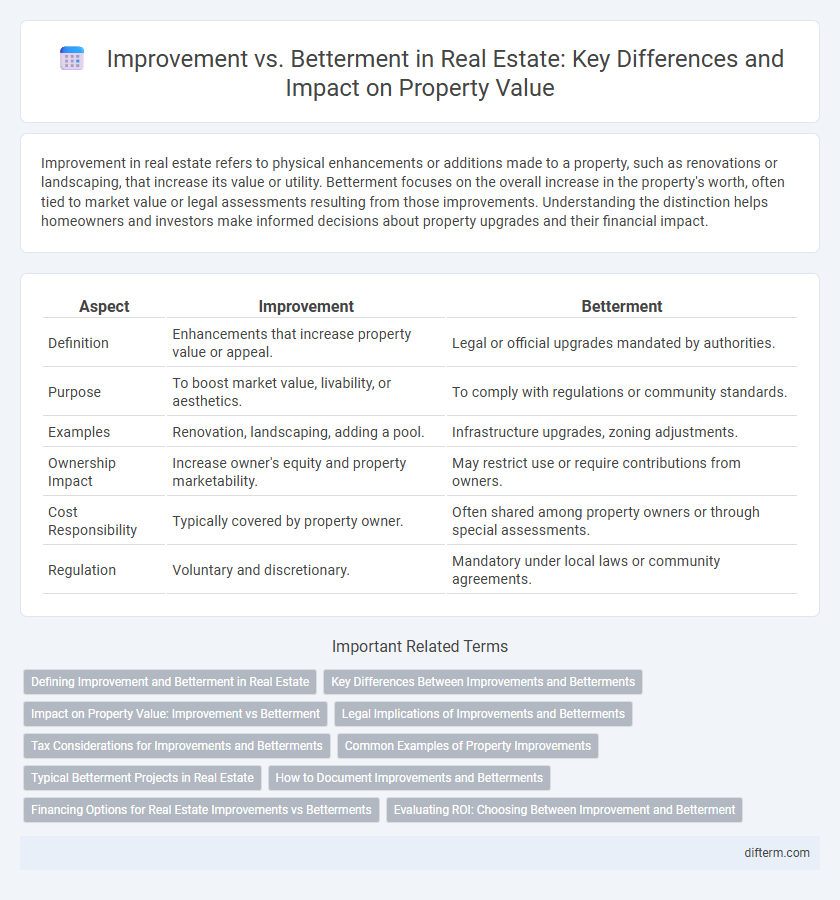

Improvement in real estate refers to physical enhancements or additions made to a property, such as renovations or landscaping, that increase its value or utility. Betterment focuses on the overall increase in the property's worth, often tied to market value or legal assessments resulting from those improvements. Understanding the distinction helps homeowners and investors make informed decisions about property upgrades and their financial impact.

Table of Comparison

| Aspect | Improvement | Betterment |

|---|---|---|

| Definition | Enhancements that increase property value or appeal. | Legal or official upgrades mandated by authorities. |

| Purpose | To boost market value, livability, or aesthetics. | To comply with regulations or community standards. |

| Examples | Renovation, landscaping, adding a pool. | Infrastructure upgrades, zoning adjustments. |

| Ownership Impact | Increase owner's equity and property marketability. | May restrict use or require contributions from owners. |

| Cost Responsibility | Typically covered by property owner. | Often shared among property owners or through special assessments. |

| Regulation | Voluntary and discretionary. | Mandatory under local laws or community agreements. |

Defining Improvement and Betterment in Real Estate

Improvement in real estate refers to any physical addition or change that increases the property's value, utility, or lifespan, such as renovating a kitchen or adding a new bathroom. Betterment specifically denotes enhancements that go beyond standard maintenance or repairs, resulting in a higher property value or increased market appeal. Understanding the distinction between improvement and betterment is crucial for property owners when assessing tax implications and investment returns.

Key Differences Between Improvements and Betterments

Improvements in real estate refer to additions or upgrades that enhance the property's value, utility, or lifespan without fundamentally changing its nature. Betterments involve significant alterations or restorations that improve the structural integrity or efficiency, often resulting in increased market worth. The key difference lies in scope: improvements are routine enhancements, while betterments are substantial changes that elevate the property's overall condition and performance.

Impact on Property Value: Improvement vs Betterment

Improvements typically enhance a property's functionality or aesthetics, directly increasing its market value through upgrades like modern kitchens or energy-efficient windows. Betterments involve substantial enhancements or expansions, such as adding a new room or upgrading infrastructure, which significantly raise the property's overall worth. Understanding the distinction helps investors and homeowners strategically allocate resources to maximize return on investment in real estate.

Legal Implications of Improvements and Betterments

Improvements in real estate refer to physical changes that enhance the property's value, while betterments imply essential upgrades that correct defects or adapt the property to new uses, both carrying distinct legal implications regarding ownership and compensation. Legal disputes often arise over whether added features qualify as improvements or betterments, influencing a party's right to reimbursement or claim on the property upon transfer or termination of tenancy. Courts typically assess the nature, purpose, and necessity of the work to determine the applicable legal remedies and obligations under property and contract law.

Tax Considerations for Improvements and Betterments

Improvements and betterments to real estate carry distinct tax implications, with improvements typically capitalized and added to the property's basis, reducing taxable gain upon sale. Betterments, which restore or enhance property value beyond ordinary repairs, also increase the property's basis and may qualify for depreciation deductions if used in a trade or business. Accurate classification and documentation of these expenditures are essential to optimize tax benefits and ensure compliance with IRS regulations.

Common Examples of Property Improvements

Common examples of property improvements include adding a new roof, installing energy-efficient windows, and upgrading HVAC systems, all of which enhance the property's value and functionality. Improvements differ from betterments in that improvements typically restore or maintain the property's current condition, while betterments elevate the property beyond its original state. Investment in high-quality kitchen remodels, bathroom upgrades, and landscaping are also considered significant property improvements that contribute to increased market value.

Typical Betterment Projects in Real Estate

Typical betterment projects in real estate include property expansions, such as adding new rooms or floors, and significant upgrades like installing energy-efficient windows or modern HVAC systems. These projects enhance the overall value and functionality of a property beyond mere repairs or maintenance. Unlike routine improvements, betterments often involve substantial investments that increase the property's market appeal and longevity.

How to Document Improvements and Betterments

Documenting improvements and betterments requires detailed records including contracts, receipts, and before-and-after photographs to validate changes made to a property. Clearly distinguishing between improvements, which increase property value or extend its life, and betterments, which enhance functionality or aesthetics, is essential for accurate accounting and tax purposes. Maintaining organized documentation ensures compliance with IRS regulations and supports claims for depreciation or capital gains adjustments.

Financing Options for Real Estate Improvements vs Betterments

Financing options for real estate improvements typically involve loans or lines of credit that cover repairs or upgrades that maintain the property's current condition, such as HVAC replacements or roof repairs. Betterments require more substantial investment and financing strategies, often including construction loans or equity refinancing, aimed at increasing the property's value or functionality, like adding a new room or upgrading systems for energy efficiency. Understanding the distinction influences loan types, interest rates, and eligibility, directly impacting budget planning and long-term property value.

Evaluating ROI: Choosing Between Improvement and Betterment

Evaluating ROI in real estate requires distinguishing between improvement and betterment, as improvements typically enhance property value and increase rental income, while betterments add substantial long-term value by upgrading infrastructure or structural components. Investors should analyze cost-to-value ratios, considering market trends and potential appreciation to determine which option maximizes returns. Prioritizing betterments often results in higher tax benefits and stronger asset appreciation compared to routine improvements.

improvement vs betterment Infographic

difterm.com

difterm.com