An adjustable-rate mortgage (ARM) offers lower initial interest rates that adjust periodically based on market conditions, providing potential savings during times of falling rates. In contrast, a fixed-rate mortgage maintains a consistent interest rate and stable monthly payments throughout the loan term, providing budgeting certainty for homeowners. Choosing between an ARM and fixed-rate mortgage depends on your risk tolerance, anticipated length of homeownership, and expectations for future interest rate trends.

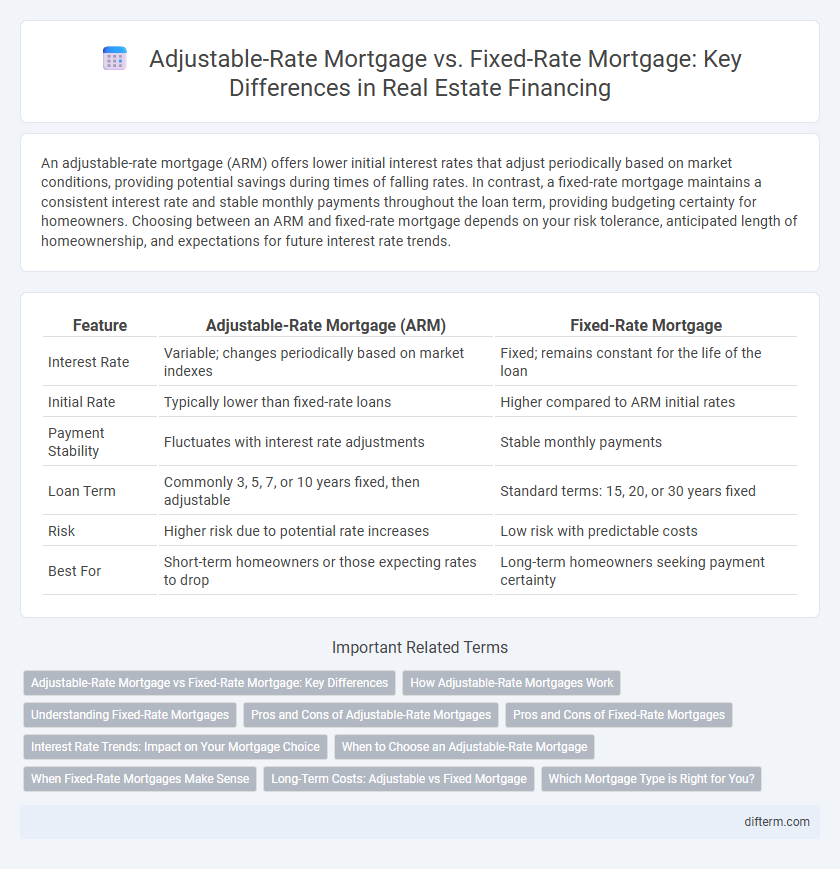

Table of Comparison

| Feature | Adjustable-Rate Mortgage (ARM) | Fixed-Rate Mortgage |

|---|---|---|

| Interest Rate | Variable; changes periodically based on market indexes | Fixed; remains constant for the life of the loan |

| Initial Rate | Typically lower than fixed-rate loans | Higher compared to ARM initial rates |

| Payment Stability | Fluctuates with interest rate adjustments | Stable monthly payments |

| Loan Term | Commonly 3, 5, 7, or 10 years fixed, then adjustable | Standard terms: 15, 20, or 30 years fixed |

| Risk | Higher risk due to potential rate increases | Low risk with predictable costs |

| Best For | Short-term homeowners or those expecting rates to drop | Long-term homeowners seeking payment certainty |

Adjustable-Rate Mortgage vs Fixed-Rate Mortgage: Key Differences

Adjustable-rate mortgages (ARMs) feature interest rates that fluctuate based on market indexes, resulting in potentially lower initial payments but increased future uncertainty. Fixed-rate mortgages maintain a consistent interest rate and monthly payment throughout the loan term, providing financial stability and predictability. Homebuyers should weigh factors like market trends, loan duration, and risk tolerance when choosing between ARM and fixed-rate mortgage options.

How Adjustable-Rate Mortgages Work

Adjustable-rate mortgages (ARMs) feature interest rates that change periodically based on an underlying index plus a margin, resulting in monthly payments that can increase or decrease over the loan term. Common indices include the LIBOR, SOFR, or Treasury rates, which serve as benchmarks for rate adjustments typically occurring annually after an initial fixed-rate period. Borrowers benefit from lower initial rates compared to fixed-rate mortgages but face potential payment volatility due to market fluctuations influencing the adjustable rate.

Understanding Fixed-Rate Mortgages

Fixed-rate mortgages offer consistent monthly payments by locking in a constant interest rate throughout the loan term, providing financial stability for homeowners. These loans typically span 15, 20, or 30 years, with interest rates influenced by market trends and borrower creditworthiness at the time of closing. Homebuyers prioritize fixed-rate mortgages for predictable budgeting and long-term protection against rising interest rates.

Pros and Cons of Adjustable-Rate Mortgages

Adjustable-rate mortgages (ARMs) offer lower initial interest rates compared to fixed-rate mortgages, making them attractive for buyers planning to sell or refinance within a few years. However, ARMs carry the risk of increased monthly payments after the initial fixed period due to interest rate adjustments tied to market indexes. Borrowers should carefully evaluate potential rate fluctuations and their financial stability before choosing an ARM over a fixed-rate mortgage.

Pros and Cons of Fixed-Rate Mortgages

Fixed-rate mortgages offer predictable monthly payments and protection against interest rate fluctuations, making budgeting easier for homeowners. Their higher initial interest rates compared to adjustable-rate mortgages can result in increased long-term costs if market rates remain stable or decline. Borrowers planning to stay in their homes for extended periods benefit most from the stability and financial certainty of fixed-rate loans.

Interest Rate Trends: Impact on Your Mortgage Choice

Interest rate trends critically influence the decision between adjustable-rate mortgages (ARMs) and fixed-rate mortgages, as fluctuating rates can increase monthly payments on ARMs while fixed rates offer predictable costs. During periods of rising interest rates, fixed-rate mortgages provide financial stability by locking in a consistent rate, protecting borrowers from escalating expenses. Conversely, if interest rates are expected to decline or remain low, ARMs may offer lower initial rates and potential savings, but carry the risk of future increases impacting affordability.

When to Choose an Adjustable-Rate Mortgage

When you plan to sell or refinance your property within a short period, typically 5 to 7 years, an adjustable-rate mortgage (ARM) offers lower initial interest rates compared to fixed-rate mortgages, reducing overall borrowing costs. Borrowers expecting rising income or anticipating a decline in interest rates may benefit from the flexibility of ARMs, which adjust periodically after an initial fixed period. Investing in an ARM suits those with risk tolerance who prioritize short-term savings and potential market-rate advantages over long-term payment stability.

When Fixed-Rate Mortgages Make Sense

Fixed-rate mortgages make sense when stability and predictable monthly payments are a priority, especially for homebuyers planning to stay in the property long-term. These loans protect against interest rate fluctuations, ensuring consistent costs throughout the loan term, typically 15 or 30 years. Borrowers can effectively budget and build equity without the risk of future rate increases common in adjustable-rate mortgages.

Long-Term Costs: Adjustable vs Fixed Mortgage

Adjustable-rate mortgages (ARMs) typically start with lower interest rates than fixed-rate mortgages, potentially reducing initial monthly payments but carrying the risk of increased rates over time, which can raise long-term costs. Fixed-rate mortgages lock in a consistent interest rate for the entire loan term, providing predictable monthly payments and protecting borrowers from future rate hikes, often leading to higher initial costs but greater long-term financial stability. Homebuyers should weigh the risk tolerance and market conditions to determine whether the potentially lower initial costs of an ARM outweigh the steady, predictable expenses of a fixed-rate mortgage over the loan duration.

Which Mortgage Type is Right for You?

Choosing between an adjustable-rate mortgage (ARM) and a fixed-rate mortgage depends on your financial stability, risk tolerance, and long-term housing plans. Fixed-rate mortgages offer predictable monthly payments with stable interest rates, ideal for buyers planning to stay in one home for many years. An ARM provides lower initial rates that adjust over time, appealing to those expecting to sell or refinance before rate adjustments increase payments.

adjustable-rate mortgage vs fixed-rate mortgage Infographic

difterm.com

difterm.com