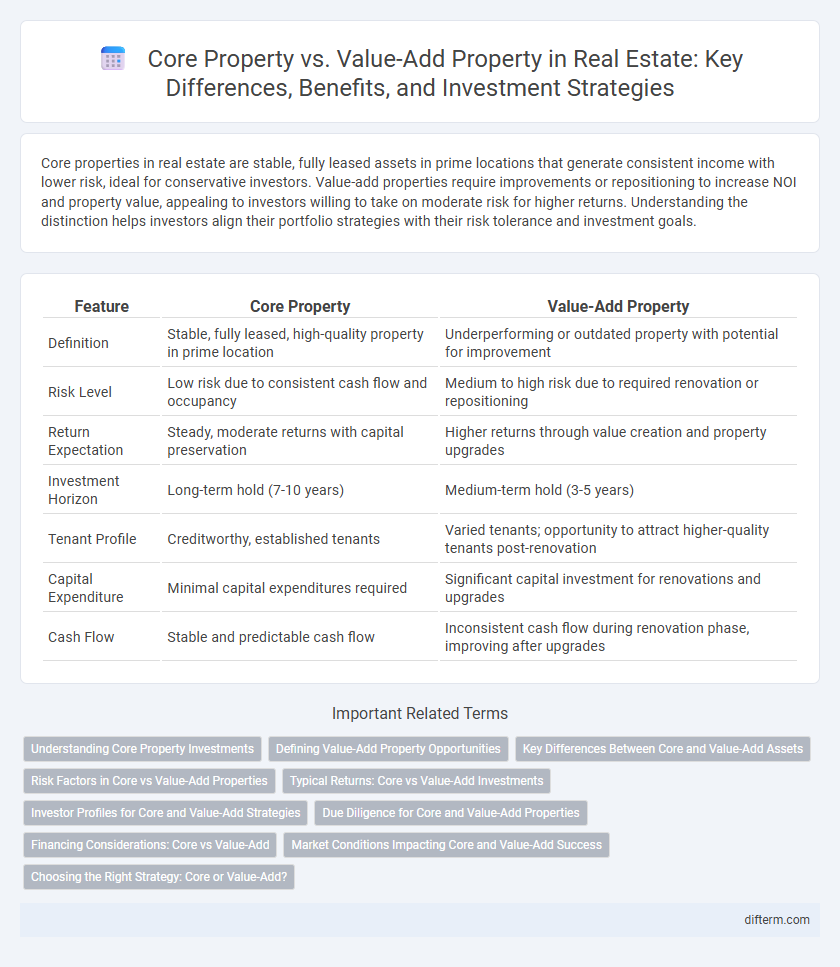

Core properties in real estate are stable, fully leased assets in prime locations that generate consistent income with lower risk, ideal for conservative investors. Value-add properties require improvements or repositioning to increase NOI and property value, appealing to investors willing to take on moderate risk for higher returns. Understanding the distinction helps investors align their portfolio strategies with their risk tolerance and investment goals.

Table of Comparison

| Feature | Core Property | Value-Add Property |

|---|---|---|

| Definition | Stable, fully leased, high-quality property in prime location | Underperforming or outdated property with potential for improvement |

| Risk Level | Low risk due to consistent cash flow and occupancy | Medium to high risk due to required renovation or repositioning |

| Return Expectation | Steady, moderate returns with capital preservation | Higher returns through value creation and property upgrades |

| Investment Horizon | Long-term hold (7-10 years) | Medium-term hold (3-5 years) |

| Tenant Profile | Creditworthy, established tenants | Varied tenants; opportunity to attract higher-quality tenants post-renovation |

| Capital Expenditure | Minimal capital expenditures required | Significant capital investment for renovations and upgrades |

| Cash Flow | Stable and predictable cash flow | Inconsistent cash flow during renovation phase, improving after upgrades |

Understanding Core Property Investments

Core property investments consist of high-quality, well-located assets with stable cash flows and minimal short-term risk, often found in prime urban markets. These properties typically offer lower returns but provide long-term income stability and preservation of capital. Investors prioritize core properties for their resilience during economic fluctuations and consistent income generation from reputable tenants.

Defining Value-Add Property Opportunities

Value-add properties present opportunities to increase asset value through strategic improvements such as renovations, operational enhancements, or lease restructuring, distinguishing them from core properties that offer stable, low-risk cash flow with minimal need for intervention. Investors targeting value-add properties focus on underperforming or mismanaged assets requiring capital infusion and active management to unlock potential appreciation and higher returns. Identifying value-add opportunities involves analyzing market trends, property conditions, and financial performance metrics to determine the feasibility and scale of value enhancement.

Key Differences Between Core and Value-Add Assets

Core properties are stabilized, income-generating real estate assets located in prime locations with low risk and predictable cash flows, typically attracting conservative investors seeking steady returns. Value-add properties require improvements or renovations to enhance their performance and increase value, involving moderate risk but offering higher potential returns for investors willing to engage in active asset management. The key differences lie in risk tolerance, return expectations, property condition, and investment strategy, with core assets emphasizing stability and value-add properties focusing on growth through upgrades and operational efficiencies.

Risk Factors in Core vs Value-Add Properties

Core properties exhibit lower risk due to their stable occupancy, prime locations, and high-quality tenants, ensuring consistent cash flow and reduced volatility. Value-add properties carry higher risk since they require significant capital investment for renovations or operational improvements amid uncertain market conditions and tenant turnover. Investors must weigh the predictable income of core assets against the potential for higher returns--and increased risk--in value-add opportunities.

Typical Returns: Core vs Value-Add Investments

Core properties typically generate stable returns averaging 6-8% annually, reflecting their low-risk, fully leased, prime location status. Value-add properties offer higher potential returns of 10-15% by requiring strategic improvements, leasing, or repositioning to increase property value. Investors favor core assets for steady income and preservation of capital, while value-add opportunities attract those seeking capital appreciation and willing to accept moderate risk.

Investor Profiles for Core and Value-Add Strategies

Core property investments attract conservative investors seeking stable cash flow and low risk, typically favoring fully leased, high-quality assets in prime locations. Value-add property investments appeal to aggressive investors willing to accept higher risk for potential capital appreciation through property improvements, repositioning, or operational enhancements. Understanding these profiles enables tailored portfolio diversification aligning with income stability or growth-focused objectives.

Due Diligence for Core and Value-Add Properties

Due diligence for core properties emphasizes verifying stable cash flow, conducting thorough market analysis, and confirming high occupancy rates to ensure minimal risk and consistent returns. For value-add properties, due diligence prioritizes identifying renovation potential, estimating capital expenditure accurately, and assessing the feasibility of operational improvements to achieve significant value appreciation. Both require detailed financial modeling and inspection to mitigate risks aligned with the property's investment strategy.

Financing Considerations: Core vs Value-Add

Core properties typically attract lower-risk financing with stable interest rates due to their proven cash flow and minimal management needs, making them favorable for institutional lenders. Value-add properties require higher leverage and often face stricter loan-to-value ratios, reflecting the increased risk and rehabilitation costs associated with repositioning or renovating these assets. Loan terms for value-add investments tend to be shorter and come with higher interest rates, aligning with the need for increased scrutiny and performance milestones during the hold period.

Market Conditions Impacting Core and Value-Add Success

Core properties typically perform well in stable or strong market conditions due to their low risk and consistent income streams, attracting investors seeking steady returns. Value-add properties offer higher returns in dynamic markets where improvements and operational enhancements can significantly increase asset value. Economic factors such as interest rates, vacancy rates, and local demand heavily influence the success of both property types in their respective market environments.

Choosing the Right Strategy: Core or Value-Add?

Selecting the appropriate investment strategy between core and value-add properties hinges on risk tolerance, desired return, and investment timeline. Core properties offer stable cash flow with lower risk due to their prime locations and high occupancy rates, appealing to conservative investors seeking steady income. Value-add properties require active management and capital improvements, presenting higher risk but potentially greater returns through property repositioning and rent growth.

Core Property vs Value-Add Property Infographic

difterm.com

difterm.com