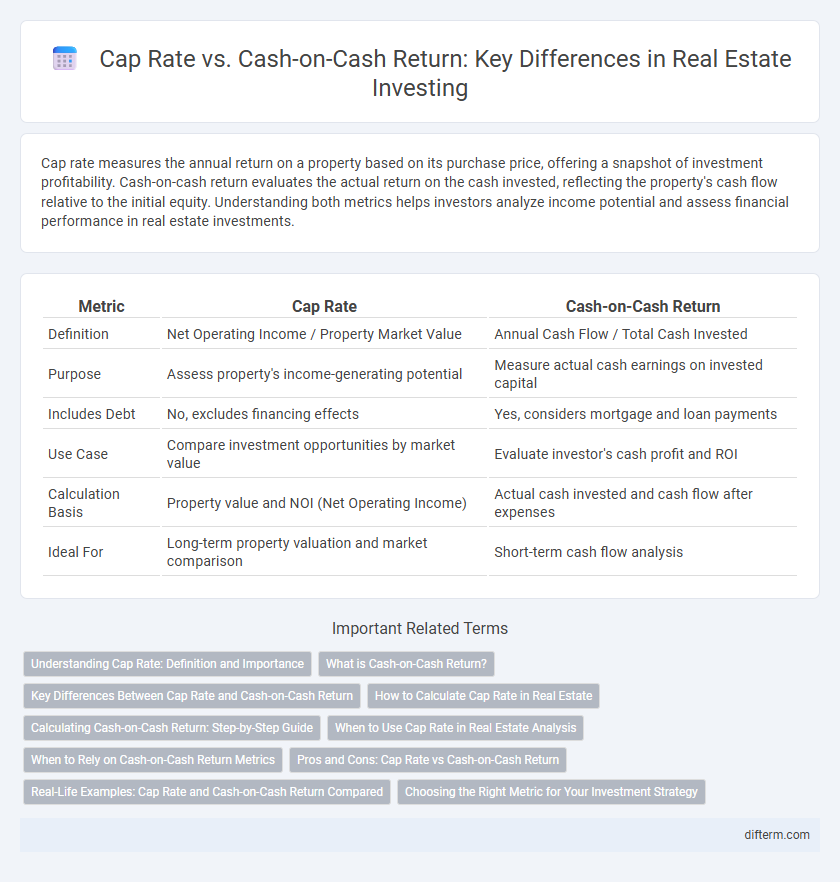

Cap rate measures the annual return on a property based on its purchase price, offering a snapshot of investment profitability. Cash-on-cash return evaluates the actual return on the cash invested, reflecting the property's cash flow relative to the initial equity. Understanding both metrics helps investors analyze income potential and assess financial performance in real estate investments.

Table of Comparison

| Metric | Cap Rate | Cash-on-Cash Return |

|---|---|---|

| Definition | Net Operating Income / Property Market Value | Annual Cash Flow / Total Cash Invested |

| Purpose | Assess property's income-generating potential | Measure actual cash earnings on invested capital |

| Includes Debt | No, excludes financing effects | Yes, considers mortgage and loan payments |

| Use Case | Compare investment opportunities by market value | Evaluate investor's cash profit and ROI |

| Calculation Basis | Property value and NOI (Net Operating Income) | Actual cash invested and cash flow after expenses |

| Ideal For | Long-term property valuation and market comparison | Short-term cash flow analysis |

Understanding Cap Rate: Definition and Importance

Cap rate, or capitalization rate, measures a real estate investment's annual net operating income (NOI) divided by its current market value or purchase price, expressed as a percentage. It serves as a crucial metric for evaluating property profitability and comparing investment opportunities in different markets or asset types. Investors rely on cap rates to estimate potential returns while assessing risk, liquidity, and market conditions within the real estate sector.

What is Cash-on-Cash Return?

Cash-on-Cash Return measures the annual pre-tax cash flow generated by an investment relative to the actual cash invested, providing investors with a clear understanding of the property's cash income performance. Unlike Cap Rate, which considers net operating income against property value, Cash-on-Cash Return focuses specifically on the return on the investor's equity or out-of-pocket investment. This metric is crucial for evaluating the effectiveness of financing strategies and ongoing cash flow potential in real estate investments.

Key Differences Between Cap Rate and Cash-on-Cash Return

Cap rate measures a property's net operating income divided by its current market value, reflecting overall profitability and market comparison. Cash-on-cash return calculates the annual pre-tax cash flow relative to the total cash invested, highlighting the investor's direct cash earnings. Key differences include cap rate's focus on property income regardless of financing, while cash-on-cash return emphasizes actual cash flow post-financing costs.

How to Calculate Cap Rate in Real Estate

Cap rate in real estate is calculated by dividing the property's net operating income (NOI) by its current market value or purchase price, expressed as a percentage. For example, if a property generates $50,000 in NOI annually and is valued at $500,000, the cap rate is 10%. This metric helps investors assess the potential return and risk level of income-producing properties.

Calculating Cash-on-Cash Return: Step-by-Step Guide

To calculate cash-on-cash return, first determine the total annual pre-tax cash flow generated by the property, which includes rental income minus operating expenses and debt service. Next, divide this annual cash flow by the total cash invested, including down payment, closing costs, and any initial repairs. This metric provides investors with a clear percentage return on their actual cash invested, offering insight into the property's short-term profitability and cash flow efficiency.

When to Use Cap Rate in Real Estate Analysis

Cap rate is best used in real estate analysis when evaluating the overall profitability and market value of income-producing properties, as it reflects the ratio of net operating income (NOI) to current property value or purchase price. It is ideal for comparing properties across different markets or assessing valuation trends without factoring financing structures or tax impacts. Investors use cap rate primarily to determine potential returns relative to market risk and to benchmark investments against local or national real estate averages.

When to Rely on Cash-on-Cash Return Metrics

Cash-on-cash return is essential for assessing the actual cash income relative to the initial investment, making it ideal for investors seeking immediate cash flow insights rather than long-term property value appreciation. This metric is most reliable when evaluating properties with financing or when cash flow timing impacts investment decisions, such as rental properties with mortgage payments. Investors reliant on steady income streams prioritize cash-on-cash return to measure real-time profitability and compare different financing structures effectively.

Pros and Cons: Cap Rate vs Cash-on-Cash Return

Cap Rate provides a quick snapshot of a property's potential return by comparing net operating income to purchase price, offering simplicity but ignoring financing effects. Cash-on-Cash Return accounts for actual cash invested and mortgage payments, delivering a more accurate measure of investor cash flow but can be skewed by loan terms. Investors benefit from using Cap Rate for property valuation and Cash-on-Cash Return for assessing cash flow performance and risk.

Real-Life Examples: Cap Rate and Cash-on-Cash Return Compared

A property purchased for $500,000 generating $50,000 net operating income results in a 10% cap rate, highlighting its income relative to value. If the investor used $100,000 cash and financed the remaining $400,000, with annual mortgage payments totaling $20,000, the cash-on-cash return would be 30% ($30,000 net cash flow divided by $100,000 cash invested). This comparison demonstrates how cap rate measures overall property performance, while cash-on-cash return emphasizes actual investor cash yield considering financing.

Choosing the Right Metric for Your Investment Strategy

Cap rate measures the property's net operating income relative to its market value, making it ideal for evaluating potential income and comparing similar investments. Cash-on-cash return focuses on the actual cash income earned against the cash invested, offering insight into short-term investment performance and financing impact. Investors prioritizing income stability and property valuation often emphasize cap rate, while those seeking immediate cash flow and financing efficiency rely on cash-on-cash return to guide decisions.

Cap Rate vs Cash-on-Cash Return Infographic

difterm.com

difterm.com