Adjustable Rate Mortgages (ARMs) offer flexible interest rates that adjust periodically based on market conditions, typically starting with a lower initial rate than fixed mortgages. Hybrid ARMs combine features of fixed-rate and adjustable-rate loans, providing a fixed interest period--usually 3, 5, 7, or 10 years--before shifting to an adjustable rate, balancing stability with potential savings. Understanding the differences between ARM and Hybrid ARM options helps homebuyers select a mortgage that aligns with their financial goals and risk tolerance.

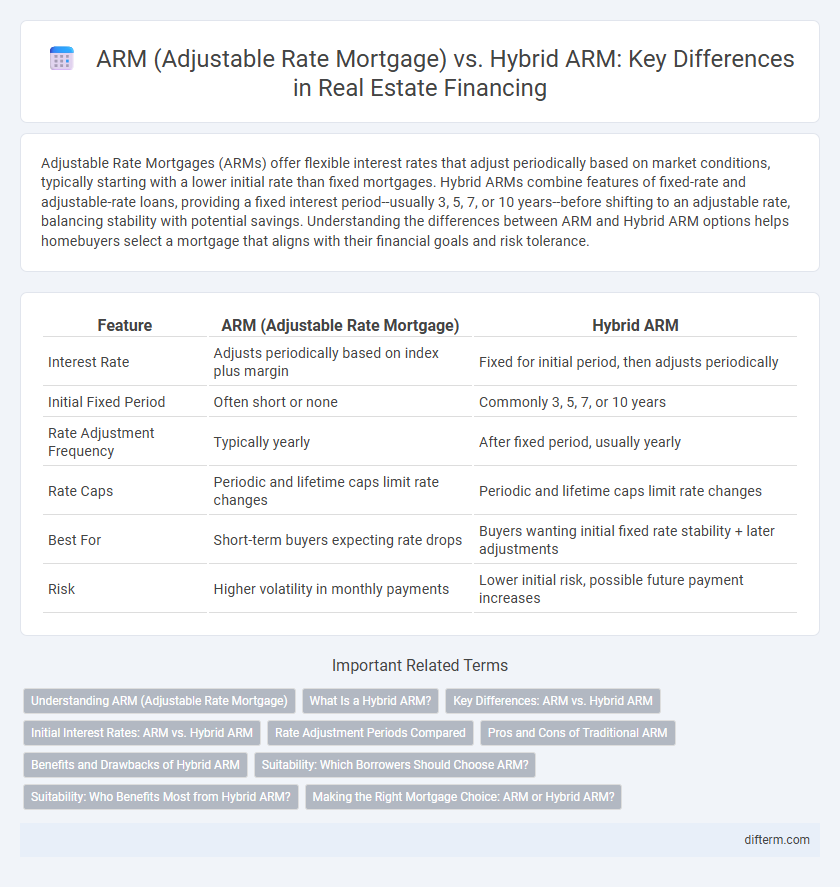

Table of Comparison

| Feature | ARM (Adjustable Rate Mortgage) | Hybrid ARM |

|---|---|---|

| Interest Rate | Adjusts periodically based on index plus margin | Fixed for initial period, then adjusts periodically |

| Initial Fixed Period | Often short or none | Commonly 3, 5, 7, or 10 years |

| Rate Adjustment Frequency | Typically yearly | After fixed period, usually yearly |

| Rate Caps | Periodic and lifetime caps limit rate changes | Periodic and lifetime caps limit rate changes |

| Best For | Short-term buyers expecting rate drops | Buyers wanting initial fixed rate stability + later adjustments |

| Risk | Higher volatility in monthly payments | Lower initial risk, possible future payment increases |

Understanding ARM (Adjustable Rate Mortgage)

An Adjustable Rate Mortgage (ARM) offers a variable interest rate that changes periodically based on a benchmark index, typically starting with a fixed rate for a predetermined period before adjustments begin. Hybrid ARMs combine features of fixed-rate and adjustable-rate mortgages by providing an initial fixed-rate period, commonly 3, 5, 7, or 10 years, followed by rate adjustments at set intervals. Understanding the structure, caps, and index tied to the ARM is crucial for borrowers to evaluate future payment variability and potential financial risks.

What Is a Hybrid ARM?

A Hybrid ARM combines a fixed interest rate for an initial period, typically 3, 5, 7, or 10 years, followed by an adjustable rate that changes annually based on market indices. This mortgage option provides borrowers stability during the fixed-rate phase while benefiting from potentially lower rates in the adjustable period compared to a standard ARM. Hybrid ARMs are popular for buyers who plan to own or refinance before the fixed-rate term ends, balancing predictability with flexibility.

Key Differences: ARM vs. Hybrid ARM

Adjustable Rate Mortgages (ARMs) feature interest rates that adjust periodically based on a specific index, typically after an initial fixed-rate period. Hybrid ARMs combine fixed-rate periods with adjustable phases, commonly structured as 3/1, 5/1, or 7/1, indicating fixed rates for 3, 5, or 7 years before adjustment begins. Key differences include the fixed-rate duration and payment predictability, where Hybrid ARMs offer a longer initial fixed period compared to standard ARMs, reducing rate fluctuation risks early on.

Initial Interest Rates: ARM vs. Hybrid ARM

Initial interest rates for Adjustable Rate Mortgages (ARMs) typically start lower than fixed-rate loans but adjust periodically based on market indexes. Hybrid ARMs combine a fixed-rate period--commonly 3, 5, 7, or 10 years--with subsequent adjustable rates, offering borrowers initial stability before rate changes begin. Borrowers often choose Hybrid ARMs to benefit from predictable initial payments while maintaining the potential for lower rates after the fixed period.

Rate Adjustment Periods Compared

Adjustable Rate Mortgages (ARMs) feature interest rates that reset periodically based on market indexes, typically after an initial fixed-rate period ranging from 3 to 10 years. Hybrid ARMs combine fixed-rate and adjustable-rate features, offering a longer initial fixed period--commonly 5, 7, or 10 years--before transitioning to annual rate adjustments linked to benchmarks like the LIBOR or the Constant Maturity Treasury (CMT). The length and frequency of rate adjustment periods significantly impact monthly payments and borrower risk exposure.

Pros and Cons of Traditional ARM

Traditional Adjustable Rate Mortgages (ARMs) offer lower initial interest rates compared to fixed-rate loans, providing potential for significant savings during the initial adjustment period. However, the primary risk lies in interest rate volatility, which can cause monthly payments to increase unpredictably over time, potentially impacting borrower affordability. Borrowers benefit from lower initial costs but must be prepared for payment fluctuations and possible refinancing challenges if rates rise sharply.

Benefits and Drawbacks of Hybrid ARM

Hybrid ARMs offer a fixed interest rate for an initial period, combining the stability of fixed-rate mortgages with the flexibility of adjustable rates. Benefits include lower initial payments compared to fixed-rate loans and protection against rising rates during the fixed term, while drawbacks involve potential payment shocks after the fixed period ends and uncertainty in long-term budgeting. Hybrid ARMs are ideal for borrowers planning to sell or refinance before adjustments begin but carry risks if rates increase significantly afterward.

Suitability: Which Borrowers Should Choose ARM?

Adjustable Rate Mortgages (ARMs) suit borrowers with short-term homeownership plans or those expecting rising incomes, as initial low rates adjust periodically based on market indices. Hybrid ARMs, combining fixed-rate periods with adjustable phases, fit buyers seeking rate stability upfront with some flexibility later, ideal for those uncertain about long-term plans but favoring lower initial payments. Both options require careful assessment of interest rate risk tolerance and future financial projections to match borrower needs effectively.

Suitability: Who Benefits Most from Hybrid ARM?

Hybrid ARMs benefit borrowers seeking initial low-interest rates with predictable payments before adjusting, ideal for those planning to sell or refinance within the fixed-rate period. Homebuyers with stable income who anticipate an increase in earnings may also suit Hybrid ARMs, balancing short-term affordability and long-term rate variability. Unlike standard ARMs, hybrids offer a fixed-rate period, providing financial stability before interest rates adjust, reducing payment shocks for cautious borrowers.

Making the Right Mortgage Choice: ARM or Hybrid ARM?

Choosing between an Adjustable Rate Mortgage (ARM) and a Hybrid ARM hinges on understanding interest rate fluctuations and loan terms, with ARM offering fully variable rates that adjust periodically after a fixed initial period. Hybrid ARMs blend fixed and adjustable features, starting with a fixed rate for several years before transitioning to variable rates, providing initial payment stability and potential long-term savings. Evaluating expected market interest trends, loan duration, and financial risk tolerance is vital for selecting the mortgage structure that aligns best with your home financing goals.

ARM (Adjustable Rate Mortgage) vs Hybrid ARM Infographic

difterm.com

difterm.com