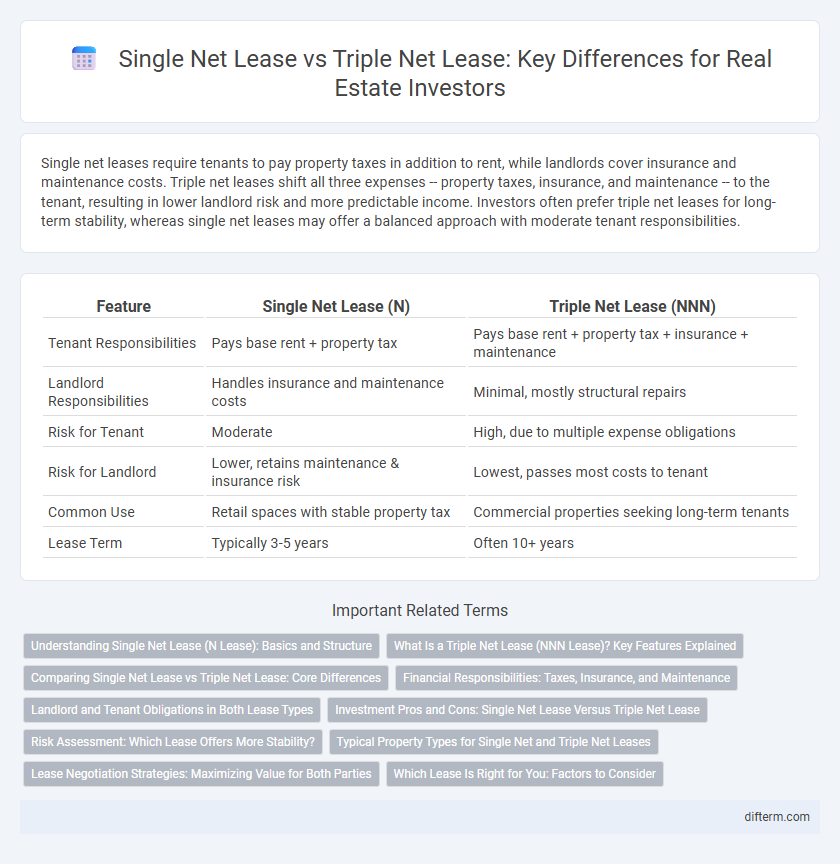

| Feature | Single Net Lease (N) | Triple Net Lease (NNN) |

|---|---|---|

| Tenant Responsibilities | Pays base rent + property tax | Pays base rent + property tax + insurance + maintenance |

| Landlord Responsibilities | Handles insurance and maintenance costs | Minimal, mostly structural repairs |

| Risk for Tenant | Moderate | High, due to multiple expense obligations |

| Risk for Landlord | Lower, retains maintenance & insurance risk | Lowest, passes most costs to tenant |

| Common Use | Retail spaces with stable property tax | Commercial properties seeking long-term tenants |

| Lease Term | Typically 3-5 years | Often 10+ years |

Understanding Single Net Lease (N Lease): Basics and Structure

A Single Net Lease (N Lease) requires the tenant to pay base rent plus property taxes, while the landlord covers other operating expenses such as insurance and maintenance. This lease structure provides a balanced risk distribution, making it attractive for investors seeking moderate responsibility without full operational cost burdens. Understanding the specific obligations in a Single Net Lease is crucial for both landlords and tenants to align financial expectations and manage property-related expenses effectively.

What Is a Triple Net Lease (NNN Lease)? Key Features Explained

A triple net lease (NNN lease) requires the tenant to pay property taxes, insurance, and maintenance costs in addition to the base rent, significantly reducing the landlord's financial responsibilities. This lease structure is common in commercial real estate, offering landlords predictable income streams and tenants more control over property expenses. Key features include long-term lease agreements, tenant responsibility for operating expenses, and lower landlord management involvement, making it appealing for investors seeking stable, passive income.

Comparing Single Net Lease vs Triple Net Lease: Core Differences

Single net leases require tenants to pay property taxes in addition to base rent, while triple net leases extend tenant obligations to include property taxes, insurance, and maintenance costs. The increased financial responsibility in triple net leases typically results in lower base rent but higher overall tenant expenses, offering landlords reduced risk and predictable income. Investors and tenants should weigh control over expenses and risk exposure when choosing between single net and triple net lease agreements.

Financial Responsibilities: Taxes, Insurance, and Maintenance

In a single net lease, tenants are responsible for paying property taxes in addition to rent, while the landlord covers insurance and maintenance costs. Conversely, a triple net lease requires tenants to assume financial responsibility for property taxes, insurance premiums, and maintenance expenses, significantly reducing the landlord's operational risk. This transfer of financial obligations affects cash flow predictability and investment risk assessment for both parties.

Landlord and Tenant Obligations in Both Lease Types

In a single net lease, the tenant is responsible for paying property taxes in addition to base rent, while the landlord covers insurance and maintenance costs, creating a shared obligation framework. A triple net lease requires the tenant to pay all three major expenses--property taxes, insurance, and maintenance--shifting nearly all property-related financial responsibilities to the tenant and minimizing landlord involvement. These distinctions impact risk allocation, with landlords favoring triple net leases for predictable income and tenants weighing increased operational costs against greater control over property expenses.

Investment Pros and Cons: Single Net Lease Versus Triple Net Lease

Single net leases (N) limit tenant responsibility to property taxes, providing landlords with moderate expense control but higher management involvement and potential cost fluctuations. Triple net leases (NNN) transfer property taxes, insurance, and maintenance expenses to tenants, offering investors predictable income streams and reduced operational risks but potentially less control over property condition. Investors seeking lower management overhead and stable cash flow often prefer triple net leases, while those willing to engage more actively might benefit from single net leases with potentially higher returns.

Risk Assessment: Which Lease Offers More Stability?

Single net leases place the tenant responsible for property taxes only, reducing the landlord's risk associated with other variable expenses like maintenance and insurance, which remain the landlord's responsibility. Triple net leases shift most financial risks to the tenant, who pays property taxes, insurance, and maintenance, offering landlords more predictable income but potentially more tenant default risk due to higher tenant cost burden. Stability in risk assessment depends on investment goals; triple net leases generally provide landlords with consistent cash flow and reduced expense volatility, while single net leases expose landlords to greater operating cost fluctuations but may attract tenants with lower financial strain.

Typical Property Types for Single Net and Triple Net Leases

Single net leases are commonly used for retail properties, such as strip malls and standalone stores, where tenants pay property taxes while landlords cover maintenance and insurance. Triple net leases are prevalent in commercial real estate including office buildings, industrial warehouses, and large retail centers, with tenants responsible for property taxes, insurance, and maintenance costs. The choice impacts risk distribution, with single net leases providing landlords more control over property management compared to triple net leases.

Lease Negotiation Strategies: Maximizing Value for Both Parties

Single net leases typically require tenants to pay property taxes while landlords cover maintenance and insurance, offering a clearer cost structure that can be leveraged in lease negotiations to secure balanced risk sharing. Triple net leases shift property taxes, insurance, and maintenance costs entirely to tenants, allowing landlords to achieve stable, predictable income but demanding tactics that create concessions or incentives to attract quality tenants. Effective lease negotiation strategies focus on transparently defining responsibilities and exploring compromises such as rent abatements or tenant improvement allowances to maximize value for both parties.

Which Lease Is Right for You: Factors to Consider

Single net lease requires tenants to pay property taxes on top of base rent, while triple net lease demands tenants cover property taxes, insurance, and maintenance costs, significantly increasing financial responsibility. Consider your risk tolerance, budget flexibility, and desire for expense control when choosing between these leases, as triple net leases offer landlords predictable income but shift operational costs to tenants. Analyze the property's condition, local market conditions, and potential for expense fluctuations to determine which lease aligns best with your investment goals and cash flow preferences.

single net lease vs triple net lease Infographic

difterm.com

difterm.com