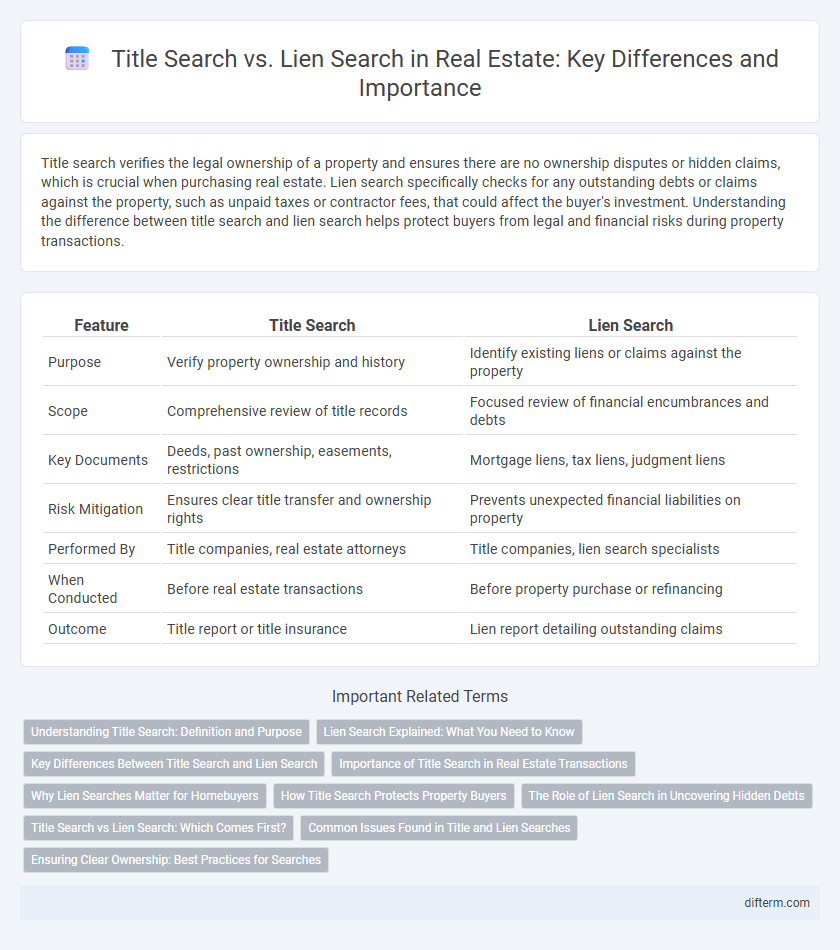

Title search verifies the legal ownership of a property and ensures there are no ownership disputes or hidden claims, which is crucial when purchasing real estate. Lien search specifically checks for any outstanding debts or claims against the property, such as unpaid taxes or contractor fees, that could affect the buyer's investment. Understanding the difference between title search and lien search helps protect buyers from legal and financial risks during property transactions.

Table of Comparison

| Feature | Title Search | Lien Search |

|---|---|---|

| Purpose | Verify property ownership and history | Identify existing liens or claims against the property |

| Scope | Comprehensive review of title records | Focused review of financial encumbrances and debts |

| Key Documents | Deeds, past ownership, easements, restrictions | Mortgage liens, tax liens, judgment liens |

| Risk Mitigation | Ensures clear title transfer and ownership rights | Prevents unexpected financial liabilities on property |

| Performed By | Title companies, real estate attorneys | Title companies, lien search specialists |

| When Conducted | Before real estate transactions | Before property purchase or refinancing |

| Outcome | Title report or title insurance | Lien report detailing outstanding claims |

Understanding Title Search: Definition and Purpose

A title search is a comprehensive examination of public records to verify a property's legal ownership and identify any encumbrances, such as liens or disputes, that could affect the transfer of ownership. Its primary purpose is to ensure the buyer receives a clear and marketable title, free from undisclosed claims or legal obstacles. Title searches protect both buyers and lenders by confirming the rightful owner and revealing any potential risks before the closing process.

Lien Search Explained: What You Need to Know

Lien search is a critical process in real estate that identifies any outstanding debts or legal claims against a property, ensuring buyers are aware of financial encumbrances before purchase. This search reveals liens such as mortgages, tax delinquencies, or contractor claims that could affect ownership transfer. Understanding lien search results helps protect buyers from inheriting unresolved financial obligations and aids sellers in clearing titles efficiently.

Key Differences Between Title Search and Lien Search

A title search verifies the legal ownership of a property and uncovers any encumbrances affecting the title, such as easements or restrictions. In contrast, a lien search specifically identifies financial claims, like mortgages, tax liens, or judgments, that could impact the property's marketability. Understanding these distinctions is essential for buyers and lenders to ensure clear property ownership and avoid unexpected financial obligations.

Importance of Title Search in Real Estate Transactions

Title search is crucial in real estate transactions to verify the property's legal ownership and uncover any encumbrances or claims against the title. This process ensures the buyer receives a clear title, preventing future disputes related to liens, easements, or ownership conflicts. Conducting a thorough title search safeguards the investment by confirming the legitimacy of the title before the sale is finalized.

Why Lien Searches Matter for Homebuyers

Lien searches are crucial for homebuyers because they reveal outstanding debts or claims against a property that could affect ownership rights and financial liability. Identifying liens such as unpaid taxes, mortgages, or contractor fees ensures buyers avoid unexpected costs and legal complications after purchase. Thorough lien searches protect investment security by confirming a clear title free from hidden encumbrances.

How Title Search Protects Property Buyers

Title search protects property buyers by verifying the legal ownership of a property and uncovering any ownership disputes, liens, or encumbrances that could affect the buyer's rights. This thorough investigation ensures that the seller has the legal authority to transfer the property without hidden claims from creditors or previous owners. By confirming clear title, buyers avoid potential legal issues and financial losses related to unresolved liens or fraudulent ownership.

The Role of Lien Search in Uncovering Hidden Debts

Lien search uncovers hidden debts by identifying outstanding claims or encumbrances against a property's title, such as unpaid taxes, mortgages, or contractor liens. This process is crucial in real estate transactions to ensure the property is free from financial liabilities that could affect ownership rights or lead to future legal disputes. Thorough lien searches protect buyers and lenders by revealing any undisclosed debts and securing clear property titles.

Title Search vs Lien Search: Which Comes First?

In real estate transactions, a title search is conducted first to verify the property's legal ownership and identify any encumbrances or defects in the title. A lien search follows to specifically uncover any outstanding debts or claims against the property that could affect the transaction. Prioritizing the title search ensures clear ownership before addressing potential liens that may complicate the sale.

Common Issues Found in Title and Lien Searches

Common issues found in title and lien searches include undisclosed heirs, incorrect property descriptions, and outstanding liens such as unpaid taxes or contractor claims. Title searches often reveal easements, encroachments, or fraudulent ownership transfers that can cloud property rights. Lien searches highlight financial encumbrances like judgments, mortgages, or mechanic's liens that may affect the property's marketability and transferability.

Ensuring Clear Ownership: Best Practices for Searches

Title search and lien search are essential steps to ensure clear property ownership by identifying existing claims, encumbrances, or liens that could affect the transaction. Conducting a thorough title search verifies the legal owner and uncovers any restrictions or disputes tied to the property, while a lien search specifically targets unpaid debts or judgments against the property. Combining both searches with accurate public record examination and professional legal review mitigates risks and secures a clear title transfer in real estate transactions.

Title Search vs Lien Search Infographic

difterm.com

difterm.com