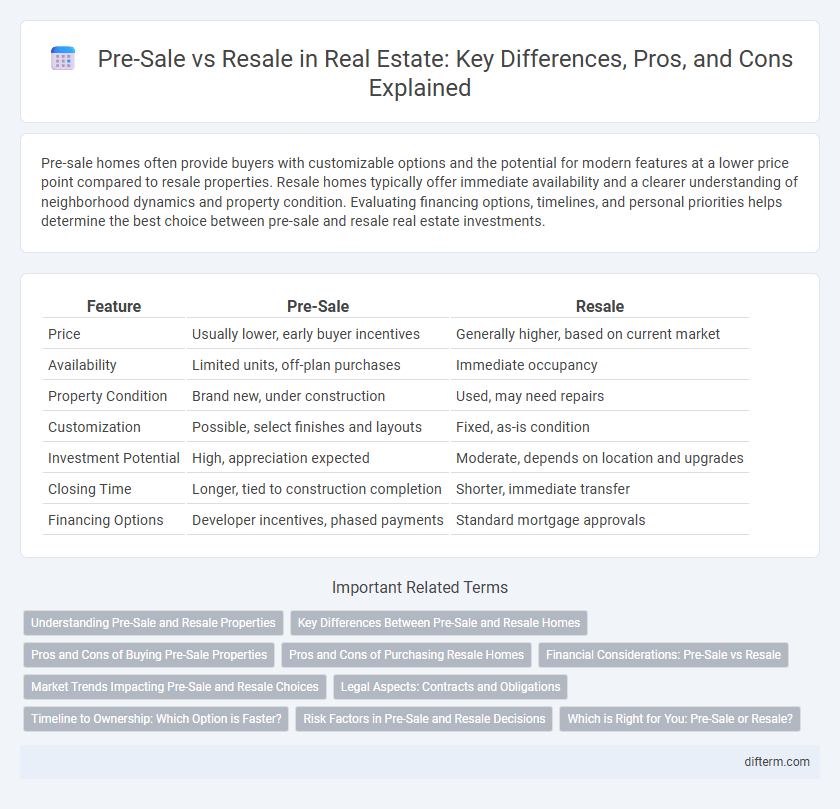

Pre-sale homes often provide buyers with customizable options and the potential for modern features at a lower price point compared to resale properties. Resale homes typically offer immediate availability and a clearer understanding of neighborhood dynamics and property condition. Evaluating financing options, timelines, and personal priorities helps determine the best choice between pre-sale and resale real estate investments.

Table of Comparison

| Feature | Pre-Sale | Resale |

|---|---|---|

| Price | Usually lower, early buyer incentives | Generally higher, based on current market |

| Availability | Limited units, off-plan purchases | Immediate occupancy |

| Property Condition | Brand new, under construction | Used, may need repairs |

| Customization | Possible, select finishes and layouts | Fixed, as-is condition |

| Investment Potential | High, appreciation expected | Moderate, depends on location and upgrades |

| Closing Time | Longer, tied to construction completion | Shorter, immediate transfer |

| Financing Options | Developer incentives, phased payments | Standard mortgage approvals |

Understanding Pre-Sale and Resale Properties

Pre-sale properties refer to real estate units sold before construction is completed, offering buyers lower prices and customization options but also involving longer wait times and potential market risks. Resale properties are existing homes available immediately, providing buyers with the advantage of physical inspections, established neighborhood insights, and often faster closing processes. Understanding the distinct benefits and challenges of pre-sale and resale properties helps investors and homebuyers make informed decisions aligned with their financial goals and timelines.

Key Differences Between Pre-Sale and Resale Homes

Pre-sale homes refer to properties purchased before construction is completed, often offering lower prices and customizable options, while resale homes are previously owned and available for immediate occupancy with established market values. Pre-sale purchases involve longer wait times and potential construction risks, whereas resale homes provide tangible inspection opportunities and quicker closing processes. Pricing structures, renovation potential, and investment timelines differ significantly, impacting buyer decisions in the real estate market.

Pros and Cons of Buying Pre-Sale Properties

Buying pre-sale properties offers lower prices and the opportunity to customize features before construction completion, appealing to investors seeking capital appreciation. However, risks include potential construction delays, market fluctuations affecting property value, and the uncertainty of final product quality without immediate physical inspection. Pre-sale buyers must weigh long-term investment potential against the possibility of waiting extended periods and dealing with project-related uncertainties.

Pros and Cons of Purchasing Resale Homes

Purchasing resale homes offers immediate availability and established neighborhood amenities, providing buyers with a clearer understanding of property conditions and potential renovation costs. However, resale properties may require more maintenance and updates compared to new builds, and they often lack the modern features and energy efficiencies found in pre-sale homes. Buyers benefit from negotiating power and price flexibility in resale markets but must carefully assess for hidden repair expenses and outdated infrastructures.

Financial Considerations: Pre-Sale vs Resale

Pre-sale properties often offer lower purchase prices and flexible payment plans, enabling buyers to manage cash flow effectively before project completion. Resale properties may require immediate full payment or mortgage approval, impacting financing options and interest rates. Considering potential appreciation and renovation costs is crucial when evaluating the overall financial benefits between pre-sale and resale real estate investments.

Market Trends Impacting Pre-Sale and Resale Choices

Market trends significantly influence buyer decisions between pre-sale and resale properties, with rising interest rates often steering demand towards resale homes due to immediate availability and predictable costs. Pre-sale properties attract investors during market upswings, leveraging price appreciation and customization options despite longer waiting periods. Shifts in economic conditions and local housing supply also dictate whether buyers prioritize the security of existing resale homes or the potential growth of pre-sale investments.

Legal Aspects: Contracts and Obligations

Pre-sale real estate contracts often include detailed clauses outlining buyer obligations, such as deposit schedules and construction timelines, which protect developers while binding buyers before project completion. Resale transactions involve established legal documents guaranteeing clear title transfer and existing property condition disclosures, ensuring buyer protection through title insurance and warranties. Understanding the distinct legal frameworks governing pre-sale and resale contracts is essential to mitigate risks related to contract enforcement, property defects, and financial liability.

Timeline to Ownership: Which Option is Faster?

Pre-sale properties typically offer a longer timeline to ownership, often requiring months or even years before completion, as buyers purchase units during the development phase. In contrast, resale properties allow for a much faster transfer of ownership, sometimes closing in as little as 30 to 60 days after an accepted offer, since the units are already built and available for immediate occupancy. Understanding these specific timelines helps buyers make strategic decisions based on their urgency to move or invest.

Risk Factors in Pre-Sale and Resale Decisions

Risk factors in pre-sale real estate include construction delays, market fluctuations, and developer solvency, which can impact delivery timelines and property value. Resale properties carry risks related to property condition, hidden defects, and potential legal issues with previous ownership or liens. Thorough due diligence and risk assessment are essential in both pre-sale and resale to mitigate financial loss and secure investment stability.

Which is Right for You: Pre-Sale or Resale?

Choosing between pre-sale and resale properties depends on factors like budget, timeline, and customization preferences. Pre-sale homes often offer lower prices and modern amenities but require waiting for construction completion. Resale properties provide immediate occupancy and established neighborhoods, typically allowing for quicker move-ins and potential negotiation on price.

pre-sale vs resale Infographic

difterm.com

difterm.com