Condos offer individual ownership of a unit and a share of common areas, providing more flexibility in buying, selling, and financing compared to co-ops. Co-ops involve purchasing shares in a corporation that owns the building, requiring board approval and often imposing stricter rules on subletting and renovations. Understanding these differences helps buyers choose the right property type that aligns with their lifestyle and investment goals.

Table of Comparison

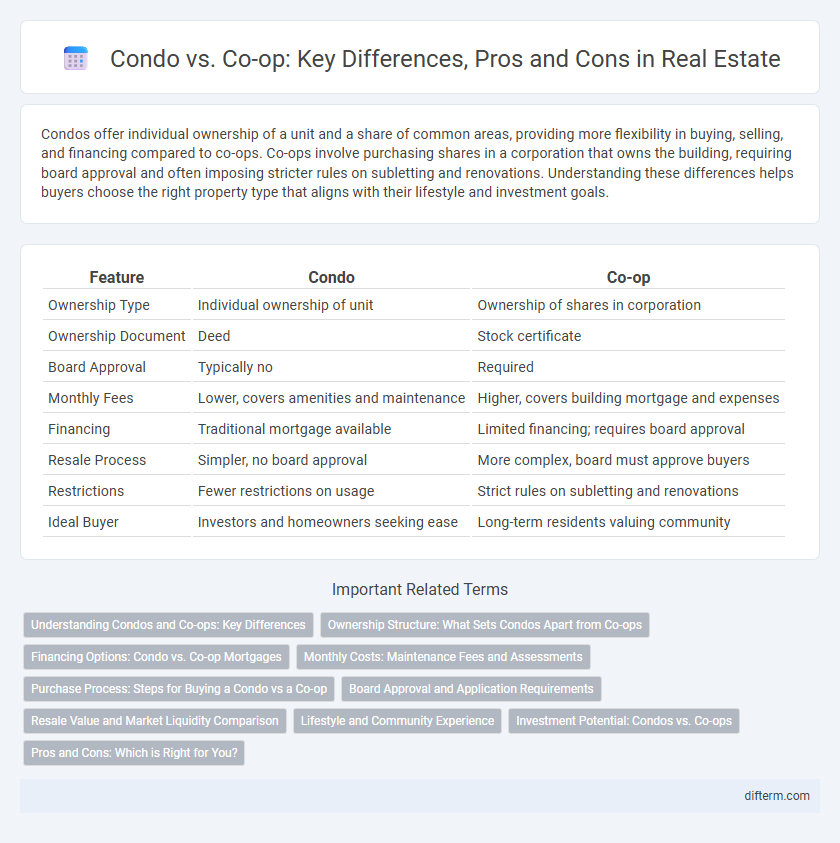

| Feature | Condo | Co-op |

|---|---|---|

| Ownership Type | Individual ownership of unit | Ownership of shares in corporation |

| Ownership Document | Deed | Stock certificate |

| Board Approval | Typically no | Required |

| Monthly Fees | Lower, covers amenities and maintenance | Higher, covers building mortgage and expenses |

| Financing | Traditional mortgage available | Limited financing; requires board approval |

| Resale Process | Simpler, no board approval | More complex, board must approve buyers |

| Restrictions | Fewer restrictions on usage | Strict rules on subletting and renovations |

| Ideal Buyer | Investors and homeowners seeking ease | Long-term residents valuing community |

Understanding Condos and Co-ops: Key Differences

Condos offer individual ownership of a unit with shared ownership of common areas, while co-ops involve purchasing shares in a corporation that owns the building, granting the right to occupy a specific unit. Condo owners have more autonomy over their property and different financing options, whereas co-op shareholders must obtain board approval for purchases and renovations. Understanding these structural and legal distinctions helps buyers make informed decisions based on their financial goals and lifestyle preferences.

Ownership Structure: What Sets Condos Apart from Co-ops

Condos offer individual ownership of a specific unit along with shared rights to common areas, providing more autonomy in property decisions. Co-ops function as a corporation where residents buy shares representing their unit, creating collective ownership and tighter approval processes. This fundamental difference impacts financing options, governance, and resale flexibility for buyers.

Financing Options: Condo vs. Co-op Mortgages

Condo financing typically offers more flexibility with conventional mortgages, lower down payment requirements, and easier approval processes compared to co-op loans. Co-op mortgages often require higher down payments, stricter financial qualifications, and board approval, making financing more challenging for some buyers. Lenders may also impose additional restrictions or require higher reserves for co-op purchases due to the cooperative ownership structure.

Monthly Costs: Maintenance Fees and Assessments

Monthly costs for condos typically include maintenance fees covering building upkeep, amenities, and common area repairs, varying from $200 to $700 per month depending on location and services. Co-op owners pay monthly maintenance fees that cover building mortgage, property taxes, and operational expenses, often resulting in higher fees than condos, sometimes exceeding $1,000. Assessments in both condos and co-ops can arise for major repairs or improvements, with co-op shareholders typically facing collective financial responsibility, while condo owners are individually assessed.

Purchase Process: Steps for Buying a Condo vs a Co-op

Buying a condo typically involves a straightforward transaction similar to purchasing traditional real estate, including a property inspection, mortgage approval, and closing with a title transfer. In contrast, purchasing a co-op requires approval from the co-op board, submission of a detailed application packet, and often a more rigorous financial review before closing. Both processes demand careful review of documents like the condo declaration or co-op proprietary lease, but co-op purchases usually entail additional layers of scrutiny and board interviews.

Board Approval and Application Requirements

Co-op purchases require board approval, involving a rigorous application process that includes submitting financial statements, employment history, and personal references to demonstrate financial stability and suitability. Condo purchases typically have a simpler application with fewer restrictions, focusing mainly on financial qualifications with no board interview or approval needed. Buyers should prepare for the co-op's comprehensive scrutiny compared to the comparatively straightforward condo application process.

Resale Value and Market Liquidity Comparison

Condos typically offer higher resale value and greater market liquidity due to individual ownership of units and easier financing options, attracting a broader pool of buyers. Co-ops often experience slower resale processes and lower market liquidity because transactions require board approval and involve shares in a corporation rather than direct property ownership. Investors prioritize condos for their potential appreciation and streamlined sales, while co-ops appeal more to owner-occupants prioritizing community control.

Lifestyle and Community Experience

Condos offer private ownership with more control over property decisions, appealing to those seeking independence and personalized living spaces. Co-ops foster a close-knit community through shared ownership and collective governance, enhancing social connections and mutual support among residents. The co-op lifestyle often includes stricter approval processes, promoting a cohesive environment that prioritizes compatibility and long-term community stability.

Investment Potential: Condos vs. Co-ops

Condos typically offer stronger investment potential due to greater liquidity, easier financing options, and the ability to rent units without restrictive board approval. Co-ops often have stringent owner approval processes and sublet limitations, which can reduce resale value and rental income opportunities. Investors prefer condos for higher market flexibility and robust appreciation prospects in competitive real estate markets.

Pros and Cons: Which is Right for You?

Condos offer individual ownership of the unit with more freedom in customization and fewer restrictions on renting, attracting buyers seeking investment flexibility and autonomy. Co-ops require approval from the board, often have stricter financial qualifications, and impose more regulations on subletting, appealing to those who value community control and potentially lower purchase prices. Evaluating your lifestyle, financial situation, and long-term goals helps determine whether the streamlined ownership of a condo or the structured, community-oriented co-op aligns best with your needs.

Condo vs Co-op Infographic

difterm.com

difterm.com