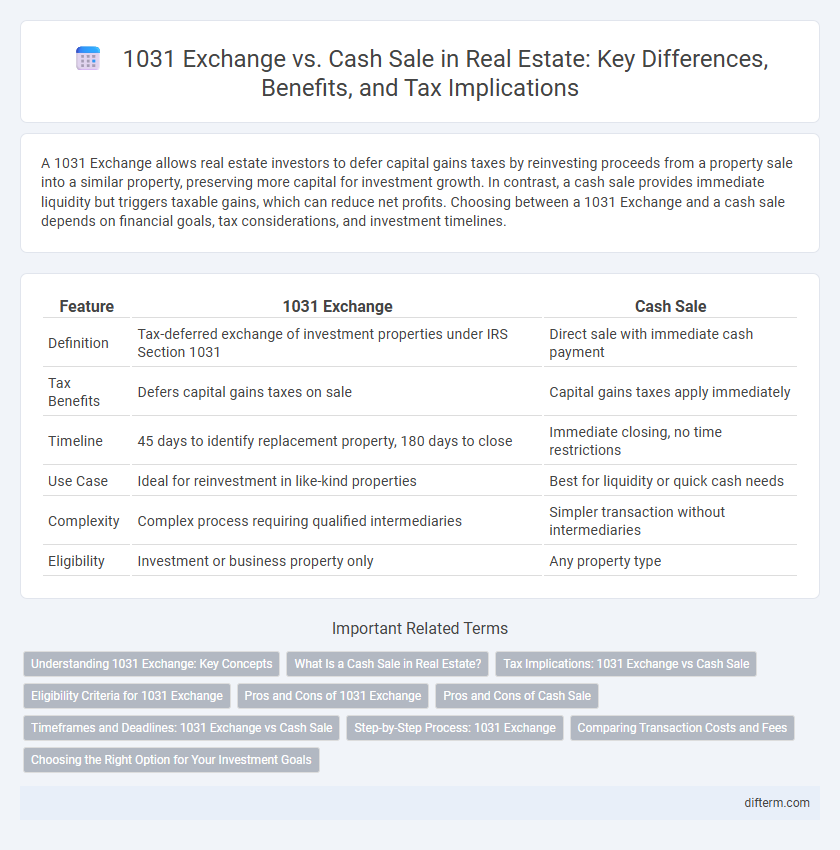

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from a property sale into a similar property, preserving more capital for investment growth. In contrast, a cash sale provides immediate liquidity but triggers taxable gains, which can reduce net profits. Choosing between a 1031 Exchange and a cash sale depends on financial goals, tax considerations, and investment timelines.

Table of Comparison

| Feature | 1031 Exchange | Cash Sale |

|---|---|---|

| Definition | Tax-deferred exchange of investment properties under IRS Section 1031 | Direct sale with immediate cash payment |

| Tax Benefits | Defers capital gains taxes on sale | Capital gains taxes apply immediately |

| Timeline | 45 days to identify replacement property, 180 days to close | Immediate closing, no time restrictions |

| Use Case | Ideal for reinvestment in like-kind properties | Best for liquidity or quick cash needs |

| Complexity | Complex process requiring qualified intermediaries | Simpler transaction without intermediaries |

| Eligibility | Investment or business property only | Any property type |

Understanding 1031 Exchange: Key Concepts

1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property within a specified timeframe. This tax-deferral strategy requires strict adherence to IRS rules, including the 45-day identification period and 180-day closing window. Unlike a cash sale, which triggers immediate tax liabilities, a 1031 Exchange leverages tax advantages to maximize investment growth and portfolio diversification.

What Is a Cash Sale in Real Estate?

A cash sale in real estate refers to a transaction where the buyer pays the full purchase price upfront without financing through a mortgage or loan. This method offers faster closing times and fewer contingencies compared to a 1031 exchange, which involves reinvesting proceeds from a property sale into a like-kind investment to defer capital gains taxes. Cash sales provide increased leverage in negotiations and eliminate lender-related delays, making them advantageous for sellers seeking quick and straightforward transactions.

Tax Implications: 1031 Exchange vs Cash Sale

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds into a like-kind property, preserving investment capital and growth potential. In contrast, a cash sale triggers immediate taxable gains, often resulting in a significant tax liability upfront. Understanding these tax implications is crucial for maximizing long-term wealth in real estate transactions.

Eligibility Criteria for 1031 Exchange

The 1031 Exchange eligibility criteria require the property to be held for investment or business purposes, excluding personal residences or properties primarily held for resale. Both relinquished and replacement properties must be like-kind, meaning they share similar nature or character, typically real estate held for productive use. Investors must identify the replacement property within 45 days and complete the exchange within 180 days to qualify for tax deferral under IRS regulations.

Pros and Cons of 1031 Exchange

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds into a like-kind property, offering significant tax advantages and increased buying power. However, the process involves strict timelines and property identification rules that can limit flexibility and complicate transactions. Compared to a cash sale, which provides immediate liquidity and fewer restrictions, a 1031 Exchange requires careful planning but can maximize long-term investment growth.

Pros and Cons of Cash Sale

A cash sale in real estate offers the advantage of a faster closing process and fewer contingencies, reducing the risk of deal fall-through. Sellers receive immediate liquidity, simplifying the transaction without the need for mortgage approval or 1031 Exchange complexities. However, cash sales may result in a higher taxable event compared to a 1031 Exchange, potentially leading to significant capital gains taxes without the benefit of tax deferral.

Timeframes and Deadlines: 1031 Exchange vs Cash Sale

In real estate transactions, a 1031 Exchange requires adherence to strict timeframes, including a 45-day identification period and a 180-day closing deadline, to defer capital gains taxes. Cash sales typically close faster, often within 30 to 45 days, with fewer deadlines and less complexity. These time-sensitive requirements make 1031 Exchanges more challenging but financially advantageous for investors seeking tax deferral.

Step-by-Step Process: 1031 Exchange

In a 1031 Exchange, the process begins with selling the original investment property and identifying potential replacement properties within 45 days. Next, the investor must purchase one or more qualified replacement properties within 180 days to defer capital gains taxes. Throughout the transaction, a qualified intermediary manages the funds to ensure compliance with IRS regulations and maintain the tax-deferred status of the exchange.

Comparing Transaction Costs and Fees

In real estate, a 1031 Exchange typically involves higher upfront transaction costs due to intermediary fees, legal expenses, and strict documentation requirements compared to a straightforward cash sale. Cash sales generally incur lower closing costs and faster processing times, avoiding additional broker or qualified intermediary fees associated with 1031 Exchanges. However, 1031 Exchanges offer potential tax deferral benefits that can offset these higher transaction fees over time.

Choosing the Right Option for Your Investment Goals

1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds into like-kind properties, maximizing long-term wealth accumulation. Cash sales provide immediate liquidity and simplicity, suitable for investors seeking quick access to funds or diversifying portfolios without reinvestment constraints. Evaluating your investment goals, tax implications, and market conditions is essential to determine whether a 1031 Exchange or cash sale aligns best with your financial strategy.

1031 Exchange vs Cash Sale Infographic

difterm.com

difterm.com