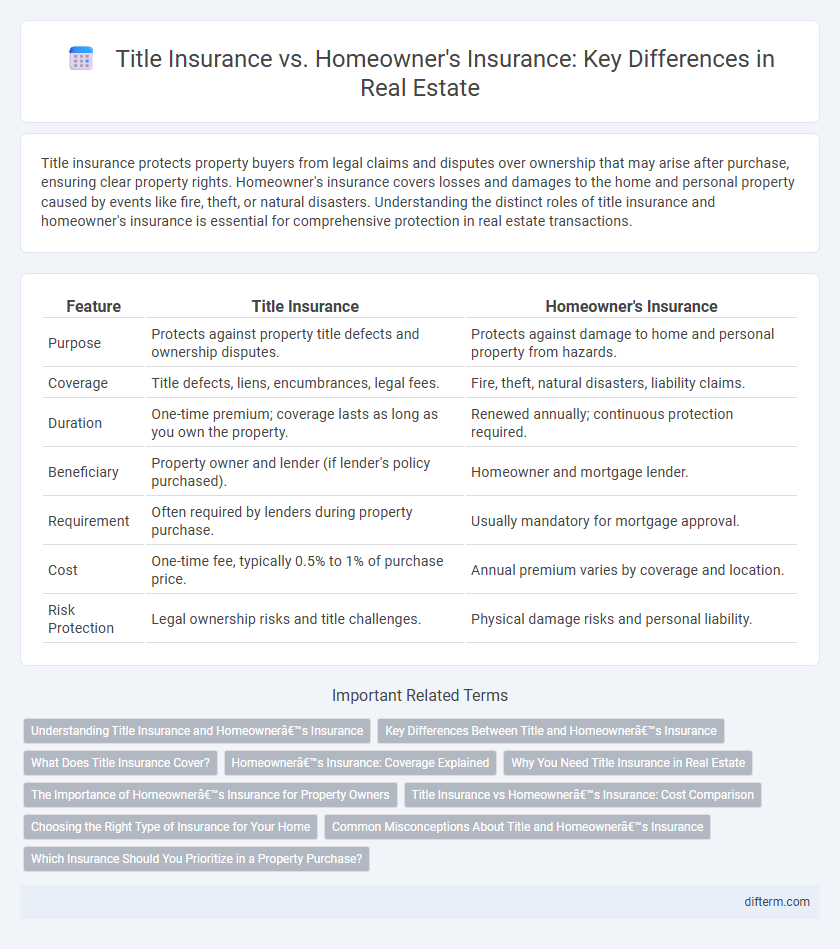

Title insurance protects property buyers from legal claims and disputes over ownership that may arise after purchase, ensuring clear property rights. Homeowner's insurance covers losses and damages to the home and personal property caused by events like fire, theft, or natural disasters. Understanding the distinct roles of title insurance and homeowner's insurance is essential for comprehensive protection in real estate transactions.

Table of Comparison

| Feature | Title Insurance | Homeowner's Insurance |

|---|---|---|

| Purpose | Protects against property title defects and ownership disputes. | Protects against damage to home and personal property from hazards. |

| Coverage | Title defects, liens, encumbrances, legal fees. | Fire, theft, natural disasters, liability claims. |

| Duration | One-time premium; coverage lasts as long as you own the property. | Renewed annually; continuous protection required. |

| Beneficiary | Property owner and lender (if lender's policy purchased). | Homeowner and mortgage lender. |

| Requirement | Often required by lenders during property purchase. | Usually mandatory for mortgage approval. |

| Cost | One-time fee, typically 0.5% to 1% of purchase price. | Annual premium varies by coverage and location. |

| Risk Protection | Legal ownership risks and title challenges. | Physical damage risks and personal liability. |

Understanding Title Insurance and Homeowner’s Insurance

Title insurance protects homeowners and lenders from financial loss due to defects in the property's title, such as liens or disputes over ownership, that may arise after purchase. Homeowner's insurance covers damages to the home and personal property caused by events like fire, theft, or natural disasters, and provides liability protection for accidents on the property. Understanding the distinct roles of title insurance and homeowner's insurance is essential for securing both legal ownership and physical property protection in real estate transactions.

Key Differences Between Title and Homeowner’s Insurance

Title insurance protects against legal defects in property ownership, covering issues such as liens, encumbrances, or disputes over title that may arise after purchase. Homeowner's insurance safeguards the physical structure and personal belongings from risks like fire, theft, or natural disasters, and provides liability coverage for accidents on the property. While title insurance is a one-time policy purchased during closing, homeowner's insurance is an ongoing policy requiring annual renewal.

What Does Title Insurance Cover?

Title insurance protects property owners and lenders against losses from defects in the title, such as undiscovered liens, encumbrances, or ownership disputes that existed before the purchase. It covers legal fees and claims arising from title issues like forged deeds, errors in public records, or unknown heirs challenging ownership. Unlike homeowner's insurance, title insurance does not cover property damage or liability from accidents on the property.

Homeowner’s Insurance: Coverage Explained

Homeowner's insurance provides comprehensive protection for your property, covering damages from fire, theft, natural disasters, and liability for accidents occurring on your premises. It typically includes dwelling coverage, personal property coverage, and additional living expenses if your home becomes uninhabitable. Understanding policy limits and exclusions is crucial to ensure adequate financial security for your real estate investment.

Why You Need Title Insurance in Real Estate

Title insurance protects real estate buyers from financial loss due to defects in property ownership, such as liens, encumbrances, or competing claims that may not surface during a standard title search. Unlike homeowner's insurance, which covers damages to the property itself from risks like fire or theft, title insurance specifically safeguards your legal ownership rights and ensures clear title transfer. Securing title insurance is essential for preventing costly legal disputes and ensuring uninterrupted property ownership.

The Importance of Homeowner’s Insurance for Property Owners

Homeowner's insurance provides essential financial protection against property damage, theft, and personal liability, covering repair and replacement costs not included in title insurance. Title insurance safeguards against legal disputes over property ownership, while homeowner's insurance addresses ongoing risks to the physical structure and personal belongings. Property owners rely on homeowner's insurance to mitigate risks from fire, natural disasters, and accidents, ensuring long-term security and peace of mind.

Title Insurance vs Homeowner’s Insurance: Cost Comparison

Title insurance typically involves a one-time premium ranging from 0.5% to 1% of the home's purchase price, protecting against ownership disputes and title defects. Homeowner's insurance requires annual premiums averaging $1,200 to $1,500, covering property damage, liability, and personal belongings. The cost difference reflects title insurance's focus on past ownership risks versus homeowner's insurance's ongoing protection for property and liability.

Choosing the Right Type of Insurance for Your Home

Title insurance protects against legal defects and claims on property ownership, ensuring the buyer's rights are secure after purchase. Homeowner's insurance covers physical damages to the property from hazards like fire, theft, or natural disasters. Choosing the right insurance involves evaluating the property's title history for title insurance and assessing risks to the home's structure and contents to determine appropriate homeowner's coverage.

Common Misconceptions About Title and Homeowner’s Insurance

Many Homebuyers mistakenly believe title insurance protects their property against physical damage, whereas it specifically safeguards against past ownership disputes and legal claims on the title. Homeowner's insurance covers damages to the structure and personal property from events like fire or theft but does not address title defects or liens. Understanding these distinctions is crucial to ensuring comprehensive real estate protection and avoiding costly gaps in coverage.

Which Insurance Should You Prioritize in a Property Purchase?

Title insurance protects against defects in property ownership and title disputes, safeguarding your investment from legal claims. Homeowner's insurance covers damages to the property and personal liability due to accidents, natural disasters, or theft. Prioritizing title insurance during purchase ensures clear ownership, while homeowner's insurance provides ongoing protection for your physical asset and personal safety.

title insurance vs homeowner's insurance Infographic

difterm.com

difterm.com