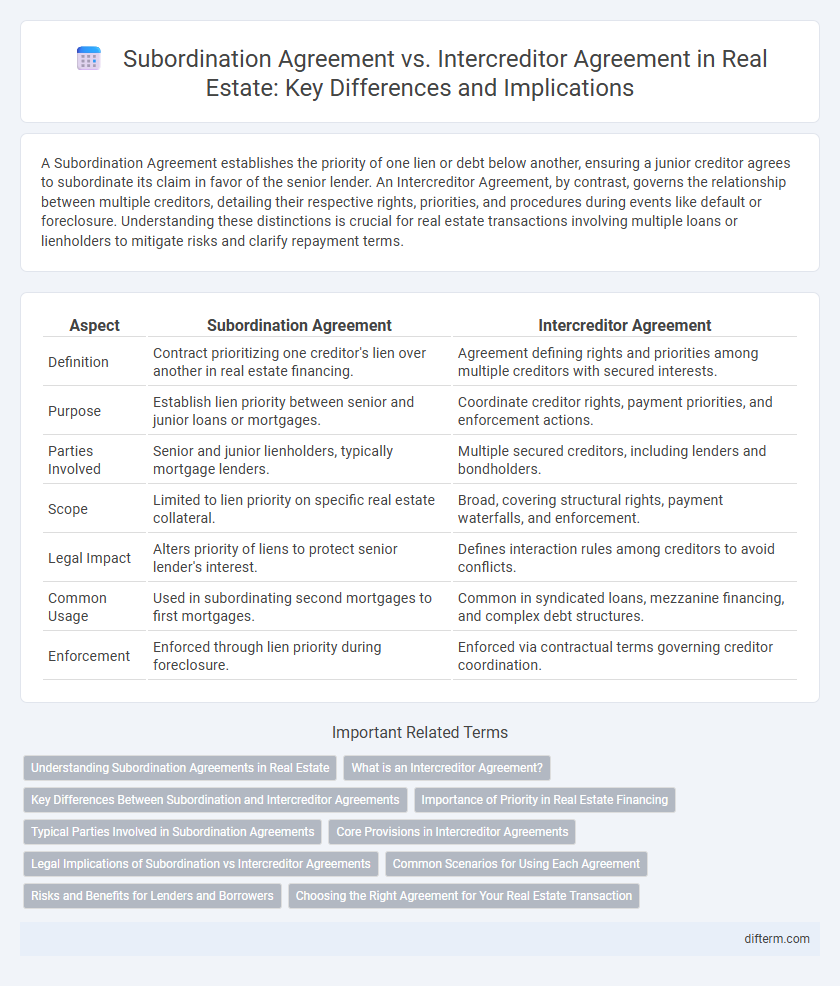

A Subordination Agreement establishes the priority of one lien or debt below another, ensuring a junior creditor agrees to subordinate its claim in favor of the senior lender. An Intercreditor Agreement, by contrast, governs the relationship between multiple creditors, detailing their respective rights, priorities, and procedures during events like default or foreclosure. Understanding these distinctions is crucial for real estate transactions involving multiple loans or lienholders to mitigate risks and clarify repayment terms.

Table of Comparison

| Aspect | Subordination Agreement | Intercreditor Agreement |

|---|---|---|

| Definition | Contract prioritizing one creditor's lien over another in real estate financing. | Agreement defining rights and priorities among multiple creditors with secured interests. |

| Purpose | Establish lien priority between senior and junior loans or mortgages. | Coordinate creditor rights, payment priorities, and enforcement actions. |

| Parties Involved | Senior and junior lienholders, typically mortgage lenders. | Multiple secured creditors, including lenders and bondholders. |

| Scope | Limited to lien priority on specific real estate collateral. | Broad, covering structural rights, payment waterfalls, and enforcement. |

| Legal Impact | Alters priority of liens to protect senior lender's interest. | Defines interaction rules among creditors to avoid conflicts. |

| Common Usage | Used in subordinating second mortgages to first mortgages. | Common in syndicated loans, mezzanine financing, and complex debt structures. |

| Enforcement | Enforced through lien priority during foreclosure. | Enforced via contractual terms governing creditor coordination. |

Understanding Subordination Agreements in Real Estate

Subordination agreements in real estate establish the priority of liens by allowing a junior lender's claim to be ranked behind a senior lien, ensuring clear lien hierarchy during property financing. These agreements protect senior lenders by confirming their primary claim to loan repayment, which is crucial during foreclosure or property sale. Understanding the enforceability and terms of subordination agreements helps mitigate risks and facilitates smoother transactions in multi-lender real estate deals.

What is an Intercreditor Agreement?

An Intercreditor Agreement is a contract between two or more creditors that establishes the priority and rights of each party regarding shared collateral or debt obligations in real estate financing. This agreement outlines how lenders will coordinate enforcement actions, payment distributions, and protect their respective interests in cases of borrower default or restructuring. It is essential for managing risks and preventing disputes among multiple lenders with overlapping security interests.

Key Differences Between Subordination and Intercreditor Agreements

Subordination agreements prioritize one debt over others by legally placing one lender's claim behind another, ensuring senior debt takes precedence in repayment or foreclosure scenarios. Intercreditor agreements outline mutual rights and responsibilities between multiple lenders with concurrent interests, detailing shared enforcement actions, payment distributions, and default remedies to prevent disputes. The primary difference lies in their scope: subordination specifically alters lien priority, while intercreditor agreements govern collaborative lender relationships and conflict resolution.

Importance of Priority in Real Estate Financing

In real estate financing, priority determines the order in which lenders are repaid during default, making subordination agreements and intercreditor agreements crucial for clarifying the ranking of liens. Subordination agreements allow a junior lender to agree that their lien will be subordinate to a senior lender's lien, ensuring clear priority and protecting senior lender interests. Intercreditor agreements are more complex, involving multiple creditors to establish rights, responsibilities, and payment hierarchies, thereby reducing conflicts and facilitating smooth loan servicing and enforcement.

Typical Parties Involved in Subordination Agreements

Typical parties involved in subordination agreements in real estate include the borrower, the senior lender, and the junior lender or lienholder. The borrower agrees that the junior lender's claim will be subordinated to the senior lender's interest, ensuring the senior lender has priority in repayment or foreclosure. These agreements are essential in transactions where multiple financing sources exist to establish clear priority among creditors.

Core Provisions in Intercreditor Agreements

Intercreditor agreements in real estate typically include core provisions such as the priority of liens, rights to payments, and default remedies among multiple lenders. These agreements clearly establish the hierarchy of claims to ensure that senior lenders maintain their priority while providing subordinate lenders with defined rights. Detailed provisions regarding enforcement actions, voting rights, and information sharing further delineate creditor responsibilities and protections.

Legal Implications of Subordination vs Intercreditor Agreements

Subordination agreements establish the priority of one lien or interest behind another, directly affecting the enforceability of security interests in real estate transactions. Intercreditor agreements outline the rights and responsibilities among multiple lenders, providing structured conflict resolution without altering lien priority. Understanding these legal distinctions is crucial for managing risk exposure and ensuring clear enforcement protocols in complex financing arrangements.

Common Scenarios for Using Each Agreement

Subordination Agreements are commonly used in real estate financing when a new lender requires priority over an existing lien, such as during refinancing or obtaining secondary mortgages. Intercreditor Agreements typically arise in complex transactions involving multiple lenders, like mezzanine financing or construction loans, to establish priority, rights, and responsibilities among creditors. These agreements help clarify lien positions and reduce conflicts when multiple loans encumber the same property.

Risks and Benefits for Lenders and Borrowers

Subordination Agreements prioritize senior lenders by legally ranking their liens above those of junior lenders, reducing risks for primary lenders but potentially limiting borrowing flexibility for borrowers. Intercreditor Agreements establish detailed rights and obligations among multiple lenders, balancing interests by clarifying loan repayment order, default remedies, and collateral sharing, which mitigates conflicts but can increase negotiation complexity. Lenders gain protection and clearer enforcement mechanisms, while borrowers benefit from structured financing options but face potentially restrictive terms impacting future borrowing capacity.

Choosing the Right Agreement for Your Real Estate Transaction

A Subordination Agreement prioritizes one lien over another, commonly used when an existing mortgage is subordinated to a new loan for property improvements or refinancing. An Intercreditor Agreement, by contrast, governs the rights and priorities between multiple lenders, often in complex transactions involving senior and mezzanine debt. Selecting the appropriate agreement depends on the structure of your financing and the relationship between involved creditors to ensure clarity in lien priorities and foreclosure rights.

Subordination Agreement vs Intercreditor Agreement Infographic

difterm.com

difterm.com