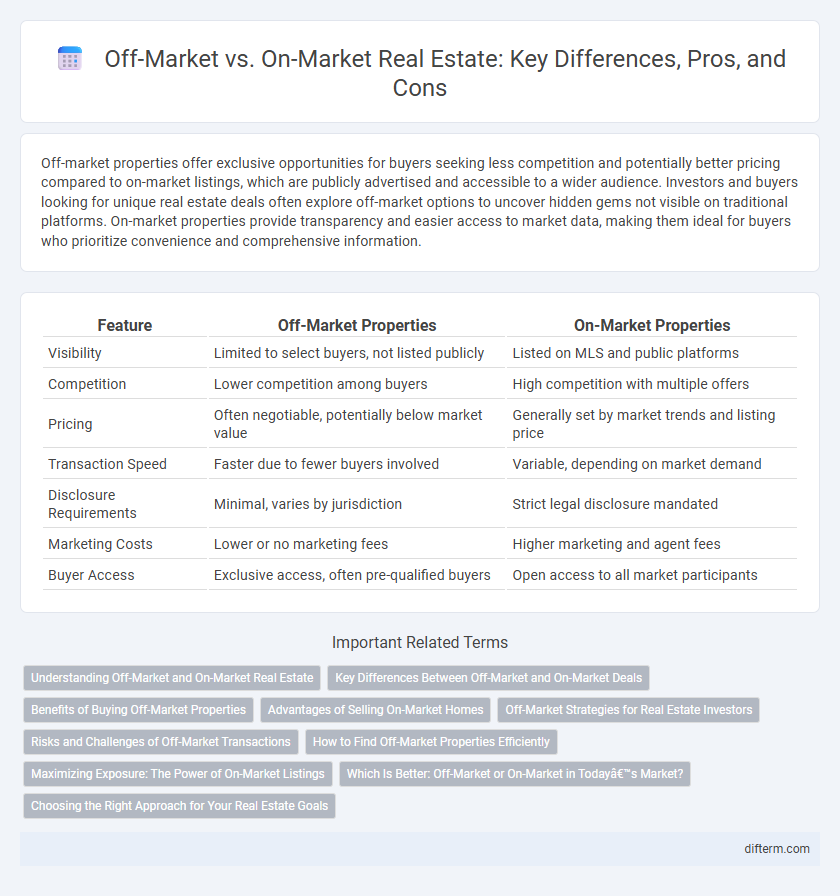

Off-market properties offer exclusive opportunities for buyers seeking less competition and potentially better pricing compared to on-market listings, which are publicly advertised and accessible to a wider audience. Investors and buyers looking for unique real estate deals often explore off-market options to uncover hidden gems not visible on traditional platforms. On-market properties provide transparency and easier access to market data, making them ideal for buyers who prioritize convenience and comprehensive information.

Table of Comparison

| Feature | Off-Market Properties | On-Market Properties |

|---|---|---|

| Visibility | Limited to select buyers, not listed publicly | Listed on MLS and public platforms |

| Competition | Lower competition among buyers | High competition with multiple offers |

| Pricing | Often negotiable, potentially below market value | Generally set by market trends and listing price |

| Transaction Speed | Faster due to fewer buyers involved | Variable, depending on market demand |

| Disclosure Requirements | Minimal, varies by jurisdiction | Strict legal disclosure mandated |

| Marketing Costs | Lower or no marketing fees | Higher marketing and agent fees |

| Buyer Access | Exclusive access, often pre-qualified buyers | Open access to all market participants |

Understanding Off-Market and On-Market Real Estate

Off-market real estate refers to properties not publicly listed on the Multiple Listing Service (MLS), offering opportunities for discreet transactions often preferred by investors seeking less competition and potential negotiation advantages. On-market real estate involves properties actively listed and marketed to the public, providing greater visibility and transparency to buyers and sellers, typically resulting in a faster sales process. Understanding the distinctions between off-market and on-market properties is essential for buyers and sellers aiming to optimize timing, pricing, and negotiation strategies in competitive real estate markets.

Key Differences Between Off-Market and On-Market Deals

Off-market real estate deals occur privately, without public listings, allowing buyers and sellers to negotiate directly and often resulting in less competition and faster transactions. On-market properties are listed publicly on multiple listing services (MLS), attracting a broader audience, which typically leads to higher visibility and potentially higher sale prices. Key differences include marketing exposure, transaction speed, and negotiation dynamics, which impact pricing strategy and buyer accessibility.

Benefits of Buying Off-Market Properties

Buying off-market properties offers access to less competition, often resulting in better negotiation leverage and potentially lower purchase prices. These transactions typically involve motivated sellers, leading to faster closings and more flexible terms. Off-market deals also provide opportunities to discover unique or undervalued real estate not listed on traditional market platforms.

Advantages of Selling On-Market Homes

Selling on-market homes increases property visibility through multiple listing services (MLS) and online real estate platforms, attracting a broader audience of potential buyers. On-market listings often generate competitive offers, potentially driving up the final sale price due to increased buyer interest and transparency. The streamlined marketing process and clear pricing strategy reduce time on market and provide sellers with valuable market feedback, enhancing decision-making.

Off-Market Strategies for Real Estate Investors

Off-market real estate strategies allow investors to access properties not publicly listed, reducing competition and enabling negotiations directly with sellers. Utilizing networking with brokers, direct mail campaigns, and leveraging social media can uncover exclusive deals often below market value. This approach often results in faster transactions and higher profit margins compared to traditional on-market listings.

Risks and Challenges of Off-Market Transactions

Off-market real estate transactions carry risks such as limited market exposure, which can result in undervaluation or missed competitive offers, leading to potential financial losses. The lack of transparency and limited buyer pool increases the chance of encountering undisclosed property issues or legal complications. Due diligence becomes more challenging without standard market data and professional intermediaries, heightening the risk of fraudulent or unfavorable terms.

How to Find Off-Market Properties Efficiently

To find off-market properties efficiently, leverage direct networking with local real estate agents, property managers, and investors who often have insider knowledge of unlisted listings. Utilize targeted marketing strategies such as sending direct mail, door knocking, or online campaigns aimed at motivated sellers to uncover hidden opportunities. Employ technology tools like property databases, public records, and specialized off-market platforms to identify potential leads before they hit the public market.

Maximizing Exposure: The Power of On-Market Listings

On-market listings maximize property exposure through multiple listing services (MLS), attracting a wider network of real estate agents and potential buyers. This increased visibility often results in competitive offers, driving up sale prices and reducing time on market. Real estate markets with high demand benefit significantly from the transparency and accessibility of on-market properties.

Which Is Better: Off-Market or On-Market in Today’s Market?

Off-market real estate transactions offer exclusivity, potentially less competition, and flexible negotiation terms, appealing to investors seeking unique or undervalued properties. On-market listings provide greater visibility, transparent pricing, and a wider range of options for buyers prioritizing market data and competitive bids. In today's market, the choice between off-market and on-market depends on buyer goals, risk tolerance, and access to insider networks.

Choosing the Right Approach for Your Real Estate Goals

Off-market real estate transactions offer exclusive access to properties before they hit the public market, often resulting in less competition and more negotiating power. On-market listings provide transparency, broad exposure, and established pricing trends, making it easier to compare and analyze market value. Selecting the right approach depends on your investment strategy, urgency, and willingness to navigate potential risks associated with off-market deals or the competitive nature of on-market opportunities.

Off-Market vs On-Market Infographic

difterm.com

difterm.com