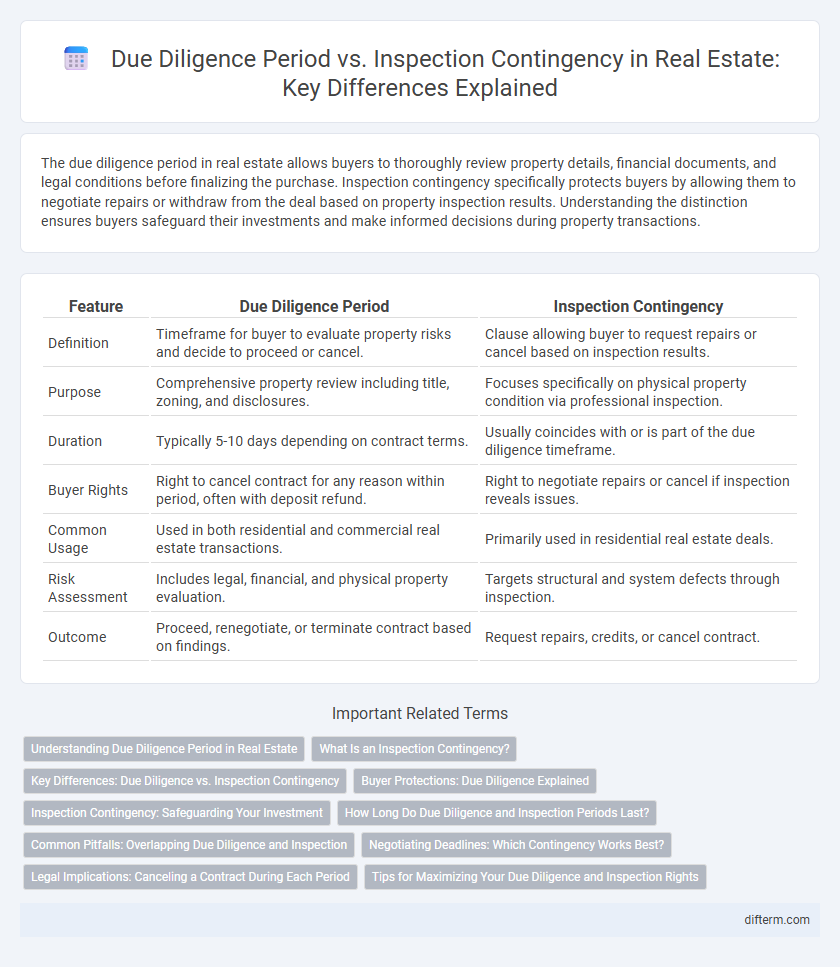

The due diligence period in real estate allows buyers to thoroughly review property details, financial documents, and legal conditions before finalizing the purchase. Inspection contingency specifically protects buyers by allowing them to negotiate repairs or withdraw from the deal based on property inspection results. Understanding the distinction ensures buyers safeguard their investments and make informed decisions during property transactions.

Table of Comparison

| Feature | Due Diligence Period | Inspection Contingency |

|---|---|---|

| Definition | Timeframe for buyer to evaluate property risks and decide to proceed or cancel. | Clause allowing buyer to request repairs or cancel based on inspection results. |

| Purpose | Comprehensive property review including title, zoning, and disclosures. | Focuses specifically on physical property condition via professional inspection. |

| Duration | Typically 5-10 days depending on contract terms. | Usually coincides with or is part of the due diligence timeframe. |

| Buyer Rights | Right to cancel contract for any reason within period, often with deposit refund. | Right to negotiate repairs or cancel if inspection reveals issues. |

| Common Usage | Used in both residential and commercial real estate transactions. | Primarily used in residential real estate deals. |

| Risk Assessment | Includes legal, financial, and physical property evaluation. | Targets structural and system defects through inspection. |

| Outcome | Proceed, renegotiate, or terminate contract based on findings. | Request repairs, credits, or cancel contract. |

Understanding Due Diligence Period in Real Estate

The due diligence period in real estate is a specified timeframe during which buyers conduct thorough investigations of a property, including reviewing title reports, financial documents, and property conditions. This period allows buyers to assess risks and negotiate repairs or contract terms before finalizing the purchase agreement. Understanding the due diligence period ensures informed decision-making and protects buyers from unforeseen issues after closing.

What Is an Inspection Contingency?

An inspection contingency is a clause in a real estate contract that allows the buyer to have the property professionally inspected and request repairs or cancel the contract if significant issues are discovered. This contingency protects the buyer by ensuring they are fully informed about the property's condition before finalizing the purchase. Unlike the broader due diligence period, which may include various investigations, the inspection contingency specifically focuses on the home inspection process and related negotiations.

Key Differences: Due Diligence vs. Inspection Contingency

The due diligence period in real estate encompasses a comprehensive evaluation phase where buyers assess all aspects of the property, including financial records, zoning laws, and title reports, while the inspection contingency specifically refers to the timeframe during which the buyer can conduct physical property inspections to identify potential defects or repairs. Unlike the inspection contingency, which can usually be waived or negotiated separately, the due diligence period is broader and typically involves contract termination rights with refunds based on findings. Understanding these distinctions is crucial for managing risks and negotiating terms effectively in residential or commercial property transactions.

Buyer Protections: Due Diligence Explained

The due diligence period allows buyers to thoroughly investigate a property's condition, title status, and financial aspects before finalizing the purchase, offering comprehensive protection against unforeseen issues. Inspection contingency specifically enables buyers to request repairs or negotiate terms based on professional home inspections, ensuring safety and structural soundness. These protections collectively minimize risks and provide buyers with the opportunity to make informed decisions during real estate transactions.

Inspection Contingency: Safeguarding Your Investment

Inspection contingency serves as a critical safeguard in real estate transactions, allowing buyers to thoroughly assess property conditions before finalizing the purchase. This contingency grants the right to negotiate repairs or withdraw if significant issues arise, thereby protecting the investment from unforeseen defects. Understanding the scope and limitations of inspection contingencies ensures buyers can make informed decisions while minimizing financial risk.

How Long Do Due Diligence and Inspection Periods Last?

Due diligence periods in real estate typically last between 7 to 14 days, allowing buyers to thoroughly review property documents, titles, and disclosures. Inspection contingencies generally span 5 to 10 days within this timeframe, giving buyers the opportunity to conduct home inspections and request repairs or renegotiations. Both periods are critical for assessing property conditions and finalizing purchase terms before contract commitment.

Common Pitfalls: Overlapping Due Diligence and Inspection

Overlapping due diligence and inspection contingencies can create confusion, leading to missed deadlines or overlooked issues in real estate transactions. Buyers often struggle to distinguish between the inspection contingency, which typically addresses property condition, and the broader due diligence period that includes title and zoning reviews. Clear timelines and communication are essential to avoid disputes and ensure all concerns are thoroughly addressed before closing.

Negotiating Deadlines: Which Contingency Works Best?

Negotiating deadlines in real estate hinges on understanding the differences between the due diligence period and inspection contingency. The due diligence period offers a broader timeframe for buyers to investigate property conditions and legal aspects, allowing more comprehensive evaluation and negotiation leverage. In contrast, inspection contingencies are typically shorter, focused specifically on identifying defects, often triggering repair requests or contract termination within a strict deadline, making them ideal for buyers prioritizing swift decisions on property condition.

Legal Implications: Canceling a Contract During Each Period

The due diligence period allows buyers to cancel a real estate contract for any reason, offering broad legal protection without penalties. Inspection contingencies specifically address property condition issues, enabling cancellation if inspections reveal defects or required repairs, supported by documented findings. Understanding the distinct legal implications during each period helps buyers minimize risk, avoid contract breaches, and secure earnest money refunds.

Tips for Maximizing Your Due Diligence and Inspection Rights

Maximizing your due diligence and inspection rights requires thoroughly reviewing all property disclosures, zoning regulations, and potential environmental hazards within the due diligence period. Schedule multiple inspections, including structural, HVAC, and pest assessments, to identify any hidden defects or necessary repairs. Clearly outline inspection contingencies in the purchase agreement to negotiate repairs or price adjustments effectively before finalizing the transaction.

Due diligence period vs Inspection contingency Infographic

difterm.com

difterm.com