A mortgage broker acts as an intermediary between borrowers and multiple lenders, offering access to a variety of loan products tailored to the buyer's unique financial situation. Loan officers typically represent a single bank or lending institution, guiding clients through loan application processes specific to their organization's offerings. Choosing between a mortgage broker and a loan officer depends on whether borrowers prefer a broader range of options or a streamlined process with one lender.

Table of Comparison

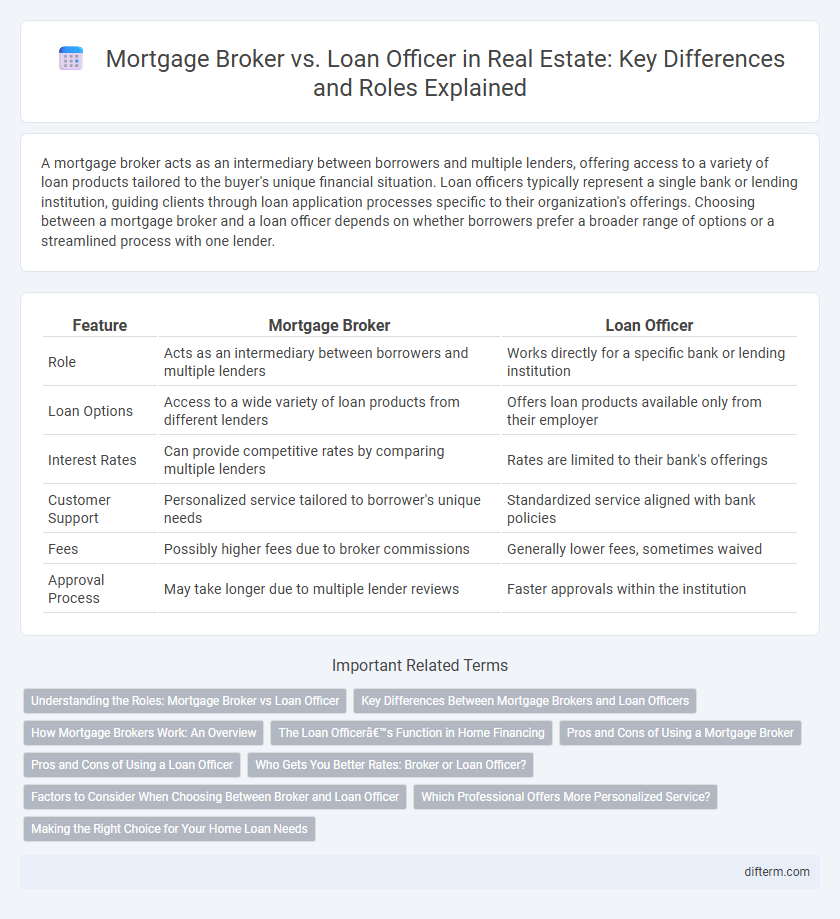

| Feature | Mortgage Broker | Loan Officer |

|---|---|---|

| Role | Acts as an intermediary between borrowers and multiple lenders | Works directly for a specific bank or lending institution |

| Loan Options | Access to a wide variety of loan products from different lenders | Offers loan products available only from their employer |

| Interest Rates | Can provide competitive rates by comparing multiple lenders | Rates are limited to their bank's offerings |

| Customer Support | Personalized service tailored to borrower's unique needs | Standardized service aligned with bank policies |

| Fees | Possibly higher fees due to broker commissions | Generally lower fees, sometimes waived |

| Approval Process | May take longer due to multiple lender reviews | Faster approvals within the institution |

Understanding the Roles: Mortgage Broker vs Loan Officer

Mortgage brokers act as intermediaries connecting borrowers with multiple lenders to find the best mortgage rates and terms, offering a wider range of options tailored to individual needs. Loan officers work directly for a specific financial institution, guiding clients through loan applications and underwriting processes with in-depth knowledge of their employer's loan products. Understanding these distinct roles helps homebuyers choose the right professional to optimize financing solutions and secure favorable mortgage agreements.

Key Differences Between Mortgage Brokers and Loan Officers

Mortgage brokers act as intermediaries who connect borrowers with multiple lenders to find the best mortgage rates and terms, while loan officers typically work for a specific bank or financial institution offering products from that single lender. Mortgage brokers provide access to a wider range of loan options, increasing the chances of securing competitive rates and customized loans. Loan officers have in-depth knowledge of their institution's loan products and can streamline the application process for borrowers seeking financing within that organization.

How Mortgage Brokers Work: An Overview

Mortgage brokers act as intermediaries between borrowers and multiple lenders, helping clients secure the best mortgage rates by comparing offers from various financial institutions. They assess a borrower's financial situation, gather necessary documentation, and submit loan applications to several lenders to maximize approval chances. Unlike loan officers employed by specific banks, mortgage brokers provide a broader range of loan options tailored to the client's unique needs.

The Loan Officer’s Function in Home Financing

Loan officers play a crucial role in home financing by evaluating borrowers' creditworthiness and guiding applicants through the mortgage application process. They work directly for banks or financial institutions, assessing financial documents, verifying income, and recommending suitable loan products based on the client's financial profile. Their expertise ensures efficient loan approval and tailored mortgage solutions for homebuyers.

Pros and Cons of Using a Mortgage Broker

Mortgage brokers offer access to multiple lenders and loan products, increasing the chances of finding competitive rates and tailored mortgage solutions, but their fees can sometimes be higher compared to direct lenders. They provide personalized guidance throughout the application process, simplifying complex paperwork, yet may have limited control over loan approval timelines. Borrowers benefit from mortgage brokers' market expertise and wider options, while the potential for conflicts of interest and less transparency on lender fees requires careful consideration.

Pros and Cons of Using a Loan Officer

Loan officers offer direct access to specific lenders and typically provide a streamlined mortgage approval process, which can speed up loan closing times. However, their product range is limited to the financial institution they represent, potentially restricting borrowers to fewer loan options. This contrasts with mortgage brokers, who source multiple lender offers, although loan officers may provide stronger institutional support and exclusive lender programs.

Who Gets You Better Rates: Broker or Loan Officer?

Mortgage brokers work with multiple lenders, giving them access to a wider range of loan products and competitive interest rates tailored to your financial profile. Loan officers, typically tied to a single bank or lending institution, can offer better rates only within their specific portfolio, which might limit your options. Choosing a mortgage broker often increases the potential for securing lower rates due to their ability to shop around and negotiate on your behalf across diverse lending sources.

Factors to Consider When Choosing Between Broker and Loan Officer

Mortgage brokers offer access to multiple lenders and diverse loan products, providing greater options and potentially better rates, while loan officers typically represent a specific financial institution with more streamlined application processes. Consider factors such as loan variety, personalized service, lender relationships, fees, and speed of approval when choosing between a mortgage broker and a loan officer. Evaluating transparency, communication style, and your individual financial situation also plays a crucial role in securing favorable mortgage terms.

Which Professional Offers More Personalized Service?

Mortgage brokers typically offer more personalized service by comparing multiple lenders to find the best rates and terms tailored to a client's unique financial situation. Loan officers usually represent a specific bank or lender, providing options limited to their institution's mortgage products. Clients seeking customized mortgage solutions and a broader selection often benefit more from working with a mortgage broker.

Making the Right Choice for Your Home Loan Needs

Choosing between a mortgage broker and a loan officer hinges on understanding their distinct roles in securing home financing. Mortgage brokers compare multiple lenders to find competitive rates and tailored loan options, while loan officers work directly for a specific bank or credit union, offering limited but potentially faster approval processes. Evaluating your credit profile, desired loan terms, and need for personalized guidance helps determine the best professional to navigate your home loan journey efficiently.

mortgage broker vs loan officer Infographic

difterm.com

difterm.com