Net Operating Income (NOI) represents the revenue remaining after deducting operating expenses from Gross Scheduled Income (GSI), which is the total income a property could generate if fully rented without any vacancies or losses. Understanding the difference between NOI and GSI helps investors assess the actual profitability and operational efficiency of a real estate asset. Accurate calculation of NOI is crucial for evaluating property performance and making informed investment decisions.

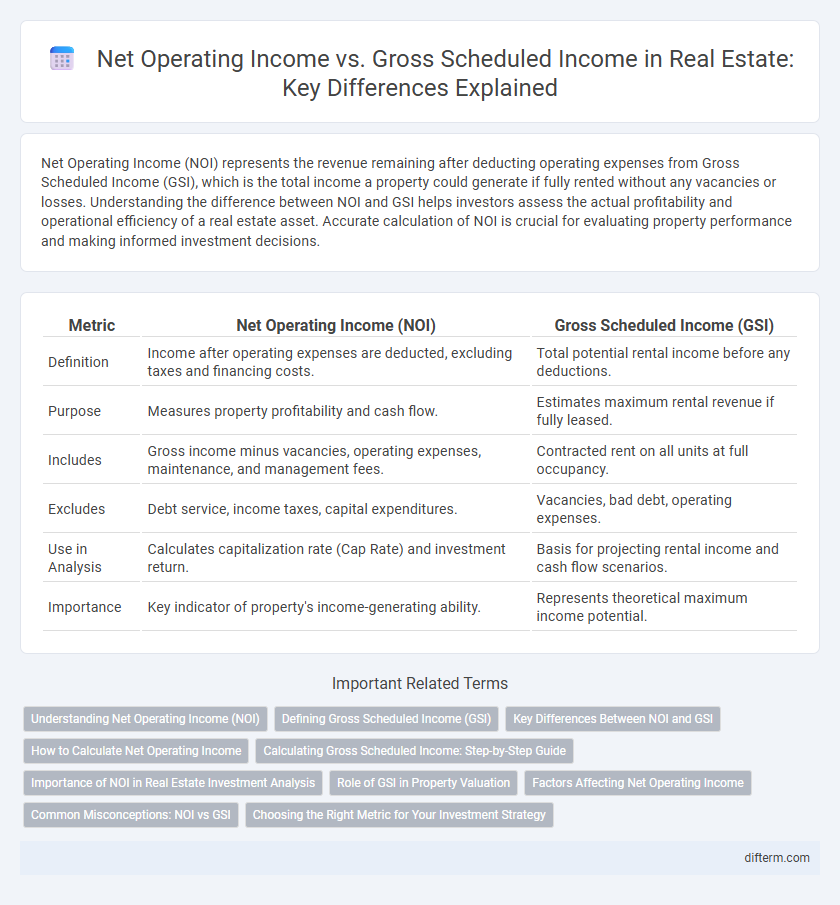

Table of Comparison

| Metric | Net Operating Income (NOI) | Gross Scheduled Income (GSI) |

|---|---|---|

| Definition | Income after operating expenses are deducted, excluding taxes and financing costs. | Total potential rental income before any deductions. |

| Purpose | Measures property profitability and cash flow. | Estimates maximum rental revenue if fully leased. |

| Includes | Gross income minus vacancies, operating expenses, maintenance, and management fees. | Contracted rent on all units at full occupancy. |

| Excludes | Debt service, income taxes, capital expenditures. | Vacancies, bad debt, operating expenses. |

| Use in Analysis | Calculates capitalization rate (Cap Rate) and investment return. | Basis for projecting rental income and cash flow scenarios. |

| Importance | Key indicator of property's income-generating ability. | Represents theoretical maximum income potential. |

Understanding Net Operating Income (NOI)

Net Operating Income (NOI) represents the total revenue generated from a property after deducting all operating expenses, excluding taxes and financing costs, providing a clear measure of its profitability. It excludes potential income losses, making it more accurate than Gross Scheduled Income (GSI), which reflects the total potential rental income before expenses and vacancies. Calculating NOI helps investors assess a property's true income-generating capability and compare investment opportunities effectively.

Defining Gross Scheduled Income (GSI)

Gross Scheduled Income (GSI) represents the total potential rental income a property can generate when fully leased at market rates, before any deductions for vacancies, credit losses, or operating expenses. It includes all scheduled rents from tenants, reflecting the maximum achievable income under optimal occupancy conditions. GSI serves as a foundational metric for evaluating property performance and is essential for calculating the Net Operating Income (NOI).

Key Differences Between NOI and GSI

Net Operating Income (NOI) represents the income generated from a property after subtracting operating expenses but before financing and tax costs, while Gross Scheduled Income (GSI) reflects the total potential rental income if the property is fully leased without any vacancies or collection losses. NOI provides a more accurate measure of a property's profitability by accounting for real operating costs, whereas GSI offers a top-line figure that highlights maximum revenue potential. Understanding the distinction between NOI and GSI is critical for investors analyzing cash flow and investment yield in real estate portfolios.

How to Calculate Net Operating Income

Net Operating Income (NOI) is calculated by subtracting operating expenses from Gross Scheduled Income (GSI), which includes all potential rental income before deductions. To accurately determine NOI, deduct costs such as property management fees, maintenance, property taxes, insurance, and utilities from the total GSI. This financial metric is essential for evaluating real estate investment profitability and comparing property performance.

Calculating Gross Scheduled Income: Step-by-Step Guide

Calculating Gross Scheduled Income (GSI) involves summing the total potential rental income from all units within a property, assuming full occupancy and no vacancies or collection losses. Start by listing each unit's monthly rent, then multiply by twelve to project annual income for each, and finally total these amounts for the property's overall GSI. This metric serves as a baseline in real estate investment analysis before accounting for vacancies and operating expenses reflected in Net Operating Income (NOI).

Importance of NOI in Real Estate Investment Analysis

Net Operating Income (NOI) represents the actual profitability of a real estate investment by subtracting operating expenses from Gross Scheduled Income (GSI), which is the total potential rental income before expenses. NOI is crucial for evaluating property performance, determining loan eligibility, and comparing investment opportunities accurately. Unlike GSI, NOI provides a realistic measure of cash flow, enabling investors to assess risk and forecast returns effectively.

Role of GSI in Property Valuation

Gross Scheduled Income (GSI) serves as a pivotal metric in property valuation by representing the total potential rental income a property can generate, assuming full occupancy and no collection losses. It establishes the baseline revenue that investors use to assess the property's income-generating capacity before expenses are deducted. Understanding GSI allows for accurate calculation of Net Operating Income (NOI), which ultimately informs investment decisions and market value assessments.

Factors Affecting Net Operating Income

Net Operating Income (NOI) is influenced by various factors including vacancy rates, operating expenses, and property management efficiency, which together determine the profitability of a real estate investment. While Gross Scheduled Income (GSI) represents the total potential rental income assuming full occupancy, NOI adjusts this figure by subtracting expenses such as property taxes, maintenance, insurance, and utilities. Effective control of these costs and minimizing vacancies are crucial to maximizing NOI and enhancing the overall return on investment.

Common Misconceptions: NOI vs GSI

Net Operating Income (NOI) is often confused with Gross Scheduled Income (GSI), yet NOI represents the actual profit after deducting operating expenses from effective rental income, while GSI reflects the total potential rental income before any expenses or vacancy adjustments. A common misconception is treating GSI as a reliable indicator of property profitability, ignoring vacancies and operational costs that significantly impact NOI. Accurate real estate investment analysis requires prioritizing NOI over GSI, as NOI provides a clearer measure of cash flow and property performance.

Choosing the Right Metric for Your Investment Strategy

Net Operating Income (NOI) reflects the profitability of a property by subtracting operating expenses from Gross Scheduled Income (GSI), providing a clearer picture of actual cash flow. Investors aiming for accurate property valuation and operational efficiency prioritize NOI to assess potential returns and risks. Choosing the right metric depends on your investment goals: use GSI for revenue potential and NOI for evaluating true profitability and sustainability.

Net Operating Income vs Gross Scheduled Income Infographic

difterm.com

difterm.com