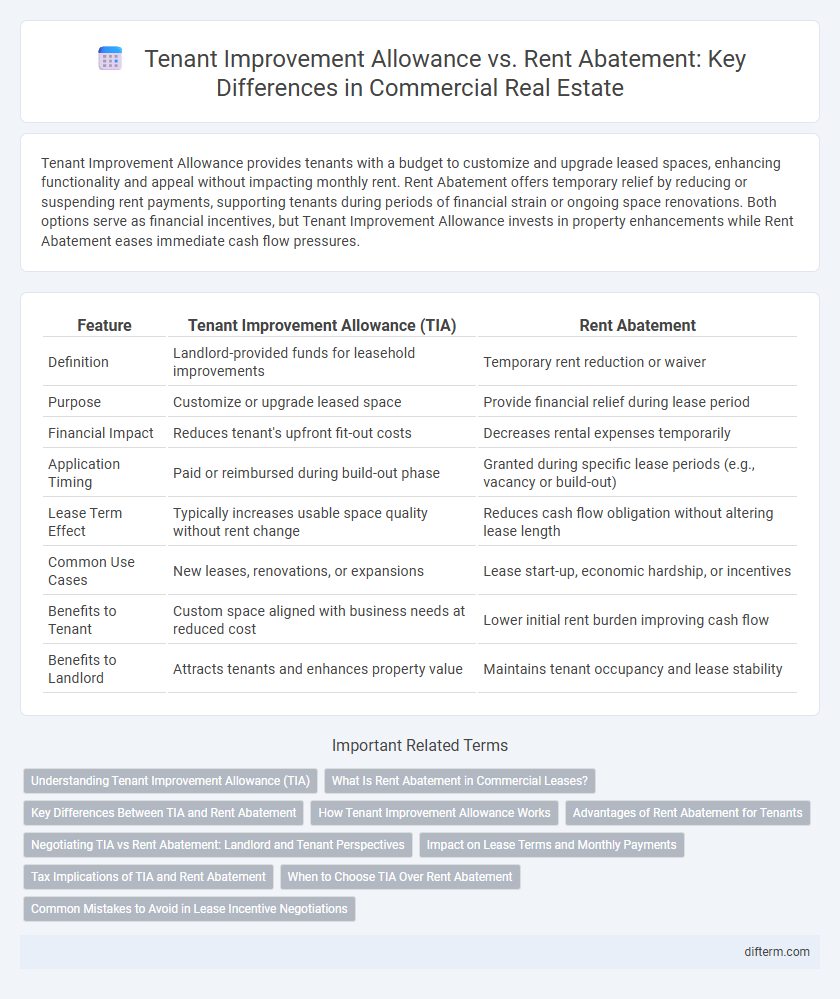

Tenant Improvement Allowance provides tenants with a budget to customize and upgrade leased spaces, enhancing functionality and appeal without impacting monthly rent. Rent Abatement offers temporary relief by reducing or suspending rent payments, supporting tenants during periods of financial strain or ongoing space renovations. Both options serve as financial incentives, but Tenant Improvement Allowance invests in property enhancements while Rent Abatement eases immediate cash flow pressures.

Table of Comparison

| Feature | Tenant Improvement Allowance (TIA) | Rent Abatement |

|---|---|---|

| Definition | Landlord-provided funds for leasehold improvements | Temporary rent reduction or waiver |

| Purpose | Customize or upgrade leased space | Provide financial relief during lease period |

| Financial Impact | Reduces tenant's upfront fit-out costs | Decreases rental expenses temporarily |

| Application Timing | Paid or reimbursed during build-out phase | Granted during specific lease periods (e.g., vacancy or build-out) |

| Lease Term Effect | Typically increases usable space quality without rent change | Reduces cash flow obligation without altering lease length |

| Common Use Cases | New leases, renovations, or expansions | Lease start-up, economic hardship, or incentives |

| Benefits to Tenant | Custom space aligned with business needs at reduced cost | Lower initial rent burden improving cash flow |

| Benefits to Landlord | Attracts tenants and enhances property value | Maintains tenant occupancy and lease stability |

Understanding Tenant Improvement Allowance (TIA)

Tenant Improvement Allowance (TIA) refers to the funds a landlord provides to a tenant to customize or renovate leased commercial space according to their specific business needs, enhancing operational functionality and aesthetic appeal. This allowance is typically negotiated as part of a lease agreement and can cover expenses such as construction, materials, and design services, directly impacting the tenant's upfront costs. Understanding TIA is crucial for tenants to leverage these funds effectively, ensuring that improvements align with long-term business goals while managing financial outlays efficiently.

What Is Rent Abatement in Commercial Leases?

Rent abatement in commercial leases refers to a temporary reduction or complete waiver of rent, often granted during tenant improvements or unexpected property issues. This financial concession helps tenants mitigate costs without terminating the lease, promoting long-term occupancy. Rent abatement differs from tenant improvement allowance, which specifically funds property customization or renovations.

Key Differences Between TIA and Rent Abatement

Tenant Improvement Allowance (TIA) refers to a landlord-provided budget for customizing rental spaces, enabling tenants to tailor the property to their business needs without upfront costs. Rent abatement is a temporary rent reduction or waiver, often granted during property repairs or initial occupancy periods to alleviate financial burden. Key differences include TIA's role in enhancing space functionality versus rent abatement's function in providing financial relief during specific timeframes.

How Tenant Improvement Allowance Works

Tenant Improvement Allowance (TIA) is a financial contribution provided by landlords to tenants for customizing leased spaces to meet specific business needs, typically calculated as a fixed dollar amount per square foot. The allowance covers construction costs such as walls, flooring, lighting, and HVAC modifications, enabling tenants to design functional work environments without bearing upfront expenses. TIAs are often negotiated as part of lease agreements and amortized over the lease term, differentiating them from rent abatement, which temporarily reduces or suspends rent payments.

Advantages of Rent Abatement for Tenants

Rent abatement provides tenants with immediate financial relief by reducing or eliminating rent payments during lease-up or renovation periods, improving cash flow management and reducing upfront expenses. Unlike tenant improvement allowances, rent abatement does not require tenants to invest capital in property modifications, minimizing financial risk and administrative burden. This advantage makes rent abatement especially beneficial for startups and businesses seeking flexible leasing terms with lower initial costs.

Negotiating TIA vs Rent Abatement: Landlord and Tenant Perspectives

Negotiating Tenant Improvement Allowance (TIA) versus rent abatement requires landlords and tenants to balance upfront construction costs against short-term financial relief. Landlords often prefer TIAs to enhance property value and attract quality tenants, while tenants may favor rent abatement for immediate cash flow benefits during build-out periods. Effective negotiation hinges on aligning the TIA amount with realistic improvement budgets and structuring rent abatement to mitigate risks associated with tenant onboarding delays.

Impact on Lease Terms and Monthly Payments

Tenant Improvement Allowance (TIA) directly reduces upfront tenant costs by providing funds for property customization, often reflected in slightly higher base rent or extended lease terms to recoup the landlord's investment. Rent abatement temporarily lowers or suspends rent payments, offering short-term financial relief without altering the overall lease duration but potentially increasing future monthly payments to compensate for the waived rent period. Both strategies influence cash flow and lease economics, with TIA impacting tenant improvements cost distribution while rent abatement affects immediate payment obligations and total lease expense timing.

Tax Implications of TIA and Rent Abatement

Tenant Improvement Allowance (TIA) is typically considered taxable income for tenants, requiring capitalization and depreciation of improvements, which can affect taxable income over the lease term. Rent abatement, often treated as a lease concession, may be excluded from income under certain IRS safe harbor rules if properly documented, reducing the tenant's taxable rent expense in the abatement period. Understanding the distinct tax treatments of TIA and rent abatement is crucial for optimizing lease negotiations and mitigating tax liabilities in commercial real estate agreements.

When to Choose TIA Over Rent Abatement

Choosing Tenant Improvement Allowance (TIA) over rent abatement is ideal when tenants require customized build-outs that enhance property functionality and long-term value. TIA provides upfront funding to tailor leased space according to specific business needs, making it suitable for companies planning extended occupancy. Rent abatement offers temporary rent relief but lacks the investment in property enhancements that TIA supports, which is critical for tenants focused on optimizing operational efficiency.

Common Mistakes to Avoid in Lease Incentive Negotiations

Misunderstanding the scope of Tenant Improvement Allowance (TIA) can lead to costly disputes if tenants assume all renovation expenses are covered, while landlords often cap the allowance or exclude certain upgrades. Confusing Rent Abatement with rent reductions during lease term can result in tenants missing critical timing and eligibility terms, causing unexpected financial liabilities. Failing to clearly document incentives in the lease agreement increases the risk of renegotiation conflicts, making it essential to define TIAs and abatements explicitly for enforceability and mutual understanding.

Tenant Improvement Allowance vs Rent Abatement Infographic

difterm.com

difterm.com