Title insurance protects homebuyers and lenders from financial loss due to defects in the property title, such as liens or ownership disputes. Mortgage insurance, on the other hand, safeguards lenders if the borrower defaults on the loan, commonly required for buyers with less than 20% down payment. Understanding the distinction between these insurances is crucial for protecting your real estate investment and managing loan risks effectively.

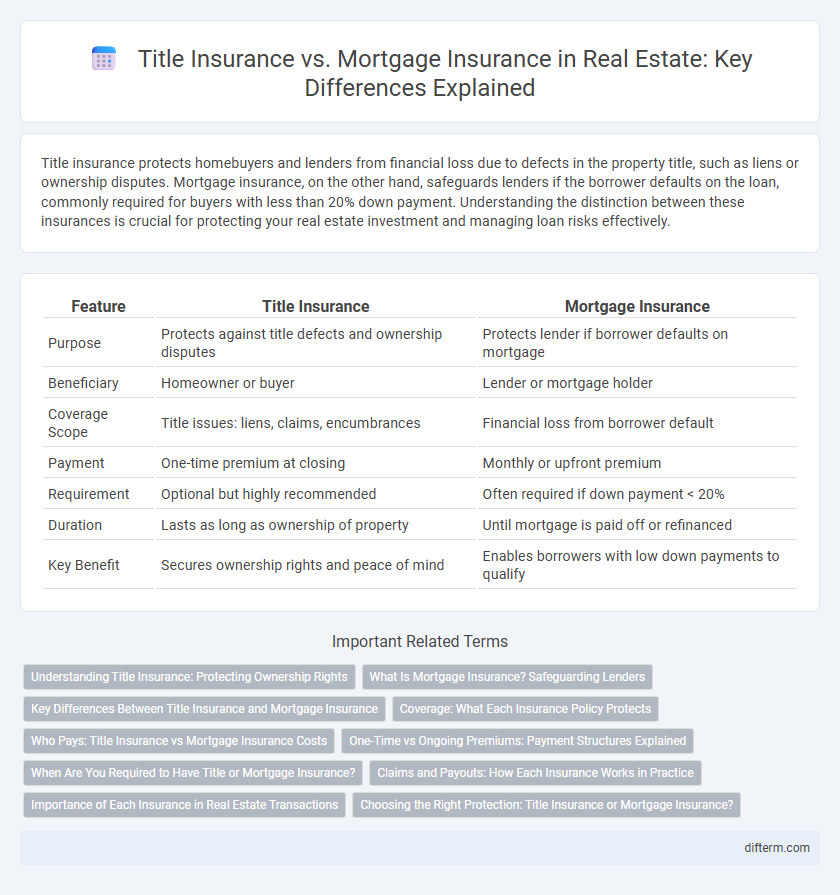

Table of Comparison

| Feature | Title Insurance | Mortgage Insurance |

|---|---|---|

| Purpose | Protects against title defects and ownership disputes | Protects lender if borrower defaults on mortgage |

| Beneficiary | Homeowner or buyer | Lender or mortgage holder |

| Coverage Scope | Title issues: liens, claims, encumbrances | Financial loss from borrower default |

| Payment | One-time premium at closing | Monthly or upfront premium |

| Requirement | Optional but highly recommended | Often required if down payment < 20% |

| Duration | Lasts as long as ownership of property | Until mortgage is paid off or refinanced |

| Key Benefit | Secures ownership rights and peace of mind | Enables borrowers with low down payments to qualify |

Understanding Title Insurance: Protecting Ownership Rights

Title insurance safeguards property owners against potential legal disputes over ownership by verifying the legitimacy of the title during real estate transactions. Unlike mortgage insurance, which protects lenders in case of borrower default, title insurance ensures buyers have clear ownership and shields against claims such as liens, encumbrances, or title defects. This protection provides peace of mind by confirming that the seller's rights are valid and that no hidden issues will jeopardize the owner's interest in the property.

What Is Mortgage Insurance? Safeguarding Lenders

Mortgage insurance protects lenders by minimizing financial loss if a borrower defaults on a loan, particularly when the down payment is less than 20%. It is a requirement for many conventional loans and Private Mortgage Insurance (PMI) is the most common type for conventional mortgages. Unlike title insurance that safeguards property ownership, mortgage insurance specifically secures the lender's investment in the mortgage loan.

Key Differences Between Title Insurance and Mortgage Insurance

Title insurance protects property owners and lenders from financial loss due to defects in a property's title, such as liens or ownership disputes, while mortgage insurance safeguards lenders against borrower default on loan payments. Title insurance is typically a one-time premium paid at closing, covering issues that arise before ownership transfer, whereas mortgage insurance involves ongoing premiums until the loan-to-value ratio reaches a certain level or the loan is paid off. Unlike mortgage insurance, which primarily benefits lenders, title insurance protects both buyers and lenders from risks related to the property's legal ownership.

Coverage: What Each Insurance Policy Protects

Title insurance protects property buyers and lenders against financial loss from defects in the property's title, such as liens, encumbrances, or ownership disputes that arise after purchase. Mortgage insurance safeguards lenders by covering the risk of borrower default on the loan, ensuring repayment even if the borrower fails to fulfill mortgage obligations. Both policies serve distinct roles: title insurance secures ownership rights, while mortgage insurance protects the loan's repayment.

Who Pays: Title Insurance vs Mortgage Insurance Costs

Title insurance costs are typically paid once at closing by the buyer or seller depending on the local custom, ensuring protection against ownership disputes. Mortgage insurance premiums, on the other hand, are usually paid by the borrower either monthly or as a lump sum if the down payment is less than 20%, safeguarding the lender against loan default. Understanding these differences in payment responsibility is crucial for accurately budgeting real estate transaction expenses.

One-Time vs Ongoing Premiums: Payment Structures Explained

Title insurance requires a one-time premium paid at closing, providing protection against potential title defects or disputes on the property. Mortgage insurance involves ongoing premiums, typically paid monthly, to safeguard the lender against borrower default on the loan. Understanding the payment structures helps buyers budget accurately and assess long-term financial obligations in real estate transactions.

When Are You Required to Have Title or Mortgage Insurance?

Homebuyers are typically required to purchase mortgage insurance when their down payment is less than 20%, protecting lenders against default risk. Title insurance is usually mandated only by lenders during the closing process to ensure the property's title is free of liens or disputes, benefiting both buyer and lender. While mortgage insurance payments may continue until equity reaches 20%, title insurance is a one-time premium that safeguards ownership rights.

Claims and Payouts: How Each Insurance Works in Practice

Title insurance protects homeowners and lenders against financial loss from defects or disputes over property ownership, with claims typically resolved through legal defense or reimbursement of covered losses. Mortgage insurance safeguards lenders by covering missed loan payments or defaults, triggering payouts only when the borrower fails to meet mortgage obligations. While title insurance claims revolve around ownership issues, mortgage insurance claims are tied directly to borrower payment performance.

Importance of Each Insurance in Real Estate Transactions

Title insurance protects buyers and lenders from potential legal defects in property ownership, ensuring clear ownership and preventing costly disputes. Mortgage insurance safeguards lenders by covering loan defaults, enabling borrowers to access financing with lower down payments. Both insurances are crucial for mitigating risk and providing financial security during real estate transactions.

Choosing the Right Protection: Title Insurance or Mortgage Insurance?

Title insurance protects property owners and lenders against disputes over ownership and hidden title defects, ensuring secure real estate transactions. Mortgage insurance safeguards lenders by covering loan defaults, especially when buyers put down less than 20% on a home purchase. Homebuyers should assess their financial situation and risk exposure to determine whether title insurance or mortgage insurance better protects their investment.

title insurance vs mortgage insurance Infographic

difterm.com

difterm.com