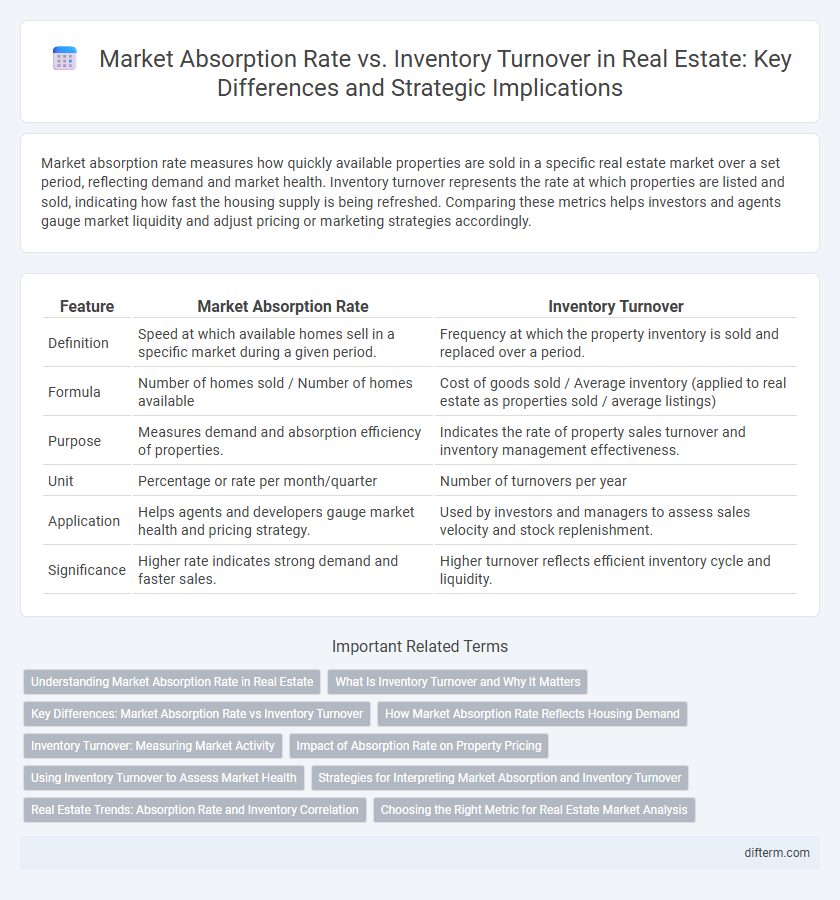

Market absorption rate measures how quickly available properties are sold in a specific real estate market over a set period, reflecting demand and market health. Inventory turnover represents the rate at which properties are listed and sold, indicating how fast the housing supply is being refreshed. Comparing these metrics helps investors and agents gauge market liquidity and adjust pricing or marketing strategies accordingly.

Table of Comparison

| Feature | Market Absorption Rate | Inventory Turnover |

|---|---|---|

| Definition | Speed at which available homes sell in a specific market during a given period. | Frequency at which the property inventory is sold and replaced over a period. |

| Formula | Number of homes sold / Number of homes available | Cost of goods sold / Average inventory (applied to real estate as properties sold / average listings) |

| Purpose | Measures demand and absorption efficiency of properties. | Indicates the rate of property sales turnover and inventory management effectiveness. |

| Unit | Percentage or rate per month/quarter | Number of turnovers per year |

| Application | Helps agents and developers gauge market health and pricing strategy. | Used by investors and managers to assess sales velocity and stock replenishment. |

| Significance | Higher rate indicates strong demand and faster sales. | Higher turnover reflects efficient inventory cycle and liquidity. |

Understanding Market Absorption Rate in Real Estate

Market absorption rate in real estate measures the pace at which available properties are sold in a specific market during a given time frame, reflecting demand relative to supply. Unlike inventory turnover, which calculates the frequency at which inventory is sold and replaced over a period, market absorption rate specifically indicates how quickly new listings are absorbed by buyers. Understanding this rate helps investors and agents evaluate market health, forecast pricing trends, and strategize marketing efforts effectively.

What Is Inventory Turnover and Why It Matters

Inventory turnover in real estate measures how quickly available properties are sold and replaced within a specific period, reflecting market demand and sales efficiency. A high inventory turnover indicates a strong market with properties moving rapidly, while a low turnover suggests slower sales and potential oversupply. Understanding inventory turnover helps investors and agents gauge market health, optimize pricing strategies, and make informed decisions on property acquisitions and sales.

Key Differences: Market Absorption Rate vs Inventory Turnover

Market absorption rate measures the speed at which available properties in a real estate market are sold or leased over a specific period, indicating demand relative to supply. Inventory turnover reflects how quickly the entire stock of properties is sold and replaced during a timeframe, highlighting market liquidity and sales efficiency. Key differences include absorption rate's focus on market demand dynamics and inventory turnover's emphasis on sales cycle velocity and inventory replenishment.

How Market Absorption Rate Reflects Housing Demand

Market absorption rate measures the pace at which available homes are sold in a specific real estate market during a given time, indicating current housing demand strength. A higher absorption rate signifies strong buyer interest and faster sales, directly reflecting increased demand for residential properties. Inventory turnover, while related, tracks how quickly the entire stock of homes is sold and restocked, offering broader insights into market liquidity but less immediacy on demand shifts than absorption rate.

Inventory Turnover: Measuring Market Activity

Inventory turnover in real estate measures how quickly properties are sold and replaced within a given period, reflecting market liquidity and demand. Higher inventory turnover indicates a dynamic market with strong buyer interest and efficient sales, while lower turnover suggests slower activity and potential overstock. Tracking inventory turnover helps investors and agents assess market conditions, optimize pricing strategies, and forecast future supply needs.

Impact of Absorption Rate on Property Pricing

The absorption rate directly influences property pricing by indicating market demand relative to available inventory, where a higher absorption rate typically signals increased buyer interest, driving prices upward. In contrast, inventory turnover measures how quickly properties sell over a period but doesn't reflect current market velocity as precisely as absorption rate. Understanding the absorption rate helps real estate professionals strategically price properties to match market dynamics and optimize sales outcomes.

Using Inventory Turnover to Assess Market Health

Inventory turnover measures how quickly available properties are sold and replaced in the real estate market, providing a dynamic indicator of market demand and liquidity. A high inventory turnover rate signals strong buyer activity and efficient market movement, while a low rate suggests stagnation or oversupply. Assessing inventory turnover alongside market absorption rate helps investors and developers gauge market health and optimize property pricing and marketing strategies.

Strategies for Interpreting Market Absorption and Inventory Turnover

Market absorption rate and inventory turnover are critical metrics for evaluating real estate market dynamics, with absorption rate indicating the pace at which available properties are sold and inventory turnover measuring how quickly properties are replaced within a given period. Strategies for interpreting these metrics include analyzing absorption rates alongside inventory levels to identify market demand trends, and comparing turnover ratios across property types to determine investment viability. Incorporating regional economic indicators and seasonality factors enhances the accuracy of market forecasts, enabling more informed decisions on pricing, marketing, and development timing.

Real Estate Trends: Absorption Rate and Inventory Correlation

Market absorption rate measures the pace at which available properties are sold in a specific real estate market during a given period, reflecting buyer demand relative to supply. Inventory turnover quantifies how often the existing housing stock is sold and replaced over time, indicating market liquidity and seller activity. Analyzing absorption rate alongside inventory turnover reveals real estate trends by highlighting demand-supply dynamics, influencing pricing strategies and investment decisions in residential and commercial property sectors.

Choosing the Right Metric for Real Estate Market Analysis

Market absorption rate measures the speed at which available properties are sold in a specific time frame, reflecting demand in real estate markets. Inventory turnover indicates how often the entire inventory is sold and replaced over a period, highlighting supply dynamics and market liquidity. Selecting the right metric depends on whether the analysis aims to assess buyer activity or overall market supply efficiency for informed decision-making.

Market absorption rate vs Inventory turnover Infographic

difterm.com

difterm.com