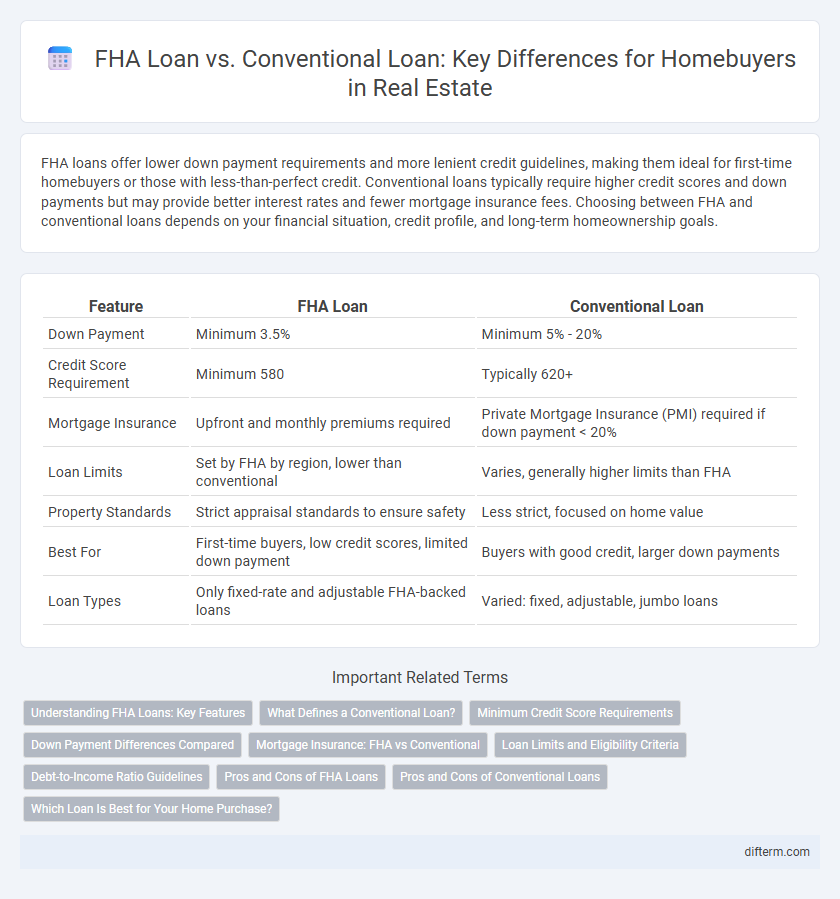

FHA loans offer lower down payment requirements and more lenient credit guidelines, making them ideal for first-time homebuyers or those with less-than-perfect credit. Conventional loans typically require higher credit scores and down payments but may provide better interest rates and fewer mortgage insurance fees. Choosing between FHA and conventional loans depends on your financial situation, credit profile, and long-term homeownership goals.

Table of Comparison

| Feature | FHA Loan | Conventional Loan |

|---|---|---|

| Down Payment | Minimum 3.5% | Minimum 5% - 20% |

| Credit Score Requirement | Minimum 580 | Typically 620+ |

| Mortgage Insurance | Upfront and monthly premiums required | Private Mortgage Insurance (PMI) required if down payment < 20% |

| Loan Limits | Set by FHA by region, lower than conventional | Varies, generally higher limits than FHA |

| Property Standards | Strict appraisal standards to ensure safety | Less strict, focused on home value |

| Best For | First-time buyers, low credit scores, limited down payment | Buyers with good credit, larger down payments |

| Loan Types | Only fixed-rate and adjustable FHA-backed loans | Varied: fixed, adjustable, jumbo loans |

Understanding FHA Loans: Key Features

FHA loans, backed by the Federal Housing Administration, require lower down payments typically starting at 3.5%, making homeownership accessible for buyers with less-than-perfect credit scores. They allow higher debt-to-income ratios compared to conventional loans, providing flexible qualification criteria that benefit first-time and low-to-moderate income buyers. Mortgage insurance premiums (MIP) are mandatory throughout the loan term or a minimum of 11 years, differentiating FHA loans from conventional loans that often offer private mortgage insurance (PMI) removal options.

What Defines a Conventional Loan?

A conventional loan is a mortgage not insured or guaranteed by the federal government, typically requiring higher credit scores and a larger down payment compared to FHA loans. These loans conform to Fannie Mae and Freddie Mac guidelines, often offering competitive interest rates and more flexible terms for borrowers with strong financial profiles. Conventional loans are ideal for buyers who can afford at least 20% down payment to avoid private mortgage insurance (PMI) costs.

Minimum Credit Score Requirements

FHA loans typically require a minimum credit score of 580 to qualify for the low down payment option, while borrowers with credit scores between 500 and 579 may still qualify with a higher down payment of 10%. Conventional loans generally require a higher minimum credit score, often starting at 620, to be eligible for favorable terms and lower private mortgage insurance premiums. Understanding these credit score thresholds is crucial for homebuyers to determine the best financing option based on their credit history.

Down Payment Differences Compared

FHA loans require a minimum down payment of 3.5% for borrowers with credit scores of 580 or higher, making them more accessible for first-time homebuyers with limited savings. Conventional loans typically demand a higher down payment, often starting at 5% but ideally 20% to avoid private mortgage insurance (PMI). The lower down payment requirement of FHA loans can ease upfront costs, but conventional loans may offer better long-term savings with lower mortgage insurance premiums for qualified buyers.

Mortgage Insurance: FHA vs Conventional

FHA loans require upfront and monthly mortgage insurance premiums regardless of down payment size, providing lenders with added security on higher-risk borrowers. Conventional loans mandate private mortgage insurance (PMI) primarily when the down payment is below 20%, which can be canceled once home equity reaches 20%. Understanding the distinct mortgage insurance structures helps borrowers optimize costs and choose the loan program best suited to their financial situation.

Loan Limits and Eligibility Criteria

FHA loans offer lower loan limits compared to conventional loans, typically capped at $472,030 in most areas but can reach higher in high-cost regions, while conventional loan limits vary based on conforming loan limits set by the Federal Housing Finance Agency, often higher than FHA limits. FHA loans require a minimum credit score of 580 with a 3.5% down payment, making them accessible to borrowers with lower credit, whereas conventional loans generally require a credit score of 620 or higher and a larger down payment, often starting at 5%. Eligibility for FHA loans is also limited to primary residences with stringent mortgage insurance requirements, while conventional loans provide more flexibility for second homes and investment properties with varying mortgage insurance conditions.

Debt-to-Income Ratio Guidelines

FHA loans typically allow a higher debt-to-income (DTI) ratio, often up to 43% or more, making them suitable for borrowers with moderate income or higher existing debts. Conventional loans usually require a lower DTI ratio, commonly below 36%, to meet underwriting standards set by Fannie Mae or Freddie Mac. Understanding these DTI guidelines is crucial for homebuyers to determine eligibility and improve chances of loan approval.

Pros and Cons of FHA Loans

FHA loans offer lower down payment requirements, often as low as 3.5%, making homeownership accessible for buyers with limited savings or lower credit scores. These loans require mortgage insurance premiums (MIP) for the life of the loan, which increases overall borrowing costs compared to conventional loans that may allow cancellation of private mortgage insurance (PMI) once sufficient equity is gained. FHA loans are ideal for first-time homebuyers or those with credit challenges, but buyers seeking to minimize long-term insurance expenses might prefer conventional loan options.

Pros and Cons of Conventional Loans

Conventional loans offer competitive interest rates and the advantage of avoiding mortgage insurance once the loan-to-value ratio drops below 80%, making them cost-effective for borrowers with strong credit and substantial down payments. However, conventional loans typically require higher credit scores and larger down payments compared to FHA loans, which can limit accessibility for first-time homebuyers or those with less-than-perfect credit. Borrowers benefit from fewer property restrictions, allowing for greater flexibility in investment properties or second homes, but must be prepared for stricter qualification criteria and potentially higher upfront costs.

Which Loan Is Best for Your Home Purchase?

FHA loans offer lower down payments and more flexible credit requirements, making them ideal for first-time homebuyers or those with less-than-perfect credit. Conventional loans typically require higher credit scores and larger down payments but provide better terms and lower overall costs for borrowers with strong financial profiles. Choosing the best loan depends on your credit score, down payment ability, and long-term financial goals.

FHA Loan vs Conventional Loan Infographic

difterm.com

difterm.com