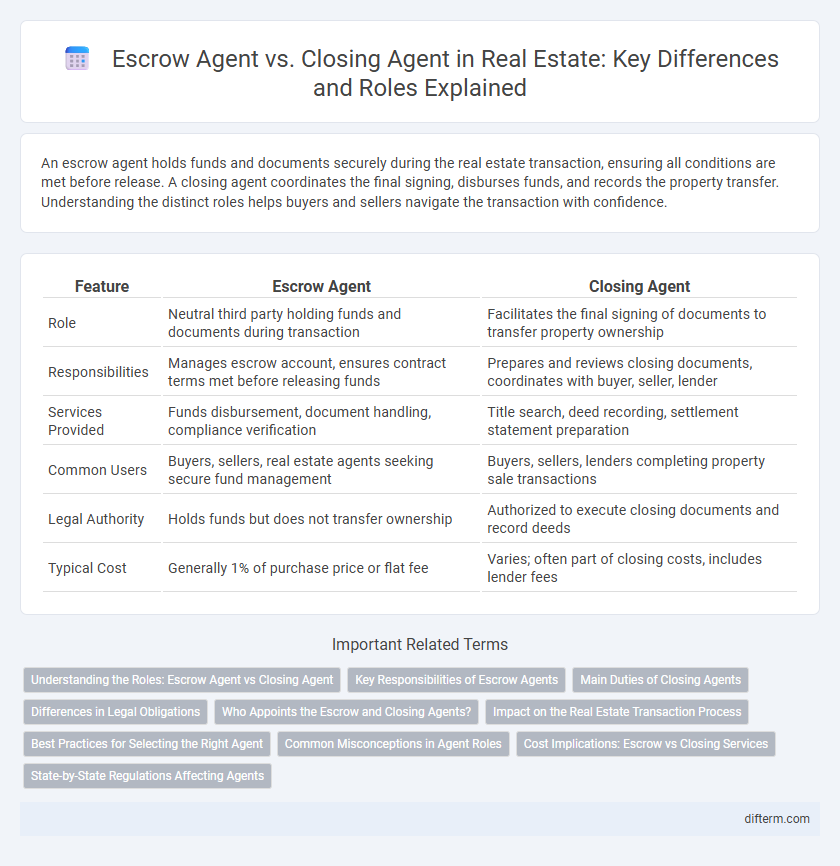

An escrow agent holds funds and documents securely during the real estate transaction, ensuring all conditions are met before release. A closing agent coordinates the final signing, disburses funds, and records the property transfer. Understanding the distinct roles helps buyers and sellers navigate the transaction with confidence.

Table of Comparison

| Feature | Escrow Agent | Closing Agent |

|---|---|---|

| Role | Neutral third party holding funds and documents during transaction | Facilitates the final signing of documents to transfer property ownership |

| Responsibilities | Manages escrow account, ensures contract terms met before releasing funds | Prepares and reviews closing documents, coordinates with buyer, seller, lender |

| Services Provided | Funds disbursement, document handling, compliance verification | Title search, deed recording, settlement statement preparation |

| Common Users | Buyers, sellers, real estate agents seeking secure fund management | Buyers, sellers, lenders completing property sale transactions |

| Legal Authority | Holds funds but does not transfer ownership | Authorized to execute closing documents and record deeds |

| Typical Cost | Generally 1% of purchase price or flat fee | Varies; often part of closing costs, includes lender fees |

Understanding the Roles: Escrow Agent vs Closing Agent

An escrow agent holds funds and documents securely until all conditions of a real estate transaction are met, ensuring impartial handling of assets between buyer and seller. A closing agent coordinates the finalizing of the transaction, managing paperwork, disbursements, and recording deeds to complete the sale. Understanding the distinct responsibilities clarifies that escrow agents focus on safeguarding assets during the process, while closing agents facilitate the formal completion and legal transfer of property ownership.

Key Responsibilities of Escrow Agents

Escrow agents play a critical role in real estate transactions by securely holding funds and documents until all contractual conditions are met, ensuring neutral third-party management throughout the process. They coordinate communication between buyers, sellers, lenders, and title companies to facilitate a smooth, error-free closing. By meticulously verifying contractual obligations, escrow agents prevent disputes and protect all parties' interests during property transfers.

Main Duties of Closing Agents

Closing agents manage the final stages of real estate transactions by coordinating document signing, verifying compliance with contract terms, and facilitating the transfer of funds. They ensure that all conditions are met before deed recording and disbursement of proceeds, safeguarding both buyer and seller interests. Their responsibilities include preparing closing statements, handling escrow funds, and filing necessary legal documents with local government offices.

Differences in Legal Obligations

An escrow agent holds and manages funds and documents impartially until all conditions of a real estate transaction are met, ensuring no party gains access prematurely. A closing agent facilitates the final steps of the transaction, coordinating document signing, disbursement of funds, and recording of legal documents, often assuming fiduciary responsibility. Legal obligations differ as escrow agents primarily safeguard assets without direct authority over the contract execution, whereas closing agents ensure compliance with contractual terms and legal recording requirements.

Who Appoints the Escrow and Closing Agents?

Escrow agents are typically appointed by mutual agreement between the buyer and seller or their respective real estate agents, ensuring impartial management of funds and documents during the transaction. Closing agents, often chosen by the title company or lender, coordinate the final steps of the property sale, including signing documents and disbursing funds. Understanding the distinct appointment processes helps clarify roles and ensures a smooth real estate closing.

Impact on the Real Estate Transaction Process

The escrow agent safeguards funds and documents during the real estate transaction, ensuring all conditions of the sale are met before distribution, which adds a layer of security and trust to the process. The closing agent coordinates final paperwork, facilitates communication among buyers, sellers, and lenders, and ensures legal compliance during the closing stage, accelerating the transfer of ownership. Both roles impact the transaction timeline and risk management, with escrow agents emphasizing protection of assets and closing agents focusing on regulatory adherence and efficient execution.

Best Practices for Selecting the Right Agent

Choosing the right escrow agent or closing agent involves verifying their licensing, experience, and reputation within the real estate industry to ensure secure transaction handling. Best practices include reviewing client testimonials, confirming their expertise with local real estate laws, and ensuring transparent communication throughout the closing process. Prioritizing agents who utilize advanced escrow software and adhere to strict compliance standards minimizes risks and fosters a smoother property transfer.

Common Misconceptions in Agent Roles

Many individuals mistakenly believe escrow agents and closing agents perform identical functions in real estate transactions, yet escrow agents primarily hold funds and documents impartially until contract terms are fulfilled, whereas closing agents manage the final paperwork and ensure legal transfer of property ownership. Another common misconception is that escrow agents can directly negotiate contract terms, but their role is strictly neutral, safeguarding funds and instructions from all parties involved. Understanding these distinct responsibilities is crucial to avoid confusion during the critical phases of property sale and closing.

Cost Implications: Escrow vs Closing Services

Escrow agents typically charge fees based on a percentage of the transaction amount, which can impact overall closing costs in real estate deals. Closing agents may offer flat fees or tiered pricing structures that can be more predictable and sometimes more cost-effective for buyers and sellers. Understanding the fee differences between escrow and closing services is crucial for budgeting in property transactions.

State-by-State Regulations Affecting Agents

State-by-state regulations significantly influence the roles and responsibilities of escrow agents and closing agents in real estate transactions, with some states requiring licensed escrow agents while others permit attorneys or title companies to perform closing duties. For example, California mandates licensed escrow officers to hold funds and manage documents, whereas Texas allows attorneys to act as closing agents without specific licensing for escrow services. Understanding these regulatory frameworks is crucial for real estate professionals and clients to ensure compliance and proper management of transaction escrow and closing processes.

Escrow Agent vs Closing Agent Infographic

difterm.com

difterm.com