Understanding the difference between PITI and principal-only payments is crucial for real estate investors managing property financing. PITI encompasses the full monthly mortgage payment, including principal, interest, taxes, and insurance, providing a comprehensive view of housing costs. Principal-only payments reduce the loan balance faster but don't cover taxes or insurance, which require separate budgeting to avoid financial surprises.

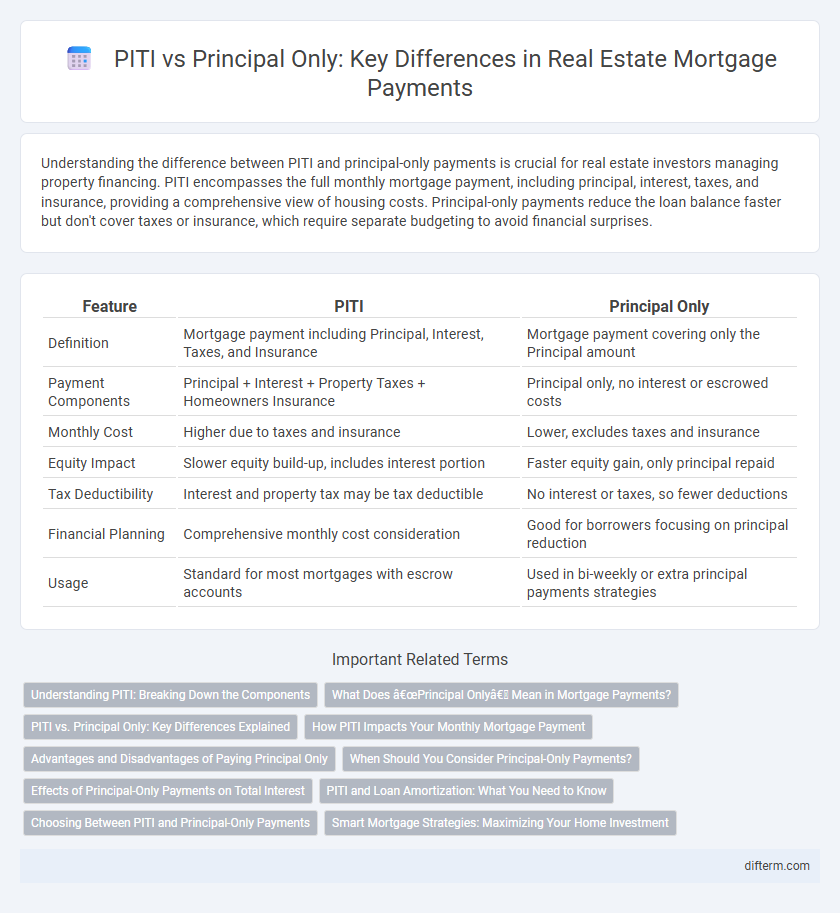

Table of Comparison

| Feature | PITI | Principal Only |

|---|---|---|

| Definition | Mortgage payment including Principal, Interest, Taxes, and Insurance | Mortgage payment covering only the Principal amount |

| Payment Components | Principal + Interest + Property Taxes + Homeowners Insurance | Principal only, no interest or escrowed costs |

| Monthly Cost | Higher due to taxes and insurance | Lower, excludes taxes and insurance |

| Equity Impact | Slower equity build-up, includes interest portion | Faster equity gain, only principal repaid |

| Tax Deductibility | Interest and property tax may be tax deductible | No interest or taxes, so fewer deductions |

| Financial Planning | Comprehensive monthly cost consideration | Good for borrowers focusing on principal reduction |

| Usage | Standard for most mortgages with escrow accounts | Used in bi-weekly or extra principal payments strategies |

Understanding PITI: Breaking Down the Components

PITI stands for Principal, Interest, Taxes, and Insurance, representing the total monthly mortgage payment a homeowner makes. Understanding each component is crucial: Principal reduces the loan balance, Interest covers the cost of borrowing, Taxes refer to property taxes levied by local governments, and Insurance includes homeowner's insurance protecting the property against damages. Calculating PITI accurately helps buyers assess affordability and plan long-term homeownership expenses effectively.

What Does “Principal Only” Mean in Mortgage Payments?

"Principal only" in mortgage payments refers to the portion of the monthly payment that directly reduces the original loan amount, excluding interest, taxes, and insurance. Paying principal only accelerates home equity buildup and can shorten the loan term significantly. Unlike PITI (Principal, Interest, Taxes, and Insurance), principal-only payments provide a focused approach to reducing debt faster without covering other housing costs.

PITI vs. Principal Only: Key Differences Explained

PITI includes principal, interest, taxes, and insurance, representing the full monthly mortgage payment and providing a comprehensive picture of housing costs. Principal-only payments reduce the loan balance faster but do not cover taxes or insurance, potentially leading to separate expenses and escrow considerations. Understanding PITI versus principal-only payments helps homeowners budget accurately and plan mortgage payoff strategies effectively.

How PITI Impacts Your Monthly Mortgage Payment

PITI represents the full monthly mortgage payment, including Principal, Interest, Taxes, and Insurance, which directly impacts your housing budget and cash flow. Unlike a Principal-only payment that reduces your loan balance exclusively, PITI incorporates property taxes and homeowners insurance, leading to a higher monthly sum but providing a comprehensive coverage of mortgage-related expenses. Understanding PITI helps homeowners accurately budget for all housing costs, maintaining financial stability throughout the loan term.

Advantages and Disadvantages of Paying Principal Only

Paying principal only on a mortgage accelerates loan payoff and reduces total interest paid, providing significant long-term savings and increased home equity. However, it may strain monthly budgets due to higher immediate payments and limits cash flow flexibility for other investments or expenses. Homeowners should weigh the benefits of interest savings against potential liquidity constraints before prioritizing principal-only payments.

When Should You Consider Principal-Only Payments?

Principal-only payments should be considered when you aim to reduce the overall loan term and save on interest costs in real estate financing. Strategic principal payments can accelerate equity buildup and improve your property's net worth, especially in a market with stable or rising home values. This approach benefits homeowners planning to sell or refinance soon, as it decreases the loan balance faster than standard PITI payments.

Effects of Principal-Only Payments on Total Interest

Making principal-only payments significantly reduces the total interest paid over the life of a mortgage by lowering the outstanding loan balance faster. This accelerated repayment shortens the loan term and decreases cumulative interest charges, resulting in substantial long-term savings. Homeowners who consistently apply extra funds toward the principal can save thousands of dollars and build equity more quickly compared to standard PITI payments.

PITI and Loan Amortization: What You Need to Know

PITI, which stands for Principal, Interest, Taxes, and Insurance, represents the full monthly mortgage payment encompassing all key components of loan amortization, providing a comprehensive understanding of housing costs. Loan amortization schedules break down each payment, showing how a portion goes towards reducing the principal balance while covering interest expenses and escrow for property taxes and insurance. Understanding PITI is crucial for accurate budgeting and assessing the true affordability of a mortgage beyond just principal-only payments.

Choosing Between PITI and Principal-Only Payments

Choosing between PITI (Principal, Interest, Taxes, and Insurance) and principal-only payments depends on your financial goals and cash flow. PITI payments cover all monthly mortgage-related costs, providing a comprehensive view of expenses, while principal-only payments accelerate loan payoff and reduce interest over time. Evaluating your budget and long-term plans helps determine the best strategy for managing a real estate mortgage effectively.

Smart Mortgage Strategies: Maximizing Your Home Investment

PITI (Principal, Interest, Taxes, and Insurance) payments provide a comprehensive view of your total monthly mortgage costs, ensuring you budget effectively for all housing expenses. Focusing only on the principal payments accelerates loan payoff and reduces interest over time, maximizing equity build-up in your home investment. Smart mortgage strategies balance timely PITI management with targeted principal prepayments to optimize long-term financial benefits and build wealth efficiently.

PITI vs Principal Only Infographic

difterm.com

difterm.com