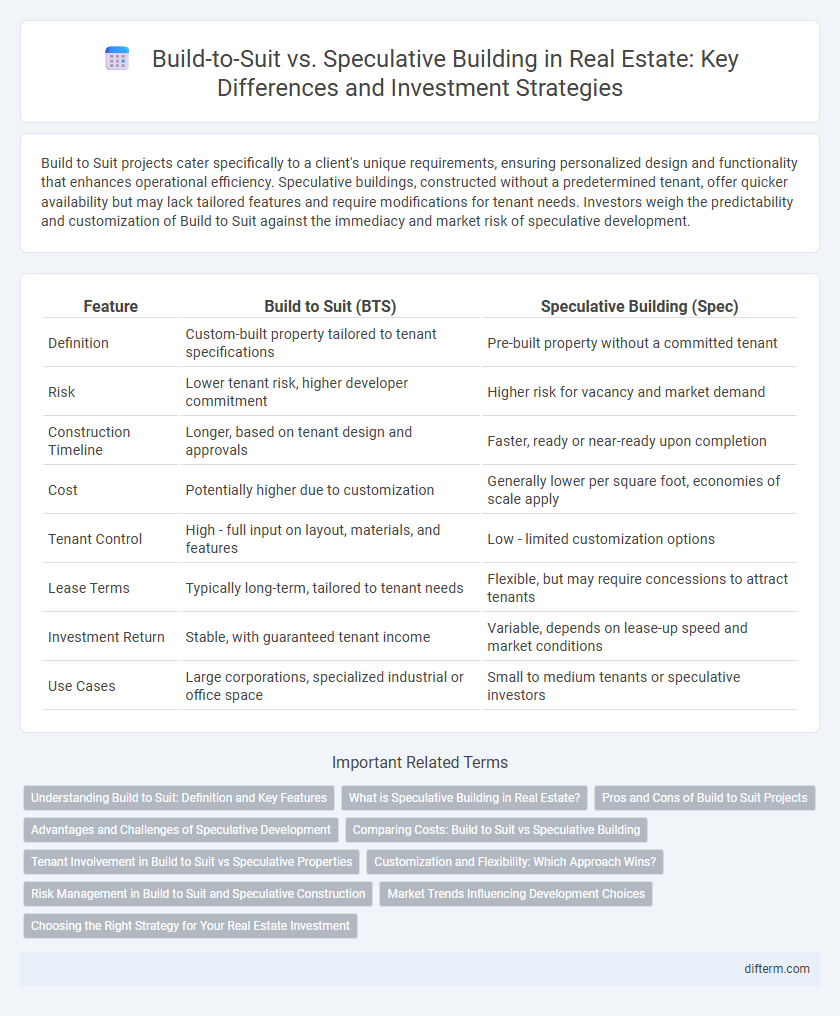

Build to Suit projects cater specifically to a client's unique requirements, ensuring personalized design and functionality that enhances operational efficiency. Speculative buildings, constructed without a predetermined tenant, offer quicker availability but may lack tailored features and require modifications for tenant needs. Investors weigh the predictability and customization of Build to Suit against the immediacy and market risk of speculative development.

Table of Comparison

| Feature | Build to Suit (BTS) | Speculative Building (Spec) |

|---|---|---|

| Definition | Custom-built property tailored to tenant specifications | Pre-built property without a committed tenant |

| Risk | Lower tenant risk, higher developer commitment | Higher risk for vacancy and market demand |

| Construction Timeline | Longer, based on tenant design and approvals | Faster, ready or near-ready upon completion |

| Cost | Potentially higher due to customization | Generally lower per square foot, economies of scale apply |

| Tenant Control | High - full input on layout, materials, and features | Low - limited customization options |

| Lease Terms | Typically long-term, tailored to tenant needs | Flexible, but may require concessions to attract tenants |

| Investment Return | Stable, with guaranteed tenant income | Variable, depends on lease-up speed and market conditions |

| Use Cases | Large corporations, specialized industrial or office space | Small to medium tenants or speculative investors |

Understanding Build to Suit: Definition and Key Features

Build to Suit (BTS) is a real estate development approach where a property is custom-designed and constructed for a specific tenant or buyer, ensuring that the building meets precise operational and spatial requirements. Key features of BTS include tenant involvement in design decisions, tailored construction timelines, and minimized risk of vacancy since the property is pre-leased or sold upon completion. This strategy contrasts with speculative building, which involves constructing properties without committed occupants, often resulting in higher market risk and potential leasing delays.

What is Speculative Building in Real Estate?

Speculative building in real estate involves developing commercial or residential properties without securing a specific tenant or buyer beforehand, relying on market demand to lease or sell the space post-construction. This approach carries higher risk but offers flexibility to adjust spaces for future occupants and capitalize on market conditions. Developers often target speculative buildings in high-demand areas, aiming to attract multiple potential tenants or investors upon completion.

Pros and Cons of Build to Suit Projects

Build to Suit projects offer tailored design and specifications that meet the unique needs of tenants, reducing long-term operational costs and enhancing functionality. However, they often involve longer development timelines and higher initial investment compared to speculative buildings, which may delay tenant occupancy and increase financial risk. Customization benefits are balanced against potential challenges like limited market liquidity and reliance on a single tenant's credit strength.

Advantages and Challenges of Speculative Development

Speculative building offers the advantage of faster project initiation by constructing properties without pre-secured tenants, enabling developers to capitalize quickly on rising market demand. This approach, however, carries challenges including higher financial risk due to uncertainty in tenant acquisition and potential vacancies. Developers must strategically assess local market conditions and trends to mitigate these risks and maximize return on investment.

Comparing Costs: Build to Suit vs Speculative Building

Build to Suit projects often incur higher initial costs due to customization requirements tailored to a tenant's specific needs, including design, materials, and technologies. Speculative buildings generally have lower upfront costs by utilizing standardized layouts and materials, but they may face longer vacancy periods and higher marketing expenses. Long-term operational costs and tenant retention rates typically favor Build to Suit developments, as they align closely with tenant specifications, reducing future modifications and turnover.

Tenant Involvement in Build to Suit vs Speculative Properties

Tenant involvement in build-to-suit properties is substantial, as tenants collaborate closely with developers to customize layouts, specifications, and amenities that meet their precise operational needs. In contrast, speculative buildings are constructed without specific tenants in mind, limiting tenant input until after completion, which may result in a less tailored fit. This difference significantly impacts tenant satisfaction and long-term lease commitments, with build-to-suit options often yielding higher retention rates and optimized functionality.

Customization and Flexibility: Which Approach Wins?

Build to Suit projects offer unparalleled customization and flexibility, allowing tenants to design spaces tailored to specific operational needs, which enhances efficiency and long-term satisfaction. Speculative buildings provide less customization but faster availability and lower initial costs, appealing to tenants seeking immediate occupancy without specific requirements. For businesses prioritizing bespoke features and operational alignment, Build to Suit clearly outperforms Speculative Building in delivering tailored real estate solutions.

Risk Management in Build to Suit and Speculative Construction

Build to Suit projects minimize financial risk by tailoring construction to specific tenant requirements, ensuring long-term lease commitments and reducing vacancy rates. Speculative buildings carry higher risk due to uncertain tenant occupancy and potential delays in leasing, which can lead to increased holding costs and reduced cash flow. Effective risk management in Build to Suit involves detailed tenant agreements and customized design, while speculative construction requires careful market analysis and flexible design to attract diverse tenants quickly.

Market Trends Influencing Development Choices

Market trends increasingly favor build-to-suit developments as businesses seek customized spaces tailored to specific operational needs, driven by a strong demand for efficiency and flexibility in commercial real estate. Speculative building still plays a significant role in high-growth areas where investor confidence supports rapid development, anticipating tenant occupancy based on macroeconomic indicators and local market dynamics. Data from recent real estate reports highlight that build-to-suit projects are gaining traction in tech hubs and logistics sectors, whereas speculative developments thrive in regions with emerging industries and robust population growth.

Choosing the Right Strategy for Your Real Estate Investment

Selecting between build-to-suit and speculative building strategies depends on investment goals, risk tolerance, and market demand. Build-to-suit offers customized property development tailored to specific tenant requirements, reducing vacancy risks and enhancing long-term lease stability. Speculative building anticipates market demand by constructing properties without pre-committed tenants, enabling faster market entry but carrying higher vacancy and financial risks.

Build to Suit vs Speculative Building Infographic

difterm.com

difterm.com