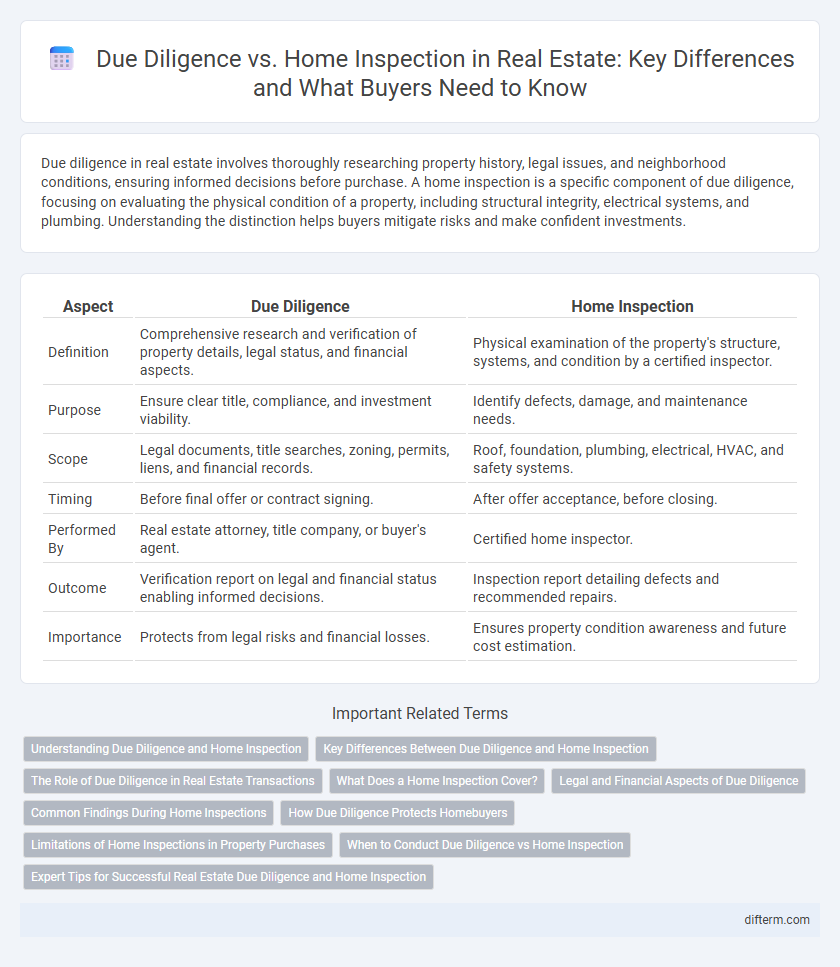

Due diligence in real estate involves thoroughly researching property history, legal issues, and neighborhood conditions, ensuring informed decisions before purchase. A home inspection is a specific component of due diligence, focusing on evaluating the physical condition of a property, including structural integrity, electrical systems, and plumbing. Understanding the distinction helps buyers mitigate risks and make confident investments.

Table of Comparison

| Aspect | Due Diligence | Home Inspection |

|---|---|---|

| Definition | Comprehensive research and verification of property details, legal status, and financial aspects. | Physical examination of the property's structure, systems, and condition by a certified inspector. |

| Purpose | Ensure clear title, compliance, and investment viability. | Identify defects, damage, and maintenance needs. |

| Scope | Legal documents, title searches, zoning, permits, liens, and financial records. | Roof, foundation, plumbing, electrical, HVAC, and safety systems. |

| Timing | Before final offer or contract signing. | After offer acceptance, before closing. |

| Performed By | Real estate attorney, title company, or buyer's agent. | Certified home inspector. |

| Outcome | Verification report on legal and financial status enabling informed decisions. | Inspection report detailing defects and recommended repairs. |

| Importance | Protects from legal risks and financial losses. | Ensures property condition awareness and future cost estimation. |

Understanding Due Diligence and Home Inspection

Due diligence in real estate involves a comprehensive investigation of legal, financial, and physical aspects of a property to identify potential risks and confirm its value. A home inspection, typically conducted by a certified inspector, focuses specifically on evaluating the structural integrity and condition of the property's systems, such as electrical, plumbing, and roofing. Understanding the distinction helps buyers make informed decisions by addressing both the broader legal and financial factors and the detailed physical state of the home.

Key Differences Between Due Diligence and Home Inspection

Due diligence in real estate involves a comprehensive evaluation of property details, including title verification, zoning laws, and financial assessments, whereas a home inspection focuses specifically on the physical condition of the property, such as structural integrity and potential repairs. Due diligence covers legal and financial risks to ensure the property's compliance and investment value, while home inspection identifies immediate maintenance issues and safety hazards. Understanding these key differences helps buyers protect their investment by addressing both legal concerns and physical property conditions before closing.

The Role of Due Diligence in Real Estate Transactions

Due diligence in real estate transactions involves a comprehensive evaluation of property documents, title status, zoning laws, and financial records to ensure legal and financial viability before closing. This process identifies potential risks such as liens, encroachments, or regulatory violations that a home inspection alone may not reveal. Understanding due diligence's role enhances buyer confidence by confirming that investment decisions are based on thorough legal and financial scrutiny beyond the physical condition of the property.

What Does a Home Inspection Cover?

A home inspection covers the evaluation of a property's structural components, including the foundation, roof, walls, and windows, as well as major systems such as electrical, plumbing, and HVAC. Inspectors assess for defects, safety hazards, and potential repairs needed to inform buyers about the home's condition. This process provides a detailed report that helps buyers make informed decisions during the real estate transaction.

Legal and Financial Aspects of Due Diligence

Due diligence in real estate involves a comprehensive legal and financial review, including title verification, zoning compliance, and assessment of liens or encumbrances to ensure clear ownership and lawful property use. Financial aspects encompass analyzing property taxes, insurance costs, and potential liabilities that may impact the investment's value or future expenses. This thorough evaluation reduces risks and safeguards buyers from unforeseen legal disputes or financial burdens compared to the limited scope of a standard home inspection.

Common Findings During Home Inspections

Common findings during home inspections include issues like faulty electrical wiring, plumbing leaks, roofing damage, foundation cracks, and HVAC system malfunctions. Real estate due diligence encompasses a broader scope, such as reviewing property titles, zoning laws, and environmental assessments alongside home inspections. Identifying these defects early helps buyers negotiate repairs or price adjustments, ensuring informed investment decisions.

How Due Diligence Protects Homebuyers

Due diligence in real estate protects homebuyers by thoroughly evaluating property titles, zoning laws, and potential liens, ensuring a clear and lawful ownership transfer. This comprehensive investigation uncovers legal and financial risks that a standard home inspection may overlook. By identifying these issues early, due diligence helps buyers make informed decisions and avoid costly disputes after purchase.

Limitations of Home Inspections in Property Purchases

Home inspections provide a detailed overview of a property's condition but often miss hidden issues like structural defects or pest infestations not visible during a standard assessment. Due diligence encompasses a broader scope, including reviewing legal documents, title searches, zoning compliance, and environmental reports, which home inspections do not cover. Relying solely on home inspections can expose buyers to unforeseen risks, making comprehensive due diligence essential in real estate transactions.

When to Conduct Due Diligence vs Home Inspection

Due diligence occurs before finalizing a real estate transaction, involving a comprehensive review of property records, zoning laws, and financial aspects to assess risks and verify information. Home inspections are conducted after the due diligence phase, typically once an offer is made, focusing on the physical condition of the property, identifying potential repairs or hazards. Conducting due diligence first ensures informed decision-making, while home inspections confirm the property's structural integrity prior to closing.

Expert Tips for Successful Real Estate Due Diligence and Home Inspection

Successful real estate due diligence involves a comprehensive evaluation of property documents, title verification, zoning laws, and environmental assessments to identify potential risks before purchase. Expert tips for home inspections include hiring certified inspectors to assess structural integrity, electrical systems, plumbing, and HVAC conditions, ensuring no hidden defects impact property value. Combining thorough due diligence with detailed home inspections maximizes investment security and prevents costly surprises post-sale.

Due Diligence vs Home Inspection Infographic

difterm.com

difterm.com