Single family homes offer privacy, spacious yards, and more control over property customization, making them ideal for families seeking a personal retreat. Multi family homes provide an opportunity for rental income and shared maintenance costs, appealing to investors or those looking to offset mortgage expenses. Choosing between the two depends on lifestyle preferences and financial goals within the real estate market.

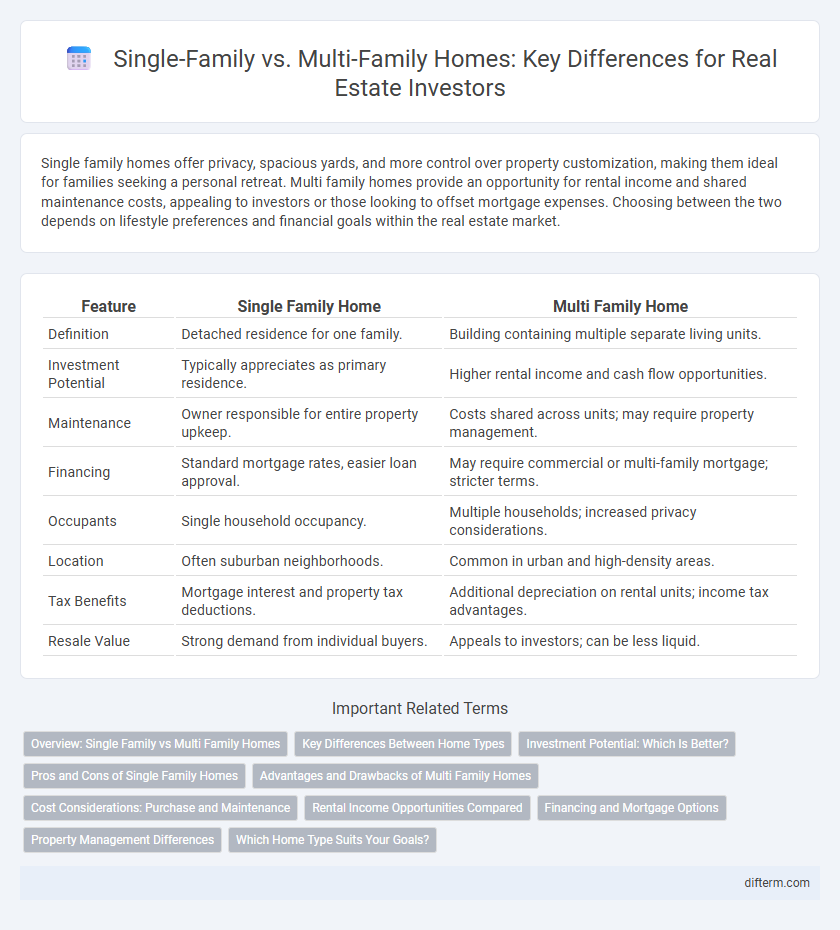

Table of Comparison

| Feature | Single Family Home | Multi Family Home |

|---|---|---|

| Definition | Detached residence for one family. | Building containing multiple separate living units. |

| Investment Potential | Typically appreciates as primary residence. | Higher rental income and cash flow opportunities. |

| Maintenance | Owner responsible for entire property upkeep. | Costs shared across units; may require property management. |

| Financing | Standard mortgage rates, easier loan approval. | May require commercial or multi-family mortgage; stricter terms. |

| Occupants | Single household occupancy. | Multiple households; increased privacy considerations. |

| Location | Often suburban neighborhoods. | Common in urban and high-density areas. |

| Tax Benefits | Mortgage interest and property tax deductions. | Additional depreciation on rental units; income tax advantages. |

| Resale Value | Strong demand from individual buyers. | Appeals to investors; can be less liquid. |

Overview: Single Family vs Multi Family Homes

Single family homes offer privacy, individual ownership, and typically higher property appreciation, making them ideal for long-term personal residences. Multi family homes provide multiple rental units within one property, generating steady rental income and diversification for real estate investors. Market trends show increasing demand for multi family properties in urban areas, while single family homes remain popular in suburban neighborhoods.

Key Differences Between Home Types

Single family homes offer private ownership of a single dwelling, providing more privacy and typically more yard space, ideal for families seeking individual living environments. Multi family homes consist of multiple units within one building or complex, facilitating rental income potential and shared maintenance costs, which appeals to investors or those looking for affordability. Key differences include ownership structure, income generation opportunities, maintenance responsibilities, and zoning regulations.

Investment Potential: Which Is Better?

Single family homes typically offer higher appreciation rates and ease of resale, making them attractive for long-term investment stability. Multi family homes generate stronger cash flow through multiple rental units and provide diversification within one property, reducing vacancy risk. Investors seeking balanced growth and income often prefer multi family properties, while those prioritizing simple management and appreciation lean toward single family homes.

Pros and Cons of Single Family Homes

Single family homes offer greater privacy, more outdoor space, and higher potential for property appreciation compared to multi family homes, making them ideal for families seeking a secluded living environment. However, these homes often come with higher maintenance costs, increased responsibility for repairs, and less opportunity for rental income generation. Buyers typically benefit from stronger resale values and community stability but face limited flexibility in housing density and income diversification.

Advantages and Drawbacks of Multi Family Homes

Multi-family homes offer distinct advantages such as diversified rental income streams and shared maintenance costs, making them ideal for investors seeking steady cash flow and risk mitigation. However, drawbacks include increased management complexity, higher initial investment, and potential for tenant disputes that can impact property value and tenant retention. Understanding these factors is essential for evaluating multi-family properties in real estate portfolios.

Cost Considerations: Purchase and Maintenance

Single-family homes generally require a higher upfront purchase price but have lower ongoing maintenance costs due to simpler systems and fewer occupants. Multi-family homes offer the advantage of multiple rental incomes offsetting the initial investment, though maintenance expenses tend to be higher because of increased wear and shared utilities. Evaluating property taxes, insurance premiums, and potential repair costs is essential to accurately compare the total cost of ownership between single-family and multi-family residences.

Rental Income Opportunities Compared

Single-family homes typically attract long-term tenants seeking privacy and stability, resulting in consistent but limited rental income from a single unit. Multi-family homes generate higher total rental income by housing multiple tenants within one property, offering diversified income streams and reduced vacancy risk. Investors often prefer multi-family properties for maximizing cash flow and accelerating portfolio growth through multiple rent payments.

Financing and Mortgage Options

Single family homes typically offer a wider range of traditional mortgage options with lower interest rates and smaller down payments, making them more accessible for first-time buyers. Multi family homes often qualify for investment property loans, which require higher credit scores, larger down payments, and typically carry higher interest rates. Financing for multi family properties can include commercial loans or FHA multifamily loans, providing options for buyers seeking rental income potential.

Property Management Differences

Single family homes typically require simpler property management due to fewer tenants and lower maintenance complexity, making them ideal for first-time landlords. Multi-family homes demand more comprehensive management strategies, including handling multiple leases, higher tenant turnover, and increased upkeep costs. Property managers in multi-family units often employ advanced systems for rent collection and maintenance scheduling to efficiently address the complexities inherent in managing multiple households.

Which Home Type Suits Your Goals?

Single family homes offer privacy, greater control over property maintenance, and typically appreciate steadily, making them ideal for buyers seeking long-term residence or stable investment. Multi family homes generate multiple rental incomes simultaneously, suitable for investors aiming to maximize cash flow and diversify their real estate portfolio. Choosing between the two depends on whether your goal prioritizes personal living space or income-generating potential in the housing market.

Single Family Home vs Multi Family Home Infographic

difterm.com

difterm.com