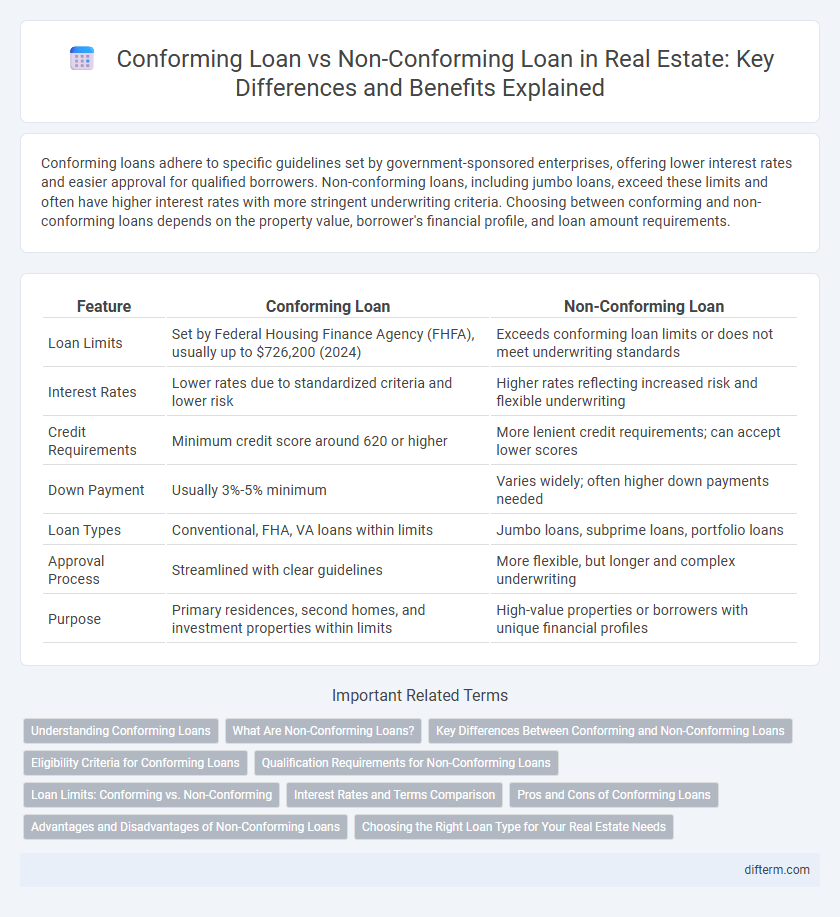

Conforming loans adhere to specific guidelines set by government-sponsored enterprises, offering lower interest rates and easier approval for qualified borrowers. Non-conforming loans, including jumbo loans, exceed these limits and often have higher interest rates with more stringent underwriting criteria. Choosing between conforming and non-conforming loans depends on the property value, borrower's financial profile, and loan amount requirements.

Table of Comparison

| Feature | Conforming Loan | Non-Conforming Loan |

|---|---|---|

| Loan Limits | Set by Federal Housing Finance Agency (FHFA), usually up to $726,200 (2024) | Exceeds conforming loan limits or does not meet underwriting standards |

| Interest Rates | Lower rates due to standardized criteria and lower risk | Higher rates reflecting increased risk and flexible underwriting |

| Credit Requirements | Minimum credit score around 620 or higher | More lenient credit requirements; can accept lower scores |

| Down Payment | Usually 3%-5% minimum | Varies widely; often higher down payments needed |

| Loan Types | Conventional, FHA, VA loans within limits | Jumbo loans, subprime loans, portfolio loans |

| Approval Process | Streamlined with clear guidelines | More flexible, but longer and complex underwriting |

| Purpose | Primary residences, second homes, and investment properties within limits | High-value properties or borrowers with unique financial profiles |

Understanding Conforming Loans

Conforming loans meet the guidelines set by government-sponsored enterprises (GSEs) Fannie Mae and Freddie Mac, including maximum loan limits, credit score requirements, and debt-to-income ratios. These loans typically offer lower interest rates and easier approval due to standardization and reduced lender risk. Understanding conforming loans helps borrowers access affordable financing options with reliable underwriting standards in competitive real estate markets.

What Are Non-Conforming Loans?

Non-conforming loans are mortgage loans that do not meet the standard guidelines set by Fannie Mae or Freddie Mac, typically because they exceed the maximum loan limits or have unique borrower qualifications. These loans often have higher interest rates and stricter underwriting requirements due to increased risk for lenders. Examples include jumbo loans, which surpass conforming loan limits, and loans for borrowers with non-traditional credit profiles or income documentation.

Key Differences Between Conforming and Non-Conforming Loans

Conforming loans adhere to Fannie Mae and Freddie Mac guidelines, including loan limits typically up to $726,200 in most U.S. counties for 2024, while non-conforming loans exceed these limits or do not meet standard criteria. Interest rates on conforming loans are generally lower due to reduced risk and wider market acceptance, whereas non-conforming loans carry higher rates reflecting increased lender risk. Loan-to-value ratios, credit score requirements, and documentation standards also differ, with non-conforming loans offering more flexibility but at the cost of stricter underwriting and higher borrower qualifications.

Eligibility Criteria for Conforming Loans

Conforming loans require borrowers to meet specific eligibility criteria including credit scores typically above 620, debt-to-income ratios generally under 43%, and property values within the maximum loan limits set by the Federal Housing Finance Agency (FHFA). These loans must also conform to Fannie Mae and Freddie Mac guidelines, ensuring standardized underwriting processes and documentation. Borrowers must provide steady income verification and meet residency use requirements to qualify for conforming mortgage loans.

Qualification Requirements for Non-Conforming Loans

Qualification requirements for non-conforming loans typically include higher credit score thresholds, often above 700, and larger down payments ranging from 20% to 30% compared to conforming loans. Borrowers must demonstrate strong income documentation, a low debt-to-income ratio usually below 43%, and substantial reserves to mitigate the higher risk lenders associate with non-conforming loans. These stricter criteria reflect the absence of Federal Housing Finance Agency (FHFA) guidelines, giving lenders greater flexibility but demanding improved borrower financial strength.

Loan Limits: Conforming vs. Non-Conforming

Conforming loans adhere to the maximum loan limits set by the Federal Housing Finance Agency (FHFA), typically $726,200 for single-family homes in most U.S. counties in 2024. Non-conforming loans exceed these limits, often referred to as jumbo loans, and can surpass $1 million or more depending on the market. Borrowers seeking higher-value properties often turn to non-conforming loans due to their flexible limits, despite generally higher interest rates and stricter qualification criteria.

Interest Rates and Terms Comparison

Conforming loans typically offer lower interest rates due to standardized underwriting criteria set by Fannie Mae and Freddie Mac, making them more accessible to borrowers with good credit profiles. Non-conforming loans, including jumbo loans, often have higher interest rates and less favorable terms to offset the increased risk for lenders and accommodate larger loan amounts or unique borrower circumstances. Loan terms for conforming loans generally cap at 30 years, while non-conforming loans can provide more flexible terms ranging from short-term to extended durations.

Pros and Cons of Conforming Loans

Conforming loans offer lower interest rates and easier approval due to their adherence to Fannie Mae and Freddie Mac guidelines, making them ideal for borrowers with good credit and stable income. They often require lower down payments and provide predictable loan terms, increasing affordability and reducing risk. However, conforming loans have loan limits that may restrict financing options for high-value properties and can include stringent qualification criteria that exclude some borrowers.

Advantages and Disadvantages of Non-Conforming Loans

Non-conforming loans offer flexibility for borrowers who exceed conventional loan limits or have unique credit situations, often enabling financing for luxury properties or investment homes. These loans typically have higher interest rates and stricter qualification criteria compared to conforming loans, leading to increased borrowing costs and potential difficulty in approval. Limited availability in secondary markets can result in less favorable terms and reduced options for refinancing.

Choosing the Right Loan Type for Your Real Estate Needs

Choosing the right loan type for your real estate needs depends on factors like loan amount, credit score, and property type. Conforming loans adhere to Fannie Mae and Freddie Mac guidelines, offering lower interest rates and easier approval for borrowers within set limits. Non-conforming loans, including jumbo loans, cater to larger loan amounts or unique property types but often come with higher interest rates and stricter qualification requirements.

conforming loan vs non-conforming loan Infographic

difterm.com

difterm.com