Adjustable-rate loans offer varying interest rates over time, typically starting with lower rates that adjust periodically based on market conditions, which can lead to fluctuating monthly payments. Interest-only loans require borrowers to pay only the interest for a set period, resulting in lower initial payments but higher principal payments later, increasing the risk of payment shock. Choosing between these options depends on the borrower's financial stability and plans for property ownership duration.

Table of Comparison

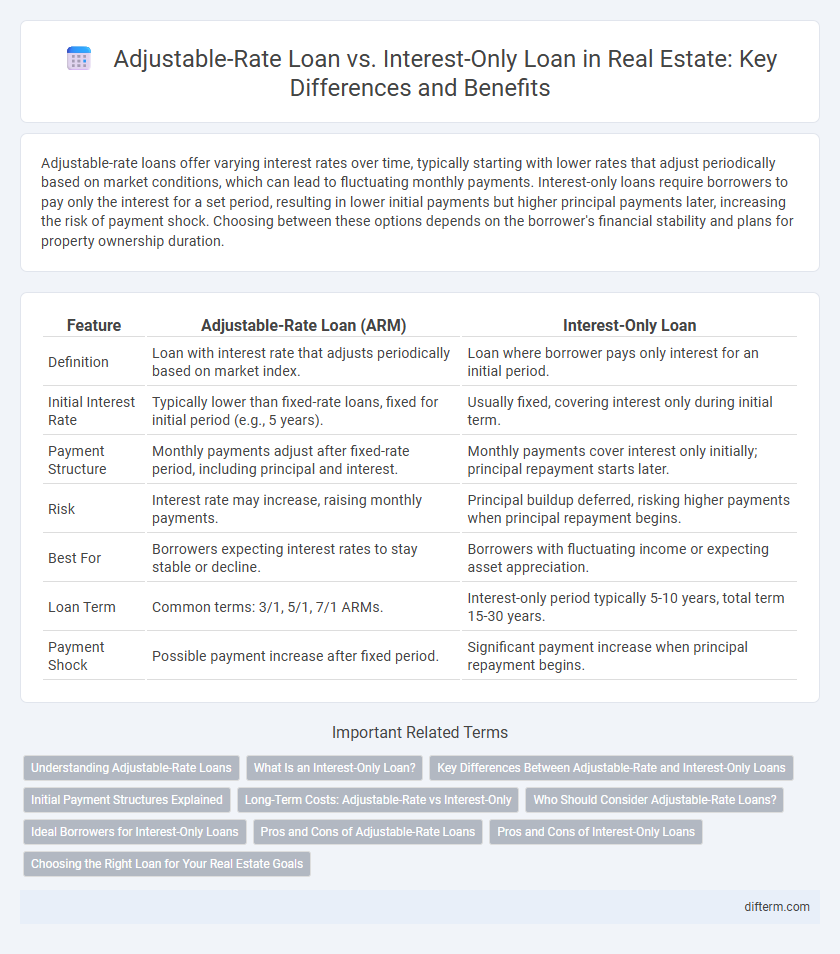

| Feature | Adjustable-Rate Loan (ARM) | Interest-Only Loan |

|---|---|---|

| Definition | Loan with interest rate that adjusts periodically based on market index. | Loan where borrower pays only interest for an initial period. |

| Initial Interest Rate | Typically lower than fixed-rate loans, fixed for initial period (e.g., 5 years). | Usually fixed, covering interest only during initial term. |

| Payment Structure | Monthly payments adjust after fixed-rate period, including principal and interest. | Monthly payments cover interest only initially; principal repayment starts later. |

| Risk | Interest rate may increase, raising monthly payments. | Principal buildup deferred, risking higher payments when principal repayment begins. |

| Best For | Borrowers expecting interest rates to stay stable or decline. | Borrowers with fluctuating income or expecting asset appreciation. |

| Loan Term | Common terms: 3/1, 5/1, 7/1 ARMs. | Interest-only period typically 5-10 years, total term 15-30 years. |

| Payment Shock | Possible payment increase after fixed period. | Significant payment increase when principal repayment begins. |

Understanding Adjustable-Rate Loans

Adjustable-rate loans feature interest rates that fluctuate based on benchmark indexes, leading to variable monthly payments over the loan term. These loans often start with lower initial rates compared to fixed-rate loans, making them appealing for borrowers planning to sell or refinance before rate adjustments occur. Understanding the risk of potential rate increases is crucial, as higher interest rates can significantly impact affordability and long-term financial planning.

What Is an Interest-Only Loan?

An interest-only loan allows borrowers to pay only the interest portion of the mortgage for a set period, typically 5 to 10 years, resulting in lower initial monthly payments. Unlike adjustable-rate loans, which have fluctuating interest rates that impact total payments, interest-only loans keep principal payments deferred, increasing risk if property values decline. This loan type is often favored by real estate investors seeking cash flow flexibility but requires careful planning to manage higher payments once the interest-only period ends.

Key Differences Between Adjustable-Rate and Interest-Only Loans

Adjustable-rate loans feature interest rates that fluctuate based on market indices, causing monthly payments to vary over time, whereas interest-only loans allow borrowers to pay only the interest for an initial period before principal repayments begin, resulting in lower early payments but higher costs later. Adjustable-rate loans often have initial fixed-rate periods followed by adjustments tied to benchmarks like the LIBOR or SOFR, impacting overall loan affordability and risk exposure. Interest-only loans are suited for borrowers expecting increased income or refinancing opportunities, while adjustable-rate loans appeal to those seeking initial stability with future rate flexibility.

Initial Payment Structures Explained

Adjustable-rate loans feature an initial low fixed interest rate that adjusts periodically based on market indexes, resulting in varying monthly payments over time. Interest-only loans require borrowers to pay only the interest during the initial term, leading to lower initial payments but no reduction in principal balance. Understanding these initial payment structures helps investors and homeowners plan cash flow and assess long-term affordability in real estate financing.

Long-Term Costs: Adjustable-Rate vs Interest-Only

Adjustable-rate loans can lead to fluctuating monthly payments due to variable interest rates, potentially increasing long-term costs as rates rise over time. Interest-only loans offer lower initial payments by deferring principal repayment, but may result in higher overall expenses as borrowers eventually repay principal and accruing interest. Evaluating long-term costs requires analyzing market interest rate trends and repayment schedules to choose the most cost-effective financing option.

Who Should Consider Adjustable-Rate Loans?

Adjustable-rate loans are ideal for borrowers expecting to sell or refinance within a few years, as the initial lower interest rates can reduce early payments. Homebuyers with fluctuating incomes or those planning short-term homeownership benefit from the flexibility of adjusting rates over time. Investors seeking to maximize cash flow during the initial loan period often prefer adjustable-rate mortgages for their potential cost savings compared to fixed-rate or interest-only loans.

Ideal Borrowers for Interest-Only Loans

Ideal borrowers for interest-only loans are experienced investors and homeowners with fluctuating cash flow who seek lower initial payments to maximize short-term liquidity. These loans benefit individuals expecting significant income growth or planning to refinance before principal repayments begin, commonly seen in real estate investors leveraging rental property cash flow. Borrowers should have a solid risk tolerance and exit strategy to manage potential payment increases when interest-only periods end.

Pros and Cons of Adjustable-Rate Loans

Adjustable-rate loans offer the advantage of lower initial interest rates compared to fixed-rate mortgages, making them attractive for buyers seeking lower initial payments. However, the fluctuating interest rates can lead to unpredictable monthly payments and potential financial strain when rates rise. Borrowers must weigh the risk of future rate increases against the benefit of initial affordability when considering adjustable-rate mortgage options.

Pros and Cons of Interest-Only Loans

Interest-only loans offer lower initial monthly payments by allowing borrowers to pay only the interest for a set period, which can improve short-term cash flow and affordability. However, these loans carry the risk of payment shock when principal repayments begin, potentially leading to significantly higher monthly obligations. Borrowers may also face difficulty in building equity during the interest-only period, making them vulnerable to market fluctuations and refinancing challenges.

Choosing the Right Loan for Your Real Estate Goals

Adjustable-rate loans offer fluctuating interest rates that start lower than fixed rates, making them suitable for buyers planning to sell or refinance before rates increase. Interest-only loans allow borrowers to pay only the interest for a set period, maximizing cash flow but increasing principal later, which benefits investors focusing on short-term gains or rental properties. Evaluating your real estate goals, financial stability, and market conditions is essential to choosing between these loan types for optimal investment outcomes.

adjustable-rate loan vs interest-only loan Infographic

difterm.com

difterm.com