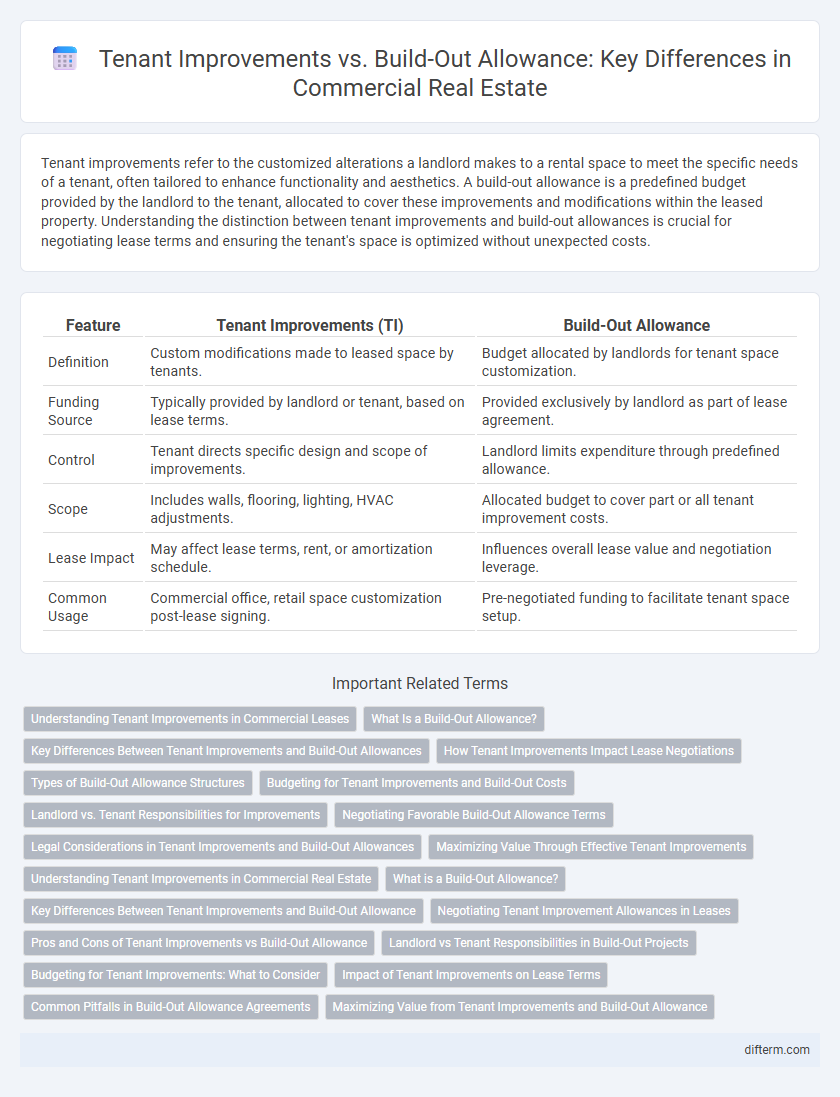

Tenant improvements refer to the customized alterations a landlord makes to a rental space to meet the specific needs of a tenant, often tailored to enhance functionality and aesthetics. A build-out allowance is a predefined budget provided by the landlord to the tenant, allocated to cover these improvements and modifications within the leased property. Understanding the distinction between tenant improvements and build-out allowances is crucial for negotiating lease terms and ensuring the tenant's space is optimized without unexpected costs.

Table of Comparison

| Feature | Tenant Improvements (TI) | Build-Out Allowance |

|---|---|---|

| Definition | Custom modifications made to leased space by tenants. | Budget allocated by landlords for tenant space customization. |

| Funding Source | Typically provided by landlord or tenant, based on lease terms. | Provided exclusively by landlord as part of lease agreement. |

| Control | Tenant directs specific design and scope of improvements. | Landlord limits expenditure through predefined allowance. |

| Scope | Includes walls, flooring, lighting, HVAC adjustments. | Allocated budget to cover part or all tenant improvement costs. |

| Lease Impact | May affect lease terms, rent, or amortization schedule. | Influences overall lease value and negotiation leverage. |

| Common Usage | Commercial office, retail space customization post-lease signing. | Pre-negotiated funding to facilitate tenant space setup. |

Understanding Tenant Improvements in Commercial Leases

Tenant improvements in commercial leases refer to the customized modifications made to a rental space to meet the tenant's specific needs, often negotiated as part of the lease agreement. These improvements can include structural changes, partitions, lighting upgrades, and HVAC installations. Understanding the scope, cost responsibilities, and approval processes for tenant improvements is critical for both landlords and tenants to ensure clarity and avoid disputes.

What Is a Build-Out Allowance?

A build-out allowance in real estate refers to a predetermined budget provided by a landlord to a tenant for customizing or improving leased commercial space. This financial support typically covers expenses such as interior construction, electrical work, flooring, and partitions to meet the tenant's operational needs. Understanding the build-out allowance helps tenants plan renovations while managing costs within lease agreements.

Key Differences Between Tenant Improvements and Build-Out Allowances

Tenant improvements (TI) refer to customized modifications made to a leased commercial space to meet a tenant's specific needs, including structural changes, fixtures, and interior finishes. Build-out allowance is the budget or amount a landlord provides to cover these tenant improvement costs, often negotiated as part of the lease agreement. The key difference lies in TI being the actual enhancements completed, while the build-out allowance is the financial contribution allocated by the landlord toward those improvements.

How Tenant Improvements Impact Lease Negotiations

Tenant improvements significantly influence lease negotiations by determining the customization level a tenant can achieve within a commercial space, directly affecting rental rates and lease terms. Landlords often offer build-out allowances to offset renovation costs, which creates leverage for tenants to negotiate more favorable lease conditions such as rent abatements or extended lease periods. The scope and value of tenant improvements also impact the overall valuation and marketability of the property for both parties.

Types of Build-Out Allowance Structures

Build-out allowance structures in real estate typically include lump-sum payments, per-square-foot allocations, and turnkey packages, each tailored to accommodate varying tenant improvement scopes and budgets. Lump-sum payments provide tenants with a fixed budget for modifications, while per-square-foot allocations offer proportional funding based on leased space size. Turnkey packages deliver fully completed interiors by the landlord, streamlining the tenant improvement process and minimizing tenant risk.

Budgeting for Tenant Improvements and Build-Out Costs

Budgeting for tenant improvements and build-out costs requires a clear understanding of the distinction between tenant improvements, which are custom modifications to meet specific tenant needs, and build-out allowances, the funds landlords allocate to cover part or all of these expenses. Accurate cost estimation incorporates factors such as construction materials, labor, design fees, and permit costs, ensuring the tenant improvement budget aligns with the landlord's build-out allowance to avoid unexpected expenses. Effective budgeting and clear negotiation of build-out allowances help tenants optimize space customization while maintaining financial control within the overall lease agreement.

Landlord vs. Tenant Responsibilities for Improvements

Tenant improvements typically refer to the customized alterations made to a rental space to meet the tenant's specific needs, with costs often shared or covered by the landlord through a build-out allowance. The landlord generally provides a build-out allowance set in the lease agreement, defining the budget available for these improvements, while the tenant assumes responsibility for managing the construction and any expenses beyond the allowance. Clear delineation of responsibilities in lease terms ensures both parties understand financial obligations related to build-out costs, maintenance, and subsequent modifications.

Negotiating Favorable Build-Out Allowance Terms

Negotiating favorable build-out allowance terms requires thorough knowledge of market rates and the specific improvements needed to maximize tenant value. Tenants should request clear definitions of what expenses qualify for reimbursement and seek caps that align with their renovation plans to avoid unexpected out-of-pocket costs. Leveraging detailed cost estimates and emphasizing long-term occupancy can strengthen the tenant's position in securing higher allowances.

Legal Considerations in Tenant Improvements and Build-Out Allowances

Legal considerations in tenant improvements and build-out allowances center on clearly defined lease agreements that specify responsibilities for construction, costs, and compliance with building codes and zoning laws. Tenants and landlords must negotiate who assumes liability for permitting, insurance, and potential damages during the improvement process, ensuring all modifications meet local regulations. Detailed clauses regarding ownership of improvements and restoration obligations at lease end are critical to mitigate disputes and protect both parties' interests.

Maximizing Value Through Effective Tenant Improvements

Maximizing value in commercial real estate hinges on strategically leveraging tenant improvements to enhance functionality and appeal. Understanding the distinction between tenant improvements, which are customized modifications to the leased space, and build-out allowances, the budget landlords provide for those modifications, is crucial for cost-effective execution. Prioritizing upgrades that increase operational efficiency and tenant satisfaction optimizes return on investment and property marketability.

Tenant Improvements vs Build-Out Allowance Infographic

difterm.com

difterm.com