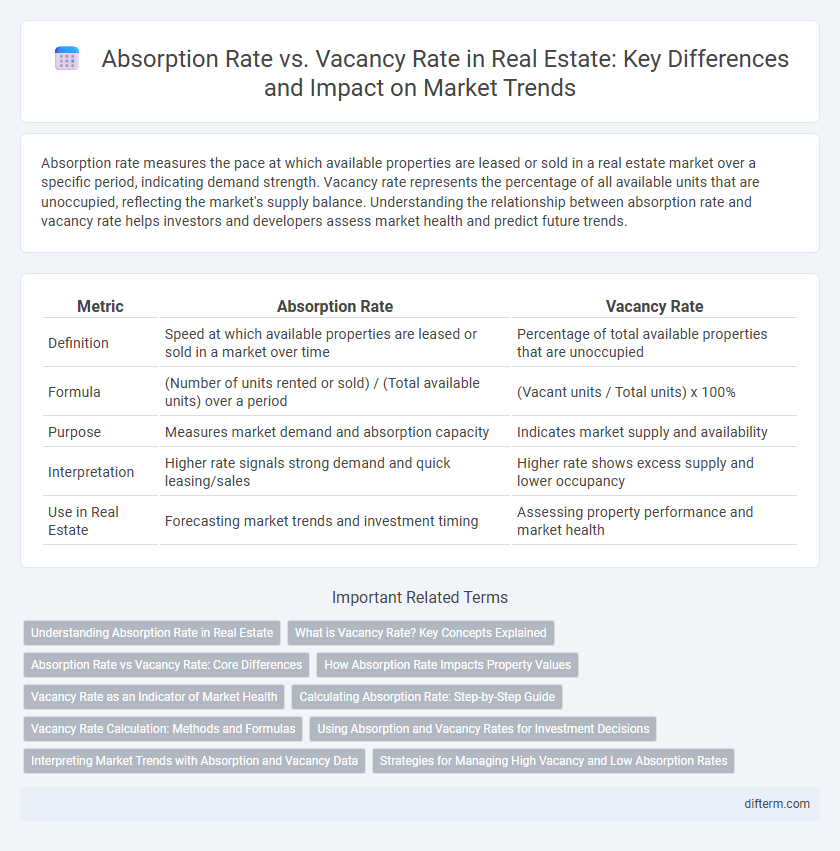

Absorption rate measures the pace at which available properties are leased or sold in a real estate market over a specific period, indicating demand strength. Vacancy rate represents the percentage of all available units that are unoccupied, reflecting the market's supply balance. Understanding the relationship between absorption rate and vacancy rate helps investors and developers assess market health and predict future trends.

Table of Comparison

| Metric | Absorption Rate | Vacancy Rate |

|---|---|---|

| Definition | Speed at which available properties are leased or sold in a market over time | Percentage of total available properties that are unoccupied |

| Formula | (Number of units rented or sold) / (Total available units) over a period | (Vacant units / Total units) x 100% |

| Purpose | Measures market demand and absorption capacity | Indicates market supply and availability |

| Interpretation | Higher rate signals strong demand and quick leasing/sales | Higher rate shows excess supply and lower occupancy |

| Use in Real Estate | Forecasting market trends and investment timing | Assessing property performance and market health |

Understanding Absorption Rate in Real Estate

Absorption rate in real estate measures the pace at which available properties are sold or leased within a specific market over a set period. A high absorption rate indicates a strong demand and a faster turnover of properties, often signaling a seller's market. Unlike vacancy rate, which reflects the percentage of unoccupied units, absorption rate directly assesses market absorption efficiency and helps investors forecast supply-demand dynamics accurately.

What is Vacancy Rate? Key Concepts Explained

Vacancy rate measures the percentage of unoccupied rental properties within a specific market or property portfolio, reflecting market supply and demand balance. It is calculated by dividing the number of vacant units by the total number of available units and multiplying by 100. A high vacancy rate often signals weak rental demand or oversupply, affecting rental prices and property values.

Absorption Rate vs Vacancy Rate: Core Differences

Absorption rate measures the pace at which available properties are sold or leased in a specific market over a given time, indicating demand strength, while vacancy rate represents the percentage of unoccupied properties relative to the total inventory, reflecting supply dynamics. A high absorption rate with a low vacancy rate signals a seller's market, whereas a low absorption rate combined with a high vacancy rate indicates an oversupply or weaker demand. Understanding these core differences helps real estate professionals strategize pricing, marketing, and investment timing effectively.

How Absorption Rate Impacts Property Values

Absorption rate directly influences property values by indicating the speed at which available real estate is sold or leased, reflecting market demand and investor confidence. A high absorption rate typically signals strong demand, leading to increased property values due to reduced inventory and heightened competition among buyers or tenants. Conversely, a low absorption rate can indicate oversupply or weaker demand, often resulting in stagnant or declining property values as sellers compete to attract limited buyers.

Vacancy Rate as an Indicator of Market Health

Vacancy rate measures the percentage of unoccupied rental properties and serves as a critical indicator of real estate market health by reflecting supply and demand dynamics. A high vacancy rate signals an oversupply or decreased demand, often leading to downward pressure on rental prices and slower property appreciation. Monitoring vacancy rates helps investors, landlords, and developers make informed decisions about pricing strategies, property investments, and development timing.

Calculating Absorption Rate: Step-by-Step Guide

Calculating absorption rate involves dividing the number of properties sold or leased in a specific period by the total available properties on the market, then multiplying by 100 to express it as a percentage. This metric provides insight into how quickly real estate inventory is being absorbed, indicating market demand and pace. Accurate absorption rate calculation helps investors and agents forecast market trends and adjust pricing or marketing strategies accordingly.

Vacancy Rate Calculation: Methods and Formulas

Vacancy rate calculation in real estate measures the proportion of vacant units relative to the total available units, typically expressed as a percentage. The primary formula is: Vacancy Rate = (Number of Vacant Units / Total Number of Units) x 100, enabling investors and property managers to assess market conditions. Accurate vacancy rate metrics guide pricing strategies and investment decisions by reflecting the demand-supply balance in rental markets.

Using Absorption and Vacancy Rates for Investment Decisions

Absorption rate measures the pace at which available properties are leased or sold, indicating market demand, while vacancy rate reflects the percentage of unoccupied units, signaling supply levels. Investors rely on high absorption rates combined with low vacancy rates to identify strong rental demand and potential for price appreciation. Analyzing these metrics together aids in forecasting cash flow stability and making informed real estate investment decisions.

Interpreting Market Trends with Absorption and Vacancy Data

Absorption rate measures the pace at which available real estate properties are sold or leased over a specific time, indicating demand strength in the market. Vacancy rate shows the percentage of unoccupied properties within a market, reflecting supply levels and potential oversupply risks. Analyzing both absorption and vacancy rates together helps identify market balance, signaling whether a market is favoring buyers or sellers and guiding investment decisions.

Strategies for Managing High Vacancy and Low Absorption Rates

High vacancy and low absorption rates indicate an oversupplied real estate market, requiring developers and property managers to implement targeted leasing incentives and enhance property appeal to attract tenants. Effective strategies include adjusting rental pricing, improving property amenities, leveraging digital marketing to reach wider audiences, and offering flexible lease terms to increase tenant retention and occupancy speed. Monitoring local market trends and collaborating with real estate agents can further optimize absorption while minimizing vacancy periods.

Absorption Rate vs Vacancy Rate Infographic

difterm.com

difterm.com