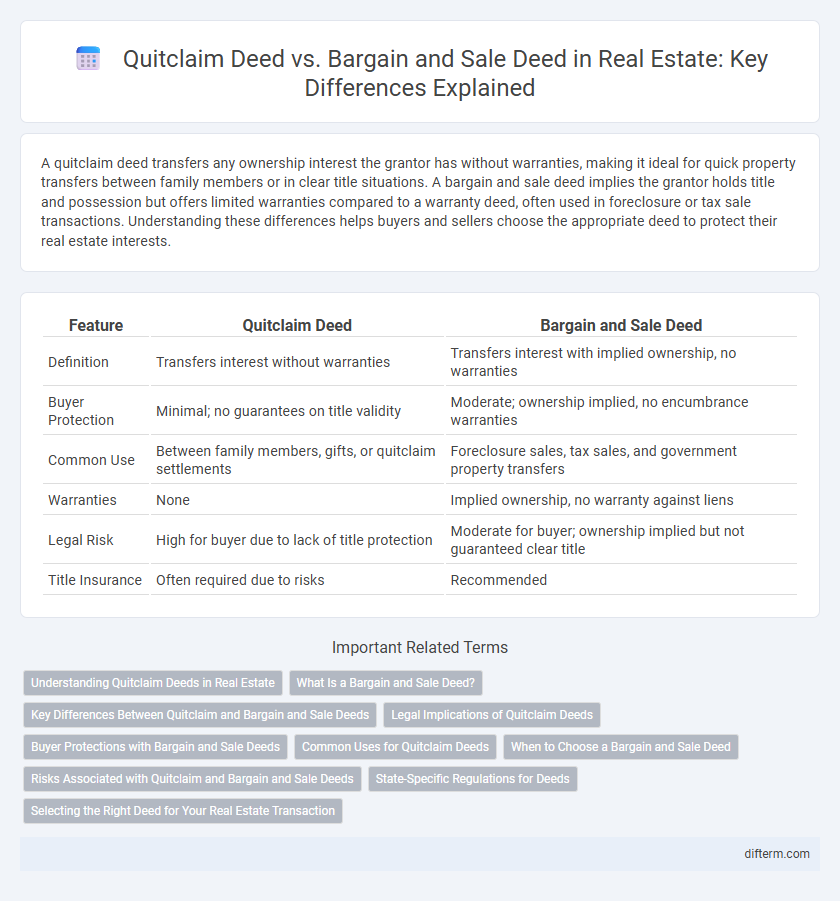

A quitclaim deed transfers any ownership interest the grantor has without warranties, making it ideal for quick property transfers between family members or in clear title situations. A bargain and sale deed implies the grantor holds title and possession but offers limited warranties compared to a warranty deed, often used in foreclosure or tax sale transactions. Understanding these differences helps buyers and sellers choose the appropriate deed to protect their real estate interests.

Table of Comparison

| Feature | Quitclaim Deed | Bargain and Sale Deed |

|---|---|---|

| Definition | Transfers interest without warranties | Transfers interest with implied ownership, no warranties |

| Buyer Protection | Minimal; no guarantees on title validity | Moderate; ownership implied, no encumbrance warranties |

| Common Use | Between family members, gifts, or quitclaim settlements | Foreclosure sales, tax sales, and government property transfers |

| Warranties | None | Implied ownership, no warranty against liens |

| Legal Risk | High for buyer due to lack of title protection | Moderate for buyer; ownership implied but not guaranteed clear title |

| Title Insurance | Often required due to risks | Recommended |

Understanding Quitclaim Deeds in Real Estate

Quitclaim deeds transfer any ownership interest a grantor has in a property without warranties or guarantees about the title's validity, making them ideal for intra-family transfers or clearing up title issues. Unlike bargain and sale deeds, which imply the grantor holds title but do not guarantee against encumbrances, quitclaim deeds offer no protection to the grantee if title defects exist. Understanding the limited legal protections of quitclaim deeds is crucial when transferring real estate to avoid future disputes or title challenges.

What Is a Bargain and Sale Deed?

A bargain and sale deed transfers property ownership with implied warranties but typically lacks explicit guarantees against liens or encumbrances. It is commonly used in real estate transactions where the grantor conveys their interest without providing full title protection. This deed offers more assurance than a quitclaim deed, which only transfers any interest the grantor may have without warranties.

Key Differences Between Quitclaim and Bargain and Sale Deeds

Quitclaim deeds transfer only the grantor's interest in a property without any warranties, making them useful for quick transfers between familiar parties but riskier for buyers due to lack of title guarantees. Bargain and sale deeds imply the grantor holds title and possession but provide limited warranties, offering more protection than quitclaim deeds while still less comprehensive than general warranty deeds. Understanding these differences is crucial for real estate transactions, as quitclaim deeds prioritize speed and simplicity, whereas bargain and sale deeds balance some assurance of title with fewer legal liabilities.

Legal Implications of Quitclaim Deeds

Quitclaim deeds transfer whatever interest the grantor has in a property without warranties, meaning the grantee assumes all risks regarding the title's validity. These deeds are often used in situations like intra-family transfers or clearing up title defects but do not protect against claims arising from previous ownership issues. Unlike bargain and sale deeds, quitclaim deeds offer no guarantees, which can lead to potential legal disputes if undisclosed encumbrances or liens exist on the property.

Buyer Protections with Bargain and Sale Deeds

Bargain and sale deeds provide stronger buyer protections compared to quitclaim deeds by implying that the grantor holds title and possession of the property, offering some assurance of ownership legitimacy. Unlike quitclaim deeds, which transfer whatever interest the grantor has without warranties, bargain and sale deeds often give buyers limited warranties against title defects arising during the grantor's ownership. This added layer of protection helps reduce the risk of future ownership disputes and enhances confidence in real estate transactions.

Common Uses for Quitclaim Deeds

Quitclaim deeds are commonly used for transferring property interests between family members, clearing title defects, or adding a spouse to a deed without warranties. These deeds are preferred in situations requiring quick and straightforward ownership changes where liability for title issues is minimal. Their simplicity makes them ideal for intra-family transfers, property settlements, and removing clouds on the title.

When to Choose a Bargain and Sale Deed

Choose a bargain and sale deed when purchasing property where the seller guarantees ownership but not against all encumbrances, commonly used in foreclosure sales or tax sales to transfer ownership with limited warranties. This deed offers more protection than a quitclaim deed, which transfers only the interest the seller has without guarantees, making it suitable when some assurance of title is necessary but full warranty is not required. Bargain and sale deeds balance risk between buyer and seller in transactions involving potentially unclear title histories.

Risks Associated with Quitclaim and Bargain and Sale Deeds

Quitclaim deeds carry significant risks as they provide no warranties or guarantees about the property title, potentially leaving the grantee vulnerable to undisclosed liens or claims. Bargain and sale deeds imply ownership without explicit warranties, which can still expose buyers to title defects or unresolved encumbrances. Understanding these risks is critical to ensure proper title insurance and thorough title searches are conducted when using either deed type in real estate transactions.

State-Specific Regulations for Deeds

State-specific regulations for quitclaim deeds often vary in terms of required disclosures and liability protections, with some states limiting their use for certain transactions to prevent fraud. Bargain and sale deeds typically carry an implied warranty of ownership, but the degree of warranty can differ significantly depending on the jurisdiction, affecting the buyer's legal recourse. Understanding local statutes and title insurance requirements is crucial when choosing between these deed types to ensure compliance and protect property interests.

Selecting the Right Deed for Your Real Estate Transaction

Selecting the right deed for your real estate transaction depends on the level of protection and transfer guarantee you require. A quitclaim deed transfers any ownership interest without warranties, making it suitable for transfers between trusted parties or family members. In contrast, a bargain and sale deed conveys ownership with implied warranties that the grantor holds title, providing more assurance for buyers in typical property sales.

quitclaim deed vs bargain and sale deed Infographic

difterm.com

difterm.com