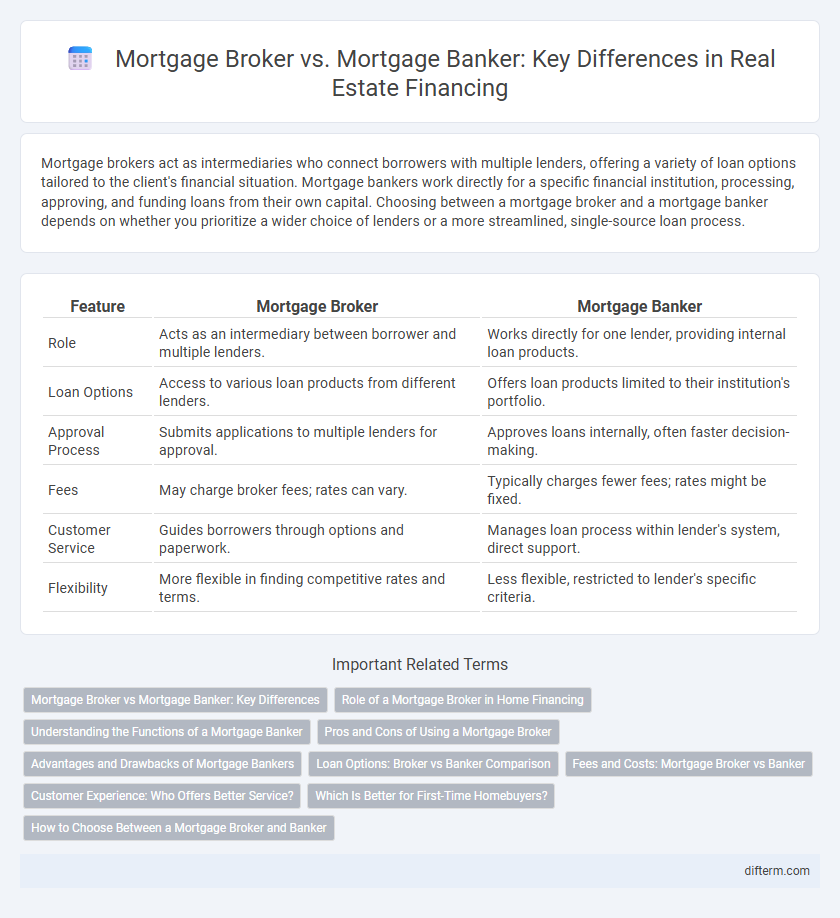

Mortgage brokers act as intermediaries who connect borrowers with multiple lenders, offering a variety of loan options tailored to the client's financial situation. Mortgage bankers work directly for a specific financial institution, processing, approving, and funding loans from their own capital. Choosing between a mortgage broker and a mortgage banker depends on whether you prioritize a wider choice of lenders or a more streamlined, single-source loan process.

Table of Comparison

| Feature | Mortgage Broker | Mortgage Banker |

|---|---|---|

| Role | Acts as an intermediary between borrower and multiple lenders. | Works directly for one lender, providing internal loan products. |

| Loan Options | Access to various loan products from different lenders. | Offers loan products limited to their institution's portfolio. |

| Approval Process | Submits applications to multiple lenders for approval. | Approves loans internally, often faster decision-making. |

| Fees | May charge broker fees; rates can vary. | Typically charges fewer fees; rates might be fixed. |

| Customer Service | Guides borrowers through options and paperwork. | Manages loan process within lender's system, direct support. |

| Flexibility | More flexible in finding competitive rates and terms. | Less flexible, restricted to lender's specific criteria. |

Mortgage Broker vs Mortgage Banker: Key Differences

Mortgage brokers act as intermediaries between borrowers and multiple lenders, providing access to a wide range of loan products and competitive rates, while mortgage bankers originate and fund loans directly using their own resources. Mortgage brokers typically offer personalized loan comparisons and flexible options, but may charge additional fees, whereas mortgage bankers streamline the approval process with quicker loan closings and consistent underwriting standards. Understanding these distinctions empowers borrowers to choose the right professional based on their needs for variety, speed, or direct servicing.

Role of a Mortgage Broker in Home Financing

A mortgage broker acts as an intermediary between homebuyers and multiple lenders, helping clients secure the best mortgage rates and loan terms by comparing various offers. They gather financial information, assess creditworthiness, and advise borrowers on suitable loan options tailored to their unique financial situations. Unlike mortgage bankers who lend directly, brokers provide access to a broader range of loan products, increasing the chances of approval and favorable financing for homebuyers.

Understanding the Functions of a Mortgage Banker

A mortgage banker directly originates and funds home loans using their own capital, managing the entire loan process from application to closing. Unlike mortgage brokers who act as intermediaries connecting borrowers with various lenders, mortgage bankers evaluate creditworthiness, underwrite loans, and handle loan servicing in-house. Their ability to quickly approve and fund mortgages provides borrowers with streamlined access to financing solutions.

Pros and Cons of Using a Mortgage Broker

Mortgage brokers offer access to multiple lenders, increasing the chances of securing competitive mortgage rates and loan terms, but may charge brokerage fees that raise overall costs. They simplify the loan process by handling paperwork and lender communications, yet their recommendations can sometimes be influenced by lender relationships instead of purely borrower interests. Unlike mortgage bankers who fund loans directly, brokers do not underwrite loans, potentially causing longer approval times depending on lender responsiveness.

Advantages and Drawbacks of Mortgage Bankers

Mortgage bankers offer quicker loan approvals and direct funding from their own resources, resulting in faster closings and potentially lower interest rates. However, their loan options are limited to in-house products, reducing flexibility compared to brokers who can access multiple lenders. Mortgage bankers may also impose stricter qualification criteria, limiting borrower eligibility in certain cases.

Loan Options: Broker vs Banker Comparison

Mortgage brokers offer access to a wider variety of loan options by working with multiple lenders, increasing the chances of finding competitive rates tailored to borrower needs. Mortgage bankers provide loan products directly from their own financial institution, often resulting in faster processing but more limited loan programs. Borrowers seeking diverse loan choices and customized solutions typically benefit more from mortgage brokers, while those prioritizing streamlined services may prefer mortgage bankers.

Fees and Costs: Mortgage Broker vs Banker

Mortgage brokers typically charge origination fees ranging from 0.5% to 2% of the loan amount, which are paid to connect borrowers with various lenders, potentially increasing overall costs. Mortgage bankers often have lower upfront fees but may include hidden costs within loan rates or closing fees, since they fund loans directly and retain servicing rights. Understanding these fee structures helps borrowers choose options that minimize total expenses based on their financial needs and loan types.

Customer Experience: Who Offers Better Service?

Mortgage brokers provide personalized customer experience by offering a variety of loan options from multiple lenders, ensuring clients find the best rates and terms tailored to their financial situation. Mortgage bankers, on the other hand, process loans in-house, which can streamline communication and speed up approval times but may limit product variety. Customers seeking customized solutions and competitive offers often prefer brokers, while those valuing faster, direct service may lean towards bankers.

Which Is Better for First-Time Homebuyers?

Mortgage brokers offer first-time homebuyers access to multiple lenders, increasing the chances of securing competitive rates and loan options tailored to individual financial situations. Mortgage bankers, by working directly with their own funds, often provide faster loan approvals and more streamlined communication, which can be beneficial for buyers needing quick closings. Choosing between a mortgage broker and a mortgage banker depends on the buyer's priority for variety versus speed in the loan process.

How to Choose Between a Mortgage Broker and Banker

Choosing between a mortgage broker and a mortgage banker depends on your need for loan variety versus direct lender interaction. Mortgage brokers offer access to multiple loan programs from various lenders, increasing loan options and competitive rates. Mortgage bankers provide faster approval and direct control over the loan process but with fewer financing options limited to their institution.

mortgage broker vs mortgage banker Infographic

difterm.com

difterm.com