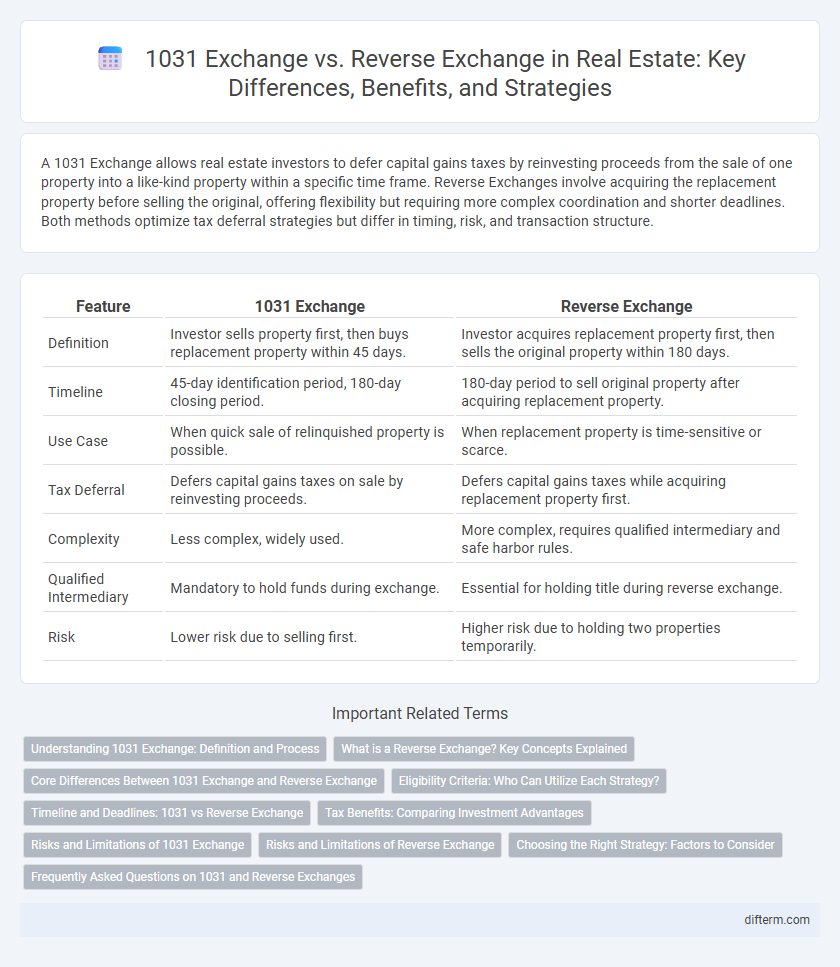

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of one property into a like-kind property within a specific time frame. Reverse Exchanges involve acquiring the replacement property before selling the original, offering flexibility but requiring more complex coordination and shorter deadlines. Both methods optimize tax deferral strategies but differ in timing, risk, and transaction structure.

Table of Comparison

| Feature | 1031 Exchange | Reverse Exchange |

|---|---|---|

| Definition | Investor sells property first, then buys replacement property within 45 days. | Investor acquires replacement property first, then sells the original property within 180 days. |

| Timeline | 45-day identification period, 180-day closing period. | 180-day period to sell original property after acquiring replacement property. |

| Use Case | When quick sale of relinquished property is possible. | When replacement property is time-sensitive or scarce. |

| Tax Deferral | Defers capital gains taxes on sale by reinvesting proceeds. | Defers capital gains taxes while acquiring replacement property first. |

| Complexity | Less complex, widely used. | More complex, requires qualified intermediary and safe harbor rules. |

| Qualified Intermediary | Mandatory to hold funds during exchange. | Essential for holding title during reverse exchange. |

| Risk | Lower risk due to selling first. | Higher risk due to holding two properties temporarily. |

Understanding 1031 Exchange: Definition and Process

A 1031 Exchange allows real estate investors to defer capital gains taxes by reinvesting proceeds from the sale of one property into a like-kind property within a strict timeline. The process requires identifying potential replacement properties within 45 days and completing the transaction within 180 days to qualify for tax deferral. Understanding these timelines and IRS regulations is crucial for maximizing tax benefits while maintaining compliance during the exchange.

What is a Reverse Exchange? Key Concepts Explained

A Reverse Exchange occurs when an investor acquires a replacement property before selling the original relinquished property, allowing more control over transaction timing in a 1031 Exchange. This strategy involves a Qualified Intermediary holding title to one property while the investor secures the other, typically with a maximum exchange period of 180 days. Key concepts include the need for proper identification of properties, adherence to IRS timelines, and compliance with complex tax rules to defer capital gains effectively.

Core Differences Between 1031 Exchange and Reverse Exchange

The core difference between a 1031 Exchange and a Reverse Exchange lies in the timing of property transactions: a 1031 Exchange requires the sale of the relinquished property before acquiring the replacement property, while a Reverse Exchange allows investors to acquire the replacement property prior to selling the existing one. In a Reverse Exchange, the replacement property is held by an Exchange Accommodation Titleholder (EAT) temporarily, enabling investors to meet specific transaction timelines. Both methods offer tax deferral benefits under IRS Section 1031 but cater to different investment strategies and market conditions.

Eligibility Criteria: Who Can Utilize Each Strategy?

Eligibility for a 1031 Exchange requires the property owner to relinquish investment or business-use real estate and acquire like-kind property, typically benefiting investors with sufficient capital gains tax liability seeking to defer taxes. Reverse Exchange, available to more experienced investors or entities, allows the buyer to acquire replacement property first, but requires meeting stricter IRS rules, including holding the property through an Exchange Accommodation Titleholder (EAT). Both strategies target real estate investors aiming to defer capital gains taxes, but eligibility depends on timing flexibility, property type, and compliance with IRS-specific procedural criteria.

Timeline and Deadlines: 1031 vs Reverse Exchange

The 1031 Exchange requires the identification of replacement property within 45 days and the acquisition to close within 180 days of the sale, adhering to strict IRS deadlines. In contrast, a Reverse Exchange allows the investor to acquire the replacement property before selling the relinquished property, but the entire transaction must be completed within 180 days, including the holding period of the parked property by an Exchange Accommodation Titleholder (EAT). Understanding these timeline differences is critical for maximizing tax deferral benefits and ensuring compliance with IRS regulations in real estate transactions.

Tax Benefits: Comparing Investment Advantages

A 1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds from the sale of a property into a like-kind property, preserving more capital for future investments. Reverse Exchanges enable acquiring replacement property before selling the relinquished property, offering flexibility in tight markets while still deferring taxes under IRS rules. Both methods provide significant tax benefits, but 1031 Exchanges are often preferred for straightforward transactions, whereas Reverse Exchanges cater to more complex investment strategies requiring precise timing.

Risks and Limitations of 1031 Exchange

1031 Exchange poses risks such as strict adherence to tight timelines, including a 45-day identification period and 180-day closing window, which if missed can disqualify the tax deferral benefit. Limitations include the requirement to identify replacement properties of equal or greater value and the complexity of ensuring the transaction qualifies under IRS rules, which can lead to costly penalties if improperly managed. Unlike Reverse Exchange, where the replacement property is acquired before selling the relinquished property, 1031 Exchange increases exposure to market fluctuations and potential loss if the sale does not close as planned.

Risks and Limitations of Reverse Exchange

Reverse exchanges involve acquiring replacement property before selling the original, which can lead to increased financial risk due to the requirement of securing short-term financing and maintaining two properties simultaneously. Holding both properties during the exchange period exposes investors to potential market fluctuations and carrying costs, such as taxes, insurance, and maintenance fees. Additionally, strict IRS guidelines limit the exchange timeline to 180 days, increasing transactional pressure and the risk of failing to meet IRS compliance, which could disqualify the tax deferral benefits.

Choosing the Right Strategy: Factors to Consider

Choosing between a 1031 Exchange and a Reverse Exchange hinges on timing flexibility, property availability, and financial readiness. A 1031 Exchange suits investors who have already sold their relinquished property and seek to defer capital gains taxes by acquiring replacement property within 45 days, while a Reverse Exchange benefits those who need to acquire a new property before selling the old one, requiring careful coordination with an Exchange Accommodation Titleholder (EAT). Evaluating market conditions, cash flow, and transaction complexity ensures alignment with investment goals and tax deferral benefits.

Frequently Asked Questions on 1031 and Reverse Exchanges

A 1031 Exchange allows investors to defer capital gains taxes by reinvesting proceeds from the sale of an investment property into a like-kind property within strict timelines, typically 45 days for identification and 180 days for closing. Reverse Exchanges, also known as parked exchanges, enable investors to acquire a replacement property before selling the original property, requiring a qualified intermediary to hold title to one of the properties during the process. Frequently asked questions often address eligibility criteria, timelines, intermediary roles, and tax implications to maximize benefits within IRS regulations.

1031 Exchange vs Reverse Exchange Infographic

difterm.com

difterm.com